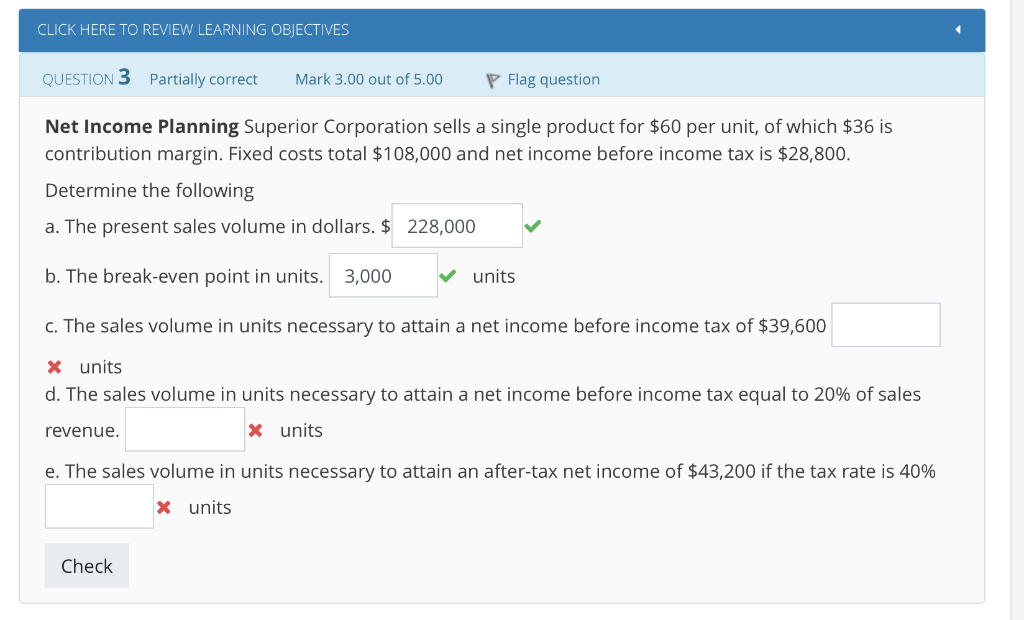

Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 3 Partially correct Mark 3.00 out of 5.00 P Flag question Net Income Planning Superior Corporation sells a

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 3 Partially correct Mark 3.00 out of 5.00 P Flag question Net Income Planning Superior Corporation sells a single product for $60 per unit, of which $36 is contribution margin. Fixed costs total $108,000 and net income before income tax is $28,800 Determine the following a. The present sales volume in dollars. $ 228,000v b. The break-even point in units. 3,000 units C. The sales volume in units necessary to attain a net income before income tax of $39,600 x units d. The sales volume in units necessary to attain a net income before income tax equal to 20% of sales revenue. e. The sales volume in units necessary to attain an after-tax net income of $43,200 if the tax rate is 40% x units x units Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts