Question: Chart in 2nd pic Betas Answer the questions below for assets A to D shown in the table: EEE a. What impact would a 10%

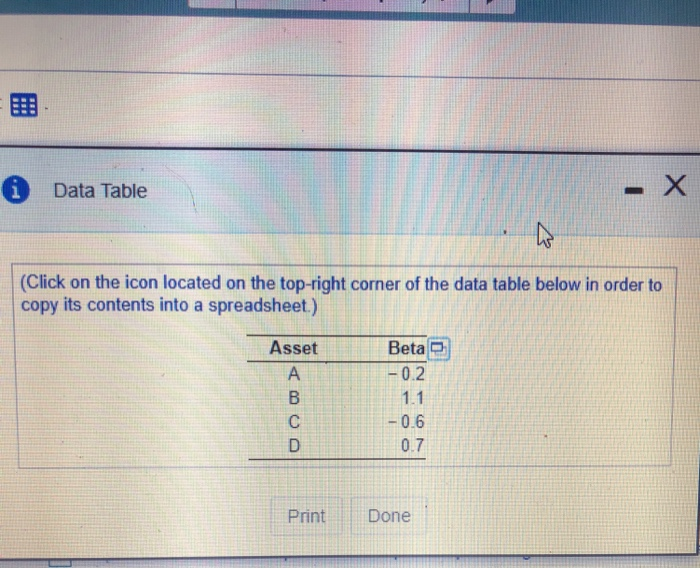

Betas Answer the questions below for assets A to D shown in the table: EEE a. What impact would a 10% increase in the market return be expected to have on each assers return? b. What impact would a 11% decrease in the market return be expected to have on each assers return? c. If you believed that the market return would increase in the near future, which asset would you prefer? d lf you believed that the market return would decrease in the near future, which asset would you prefer? a. f the market return increased by 10%, the impact to the return of asset A is Round to one decinal place Enter a posi e percentage for a increase and a negative or a decrease n the ret lfthe market return increased by 10%, the impact to the return of asset B If the market return increased by 10%, the impact to the return of asset C is % (Round to one decimal place Enter a positive percentage for an increase and a negative for a decrease in the retum lf the market retu increased by 10%, the impact to the return of asset D is [ %. Round to one decir a place Enter a positive percentage for an increase and a negative for a decrease in the etum b. If the market return decreased by 1 1%, the impact to the return of asset A is % Round to one deci al place Enter a positi e percentage for an increase and a negative or a decrease in the retum. If the market retum decreased by 1 1%, the impact to the return of asset B s % Round to one decimal place Enter a posieve percentage or an increase and a negative for a decrease the return. lf the market retum decreased by 11%, the impact to the return of asset C is % Ro nd to one decr al place Enter a posi ve percentage for an increase and a ne ihe ir a decrease n he re u Round to one decimal place Enter a positive percentage for an increase and a negative for a decrease in the return) BEE i Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Asset Beta -0.2 1.1 -0.6 0.7 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts