Question: Check your worksheet setup and formulas by changing the Bank Balance per Statement to $18,000 and the Company balance at the end of the period

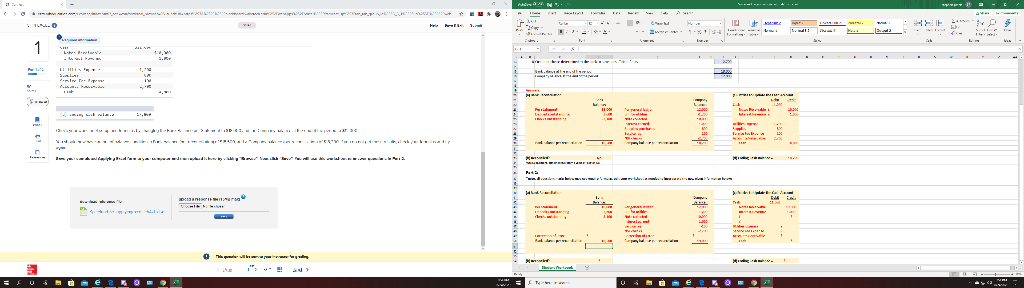

Check your worksheet setup and formulas by changing the Bank Balance per Statement to $18,000 and the Company balance at the end of the period to $12,000. You should now have an out of balance condition, a Bank balance (per reconciliation) of $18,500, and a Company balance (per reconciliation) of $18,200. If you do not get these results, check your formulas and try again. Save your completed Applying Excel form to your computer and then upload it here by clicking Browse. Next click Save. You will use this worksheet to answer questions in Part 2.

Revise your worksheet to reflect the following transactions and updated values at the end of the accounting period, then answer the questions that follow. (Note: You do not need to upload your revised worksheet for Part 2.)

| 1 | Cash on hand at the company and not yet deposited at the bank. | 7,600 | |

| 2 | EFT for monthly utility bill not yet recorded by the company. | 1,600 | |

| 3 | Note collected by the bank and not yet recorded by the company. | 10,700 | |

| 4 | Interest collected by the bank from note in #3 not yet recorded by the company. | 1,300 | |

| 5 | A check witten for insurance expense for $80 was cashed. The check was recorded on the books for $170. | ? | |

| 6 | Checks written by the company but not yet processed by the bank. | 2,700 | |

| 7 | Service fee charged by bank but not yet recorded by the company. | 100 | |

| 8 | Customer checks determined by the bank to have nonsufficient funds. | 3,200 | |

| Bank balance at the end of the period. | 16,600 | ||

| Company balance at the end of the period. | 14,310 | ||

Required: 1-a. What is the revised Cash balance at the end of the period? 1-b. Is the bank reconciliation in balance?

-

Yes

-

No

2-a. What is the balance in Cash if the entry to correct the insurance payment hasn't been made? 2-b. Would the bank reconciliation still be in balance?

-

Yes

-

No

3. Which statement below is true regarding the effect of the company incorrectly recording a customer deposit at $200,000 rather than $20,000?

-

No effect on the bank reconciliation.

-

The difference of $180,000 will be subtracted from the book balance.

-

The difference of $180,000 will be added to the book balance.

-

The bank balance will be increased by $200,000.

at HS 1. ada 1 PW 3. to 1100 2.300 Terus 13 4 300 gediwyd This = 0 AS at HS 1. ada 1 PW 3. to 1100 2.300 Terus 13 4 300 gediwyd This = 0 AS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts