Question: Chapter 7 : Stock Valuation Exercise 1 : valuing a share of a stock ( P ) that pays a dividend and you expect to

Chapter : Stock Valuation

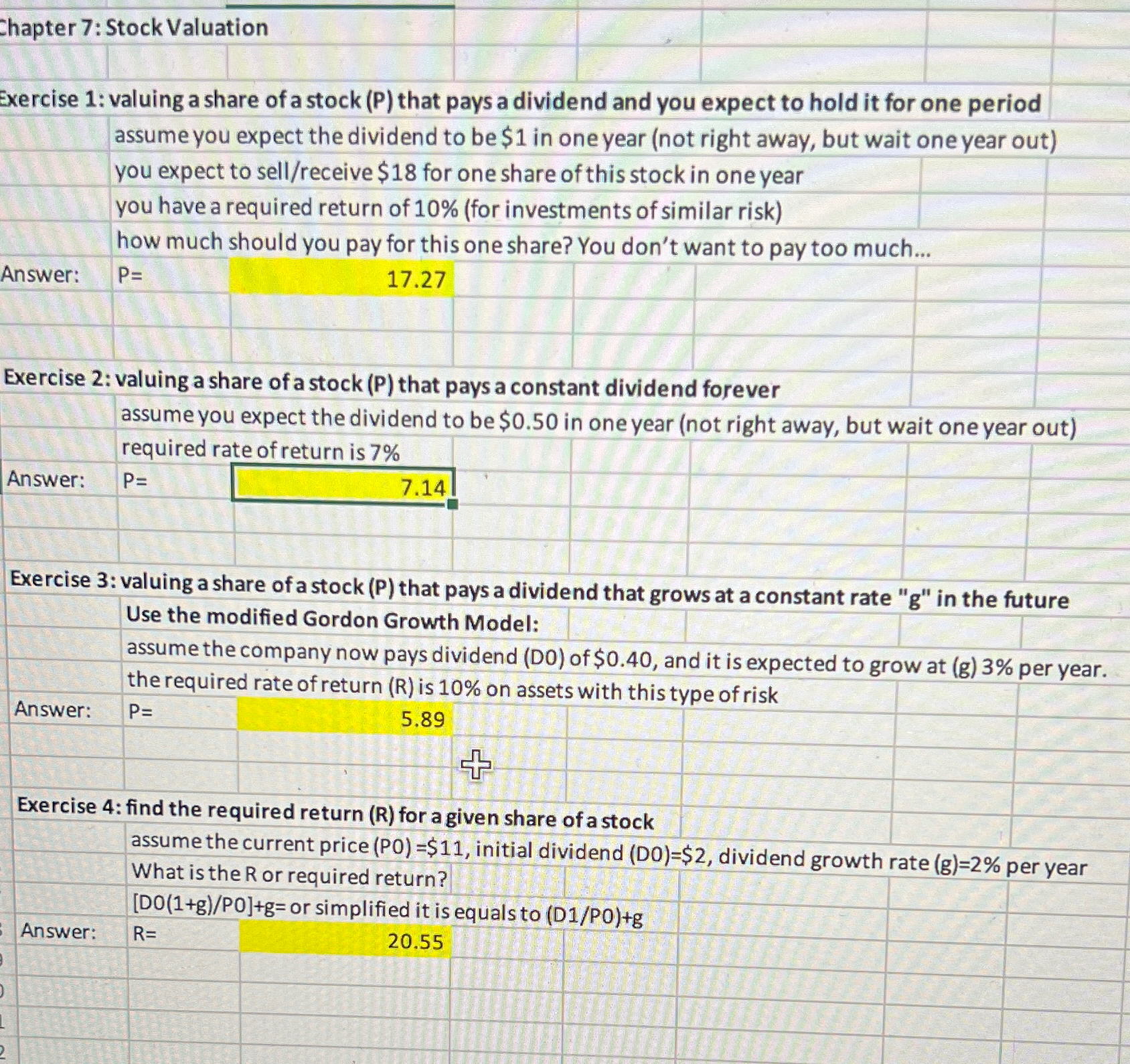

Exercise : valuing a share of a stock P that pays a dividend and you expect to hold it for one period assume you expect the dividend to be $ in one year not right away, but wait one year out you expect to sellreceive $ for one share of this stock in one year you have a required return of for investments of similar risk how much should you pay for this one share? You don't want to pay too much...

tableAnswer:

Exercise : valuing a share of a stock that pays a constant dividend forever assume you expect the dividend to be $ in one year not right away, but wait one year out

tablerequired rate of return is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock