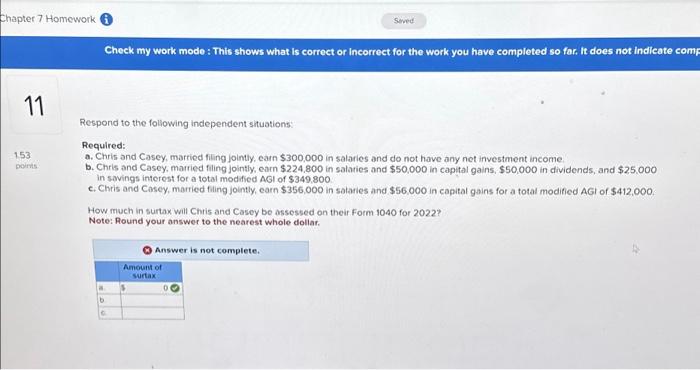

Question: Chapter 7 Homework i 11 1.53 points Check my work mode: This shows what is correct or incorrect for the work you have completed so

Respond to the following independent situations: Required: a. Chris and Casey, married filing jointly, carn $300,000 in salaries and do not have any net investment income b. Chris and Casey, married filing jointly, earn $224,800 in salaties and $50,000 in capital gains, $50,000 in dividends, and $25,000 in savings interest for a total modified AGl of $349.800 c. Chris and Casey, married faling jointly, earn $356,000 in sotaries and $56,000 in capitat gains for a total modified AGt of $412,000. How much in surtax will Chris and Casey be ossessed on their Form 1040 for 2022 ? Note: Round your answer to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts