Question: Chapter 9 Assignment Hint: These are not necessarily complete definitions, but there is only one possible description for each term. Descriptions Terms The acceptance or

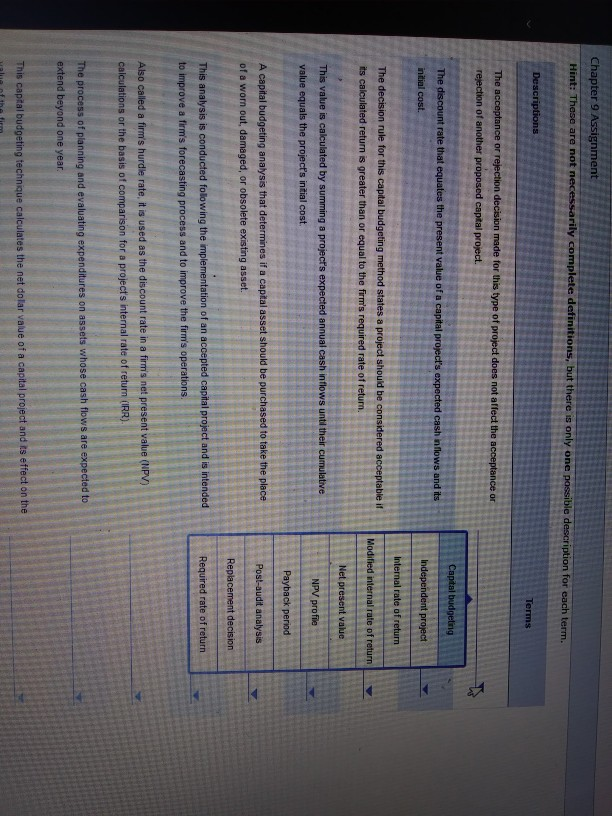

Chapter 9 Assignment Hint: These are not necessarily complete definitions, but there is only one possible description for each term. Descriptions Terms The acceptance or rejection decision made for this type of project does not affect the acceptance or rejection of another proposed capital project. Capital budgeting The discount rate that equates the present value of a capital project's expected cash in flows and its initial cost. Independent project Internal rate of return The decision rule for this capital budgeting method states a project should be considered acceptable if its calculated return is greater than or equal to the firm's required rate of retu Modified internal rate of return Net present value This value is calculated by summing a project's expected annual cash inflows until their cumulative value equals the project's initial cost. NPV profile Payback period A capital budgeting analysis that determines if a capital asset should be purchased to take the place of a wom out, damaged, or obsolete existing asset. Post-audit analysis Replacement decision Required rate of return This analysis is conducted following the implementation of an accepted capital project and is intended to improve a firm's forecasting process and to improve the firm's operations Also called a firm's hurdle rate, it is used as the discount rate in a firm's net present value (NPV) calculations or the basis of comparison for a project's internal rate of return (IRR) The process of planning and evaluating expenditures on assets whose cash flows are expected to extend beyond one year. This capital budgeting technique calculates the net dolar value of a capital project and its effect on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts