Question: com/issues/2017/feb/calculate 12-50 Basic Capital Budgeting Techniques; Uneven Net Cash Inflows with Taxes; Spreadsheet Application Use the same information for this problem as you did

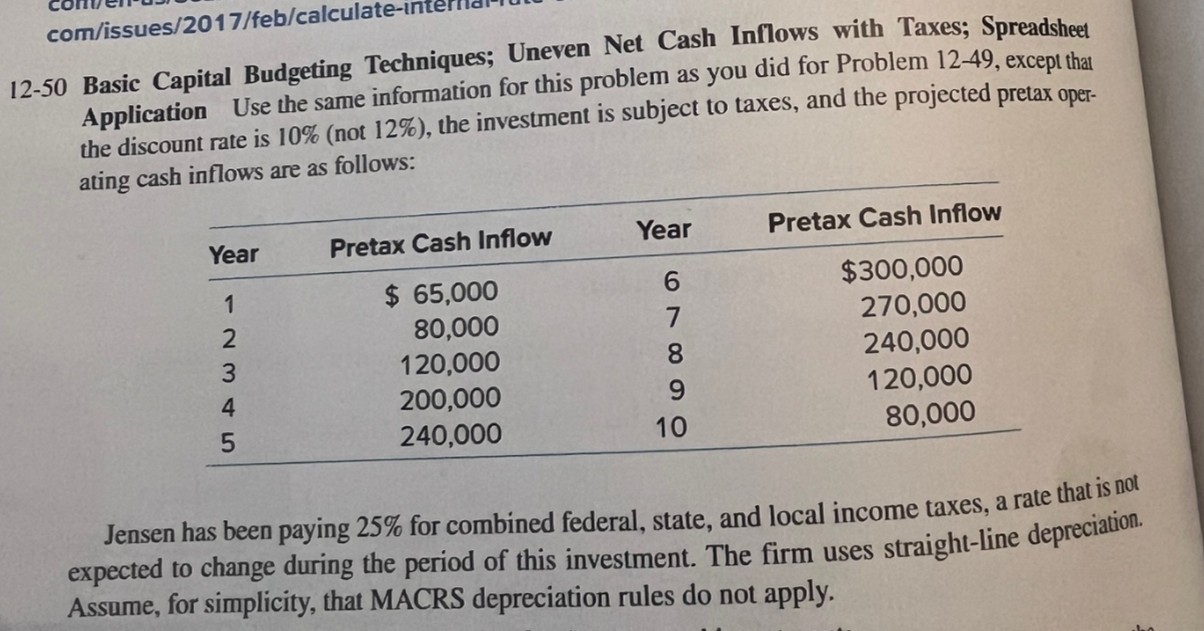

com/issues/2017/feb/calculate 12-50 Basic Capital Budgeting Techniques; Uneven Net Cash Inflows with Taxes; Spreadsheet Application Use the same information for this problem as you did for Problem 12-49, except that the discount rate is 10% (not 12%), the investment is subject to taxes, and the projected pretax oper- ating cash inflows are as follows: Year Pretax Cash Inflow Year 1 $ 65,000 -2345 80,000 120,000 200,000 240,000 67820 Pretax Cash Inflow $300,000 270,000 240,000 9 120,000 10 80,000 Jensen has been paying 25% for combined federal, state, and local income taxes, a rate that is not expected to change during the period of this investment. The firm uses straight-line depreciation. Assume, for simplicity, that MACRS depreciation rules do not apply.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts