Question: Click to see additional instructions You are considering purchasing a 9-year zero-coupon Treasury bond with a face value of $1,000. Its market price is $700.

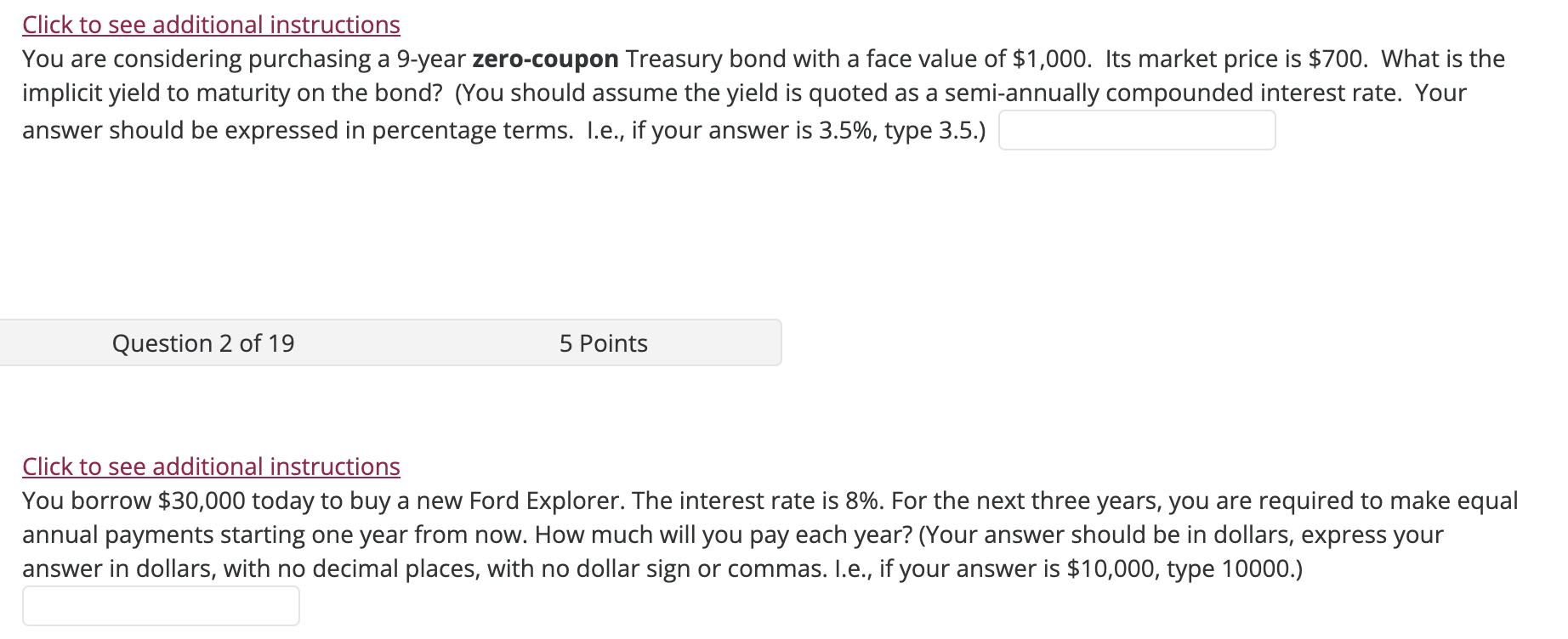

Click to see additional instructions You are considering purchasing a 9-year zero-coupon Treasury bond with a face value of $1,000. Its market price is $700. What is the implicit yield to maturity on the bond? (You should assume the yield is quoted as a semi-annually compounded interest rate. Your answer should be expressed in percentage terms. I.e., if your answer is 3.5%, type 3.5.) Question 2 of 19 5 Points Click to see additional instructions You borrow $30,000 today to buy a new Ford Explorer. The interest rate is 8%. For the next three years, you are required to make equal annual payments starting one year from now. How much will you pay each year? (Your answer should be in dollars, express your answer in dollars, with no decimal places, with no dollar sign or commas. I.e., if your answer is $10,000, type 10000.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts