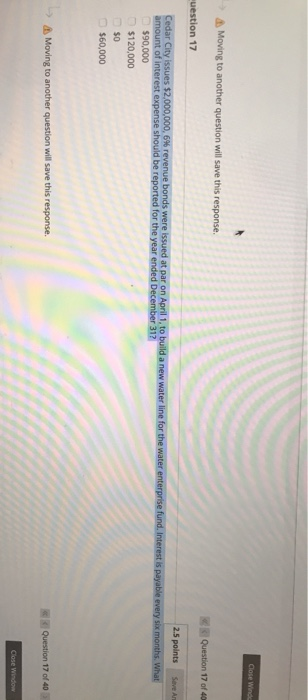

Question: Close Wind Moving to another question will save this response. Question 17 of 40 uestion 17 2.5 points Save An Cedar City issues $2,000,000, 6%

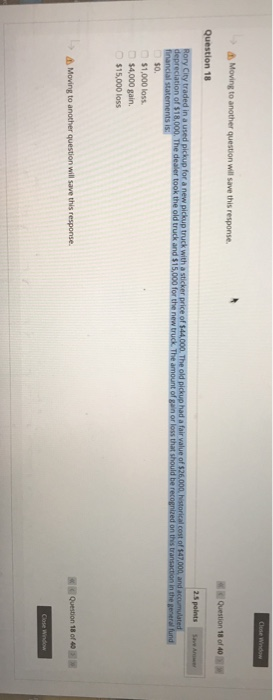

Close Wind Moving to another question will save this response. Question 17 of 40 uestion 17 2.5 points Save An Cedar City issues $2,000,000, 6% revenue bonds were issued at par on April 1, to build a new water line for the water enterprise fund. Interest is payable every six months. What amount of interest expense should be reported for the year ended December 312 $90,000 $120.000 $0 $60,000 Moving to another question will save this response. Question 17 of 40 Cose Window Close Window Moving to another question will save this response. Question 18 of 40 Question 18 2.5 points Save Aroma Rory City traded in a used pickup for a new pickup truck with a sticker price of $44,000. The old pickup had a fair value of 526,000 historical cost of $47.000, and accumulated depreciation of 518,000. The dealer took the old truck and $15,000 for the new truck. The amount of gain or loss that should be recognized on this transaction in the general fund financial statements is: $0. $1,000 loss. $4,000 gain. $15,000 loss Moving to another question will save this response. Question 18 of 40 Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts