Question: CHAPTER 8 I STOCK VALUATION331 20%. Based on the DVM, and price you should be willing to pay for this stock today? given a required

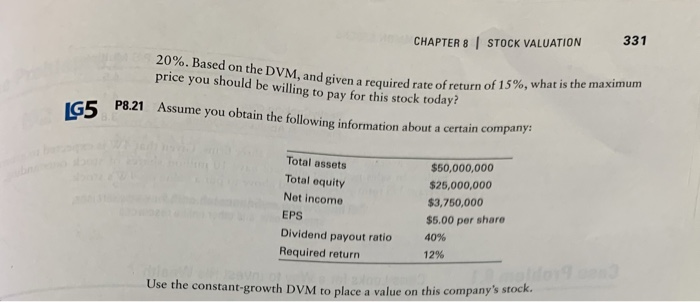

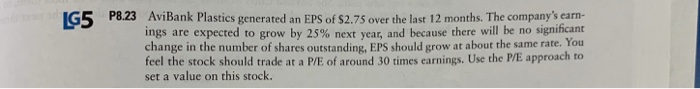

CHAPTER 8 I STOCK VALUATION331 20%. Based on the DVM, and price you should be willing to pay for this stock today? given a required rate of return of 15%, what is the maximum P8.21 Assume you obtain the following information about a certainc Total assets Total equity Net income EPS Dividend payout ratio Required return $50,000,000 25,000,000 $3,750,000 $5.00 per share 40% 12% st Use the constant-growth DVM to place a value on this company's IG5 P8.23 AviBank Plastics generated an EPS of $2.75 over the last 12 months. The company's earn- ings are expected to grow by 25% next year, and because there will be no significant change in the number of shares outstanding, EPS should grow at about the same rate. You feel the stock should trade at a P/E of around 30 times earnings. Use the P/E approach to set a value on this stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts