Question: Colorado Computer is considering expansion into the computer disk drive manufacturing business to be paid for with the $10,000,000 cash that can be raised from

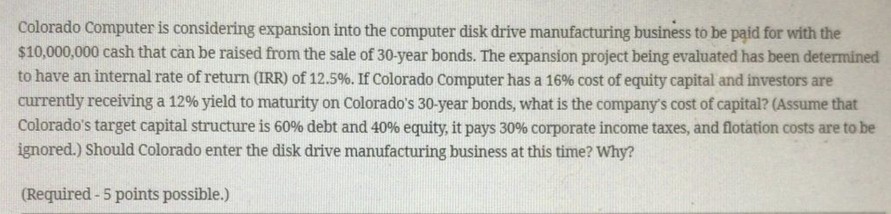

Colorado Computer is considering expansion into the computer disk drive manufacturing business to be paid for with the $10,000,000 cash that can be raised from the sale of 30-year bonds. The expansion project being evaluated has been determined to have an internal rate of return (IRR) of 12.5%. If Colorado Computer has a 16% cost of equity capital and investors are currently receiving a 12% yield to maturity on Colorado's 30-year bonds, what is the company's cost of capital? (Assume that Colorado's target capital structure is 60% debt and 40% equity, it pays 30% corporate income taxes, and flotation costs are to be ignored.) Should Colorado enter the disk drive manufacturing business at this time? Why? (Required -5 points possible.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts