Question: Com Section - This question is COMPULSORY and MUST be attempted 16. BessGoods Pic is a tall company with securities and ce a large exchanThe

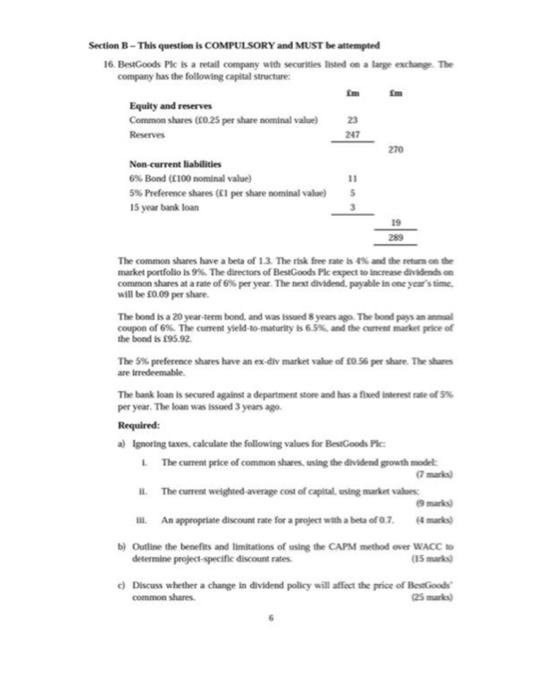

Com Section - This question is COMPULSORY and MUST be attempted 16. BessGoods Pic is a tall company with securities and ce a large exchanThe company has the following capital structures Equity and reserves Common shares (0.25 per share sominal value) 23 Reserves 247 270 Non current liabilities 6% Bond (100 nominal value) 5% Preference shares (1 per share sominal value 5 15 year bunk loan 289 The common shares have a beta of 13. The risk free rates and the return on the market portfolios 9%. The directors of BestGoods Plc expect to increased on common shares at a rate of 6% per year. The next dividend payable in one year's time. will be 0.09 perse The bond is a 20 year term bond and was issued years ago. The bond paysan coupon of 6%. The current seld-to-matarly 6.5% and the current market price of the bond is 95.92 The 5% preference shares have an ex div market value of 0:56 per share. The shares are teredeemable. The bank loan is secured against a department store and has a fleed interest rate of 5% per year. The loan was issued 3 years ago Required: a) Ignoring taxes, calculate the following values for BestGoods Pic The current price of common shwes, using the dividend growth model The current weighted average cost of capital, using market value 1. An appropriate discount rate for a project with a bete of 07.martes) b) Outline the benefits and limitations of using the CAPM method over WACC determine project specific discount rates 15 Discuss whether a change in dividend policy will affect the price of Besonde common shares Sur)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts