Question: clear Answer all the question!!! Chapter 17 Name: Content Learning Worksheet - Answer the question and provide the page number of your solution. 1. What

clear

clear

Answer all the question!!!

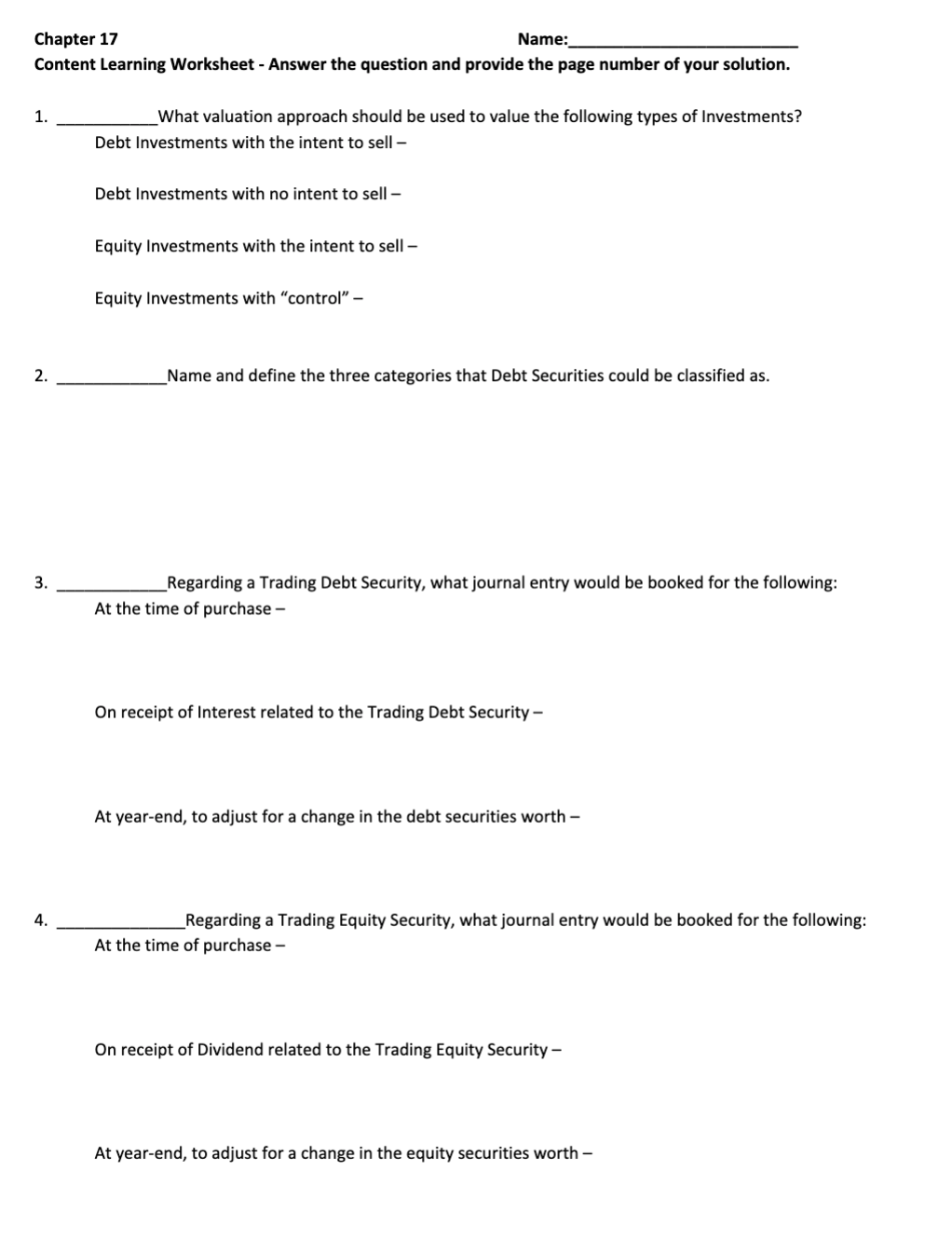

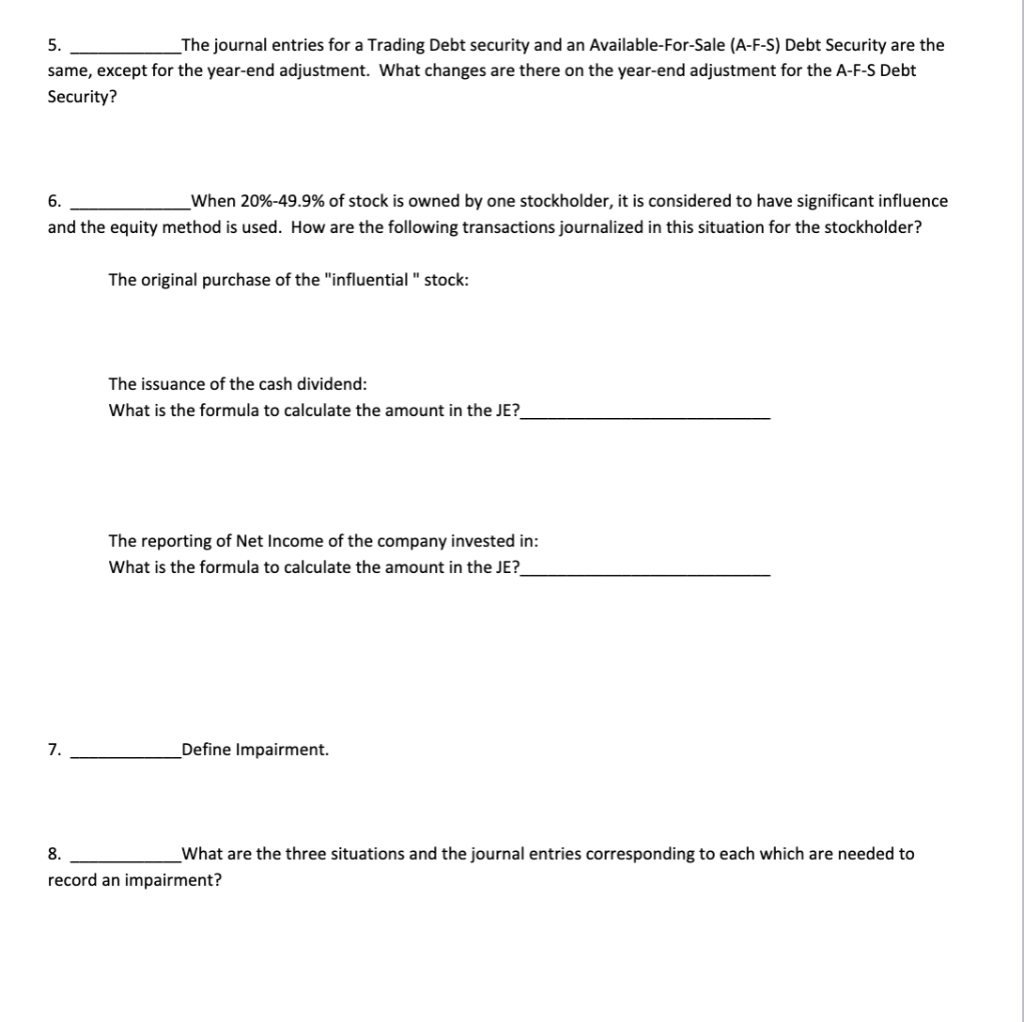

Chapter 17 Name: Content Learning Worksheet - Answer the question and provide the page number of your solution. 1. What valuation approach should be used to value the following types of Investments? Debt Investments with the intent to sell - Debt Investments with no intent to sell - Equity Investments with the intent to sell - Equity Investments with "control" - 2. Name and define the three categories that Debt Securities could be classified as. 3. Regarding a Trading Debt Security, what journal entry would be booked for the following: At the time of purchase - On receipt of Interest related to the Trading Debt Security - At year-end, to adjust for a change in the debt securities worth - 4. Regarding a Trading Equity Security, what journal entry would be booked for the following: At the time of purchase - On receipt of Dividend related to the Trading Equity Security - At year-end, to adjust for a change in the equity securities worth - 5. The journal entries for a Trading Debt security and an Available-For-Sale (A-F-S) Debt Security are the same, except for the year-end adjustment. What changes are there on the year-end adjustment for the A-F-S Debt Security? 6. When 20%-49.9% of stock is owned by one stockholder, it is considered to have significant influence and the equity method is used. How are the following transactions journalized in this situation for the stockholder? The original purchase of the "influential "stock: The issuance of the cash dividend: What is the formula to calculate the amount in the JE? The reporting of Net Income of the company invested in: What is the formula to calculate the amount in the JE? 7. Define Impairment. 8. What are the three situations and the journal entries corresponding to each which are needed to record an impairment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts