Question: Check my workCheck My Work button is now enabled2 Item 5 Item 5 7.6 points Item Skipped SafeData Corporation has the following account balances and

Check my workCheck My Work button is now enabled2

Item 5

Item 5 7.6 points Item Skipped

SafeData Corporation has the following account balances and respective fair values on June 30:

| Book Values | Fair Values | ||||||

| Receivables | $ | 100,000 | $ | 100,000 | |||

| Patented technology | 185,000 | 185,000 | |||||

| Customer relationships | 0 | 644,000 | |||||

| In-process research and development | 0 | 526,000 | |||||

| Liabilities | (576,000 | ) | (576,000 | ) | |||

| Common stock | (100,000 | ) | |||||

| Additional paid-in capital | (300,000 | ) | |||||

| Retained earnings deficit, 1/1 | 797,000 | ||||||

| Revenues | (430,000 | ) | |||||

| Expenses | 324,000 | ||||||

Privacy First, Inc., obtained all of the outstanding shares of SafeData on June 30 by issuing 20,000 shares of common stock having a $1 par value but a $65 fair value. Privacy First incurred $10,000 in stock issuance costs and paid $65,000 to an investment banking firm for its assistance in arranging the combination. In negotiating the final terms of the deal, Privacy First also agrees to pay $90,000 to SafeDatas former owners if it achieves certain revenue goals in the next two years. Privacy First estimates the probability adjusted present value of this contingent performance obligation at $27,000.

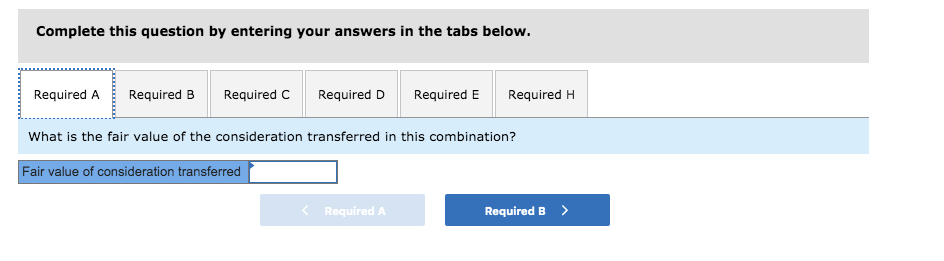

- What is the fair value of the consideration transferred in this combination?

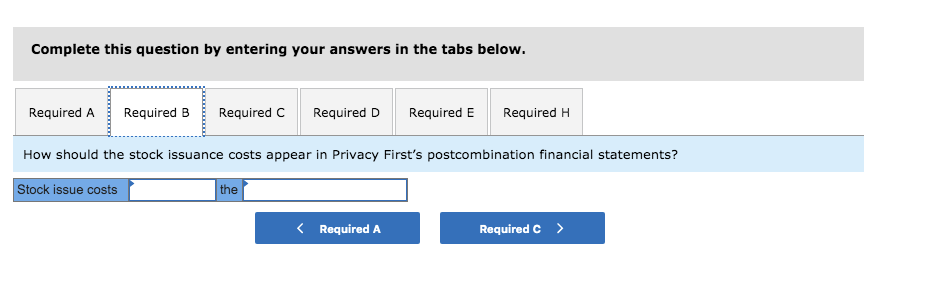

- How should the stock issuance costs appear in Privacy Firsts postcombination financial statements?

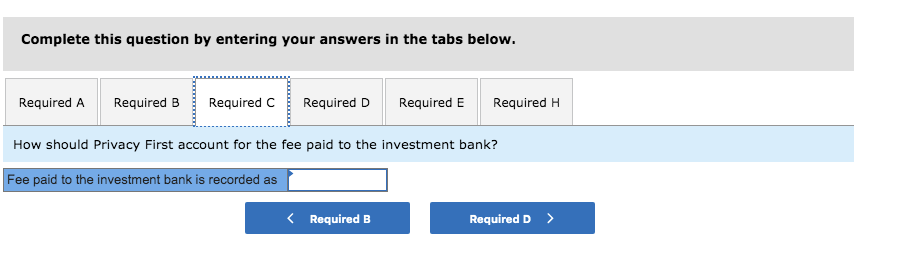

- How should Privacy First account for the fee paid to the investment bank?

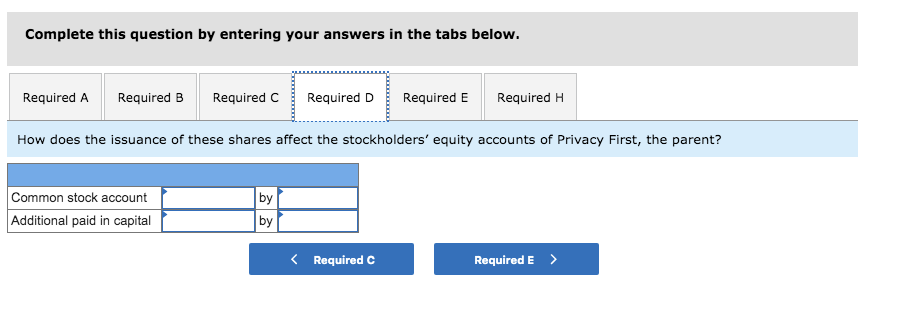

- How does the issuance of these shares affect the stockholders equity accounts of Privacy First, the parent?

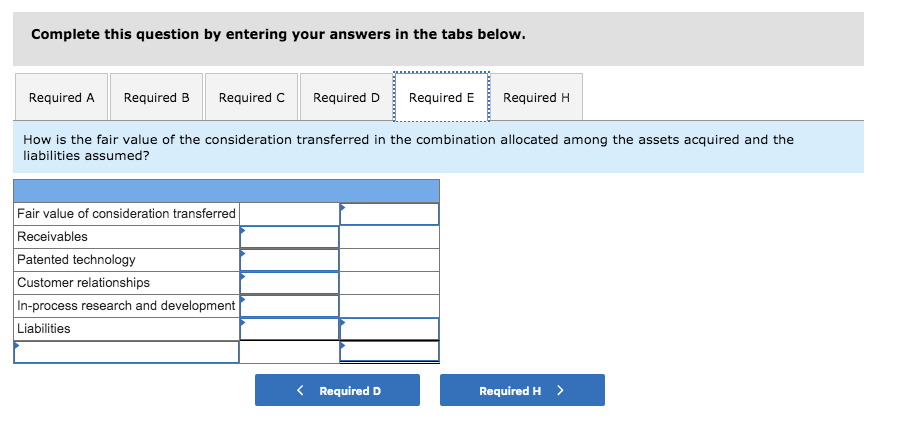

- How is the fair value of the consideration transferred in the combination allocated among the assets acquired and the liabilities assumed?

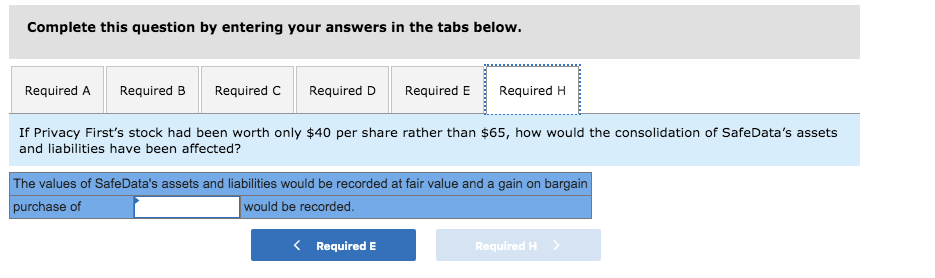

- If Privacy Firsts stock had been worth only $40 per share rather than $65, how would the consolidation of SafeDatas assets and liabilities have been affected?

Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required H What is the fair value of the consideration transferred in this combination? Fair value of consideration transferred Required A Required B > Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required H How should the stock issuance costs appear in Privacy First's postcombination financial statements? Stock issue costs the Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required H How should Privacy First account for the fee paid to the investment bank? Fee paid to the investment bank is recorded as Required B Required D > Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required H How does the issuance of these shares affect the stockholders' equity accounts of Privacy First, the parent? Common stock account Additional paid in capital by Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required H How is the fair value of the consideration transferred in the combination allocated among the assets acquired and the liabilities assumed? Fair value of consideration transferred Receivables Patented technology Customer relationships In-process research and development Liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts