Question: (Commodity Forward Pricing) Consider the following oil forward contract: - Notional amount: 10,000bbl; - Delivery Date: One month from now; - Interest rate: 0.06 per

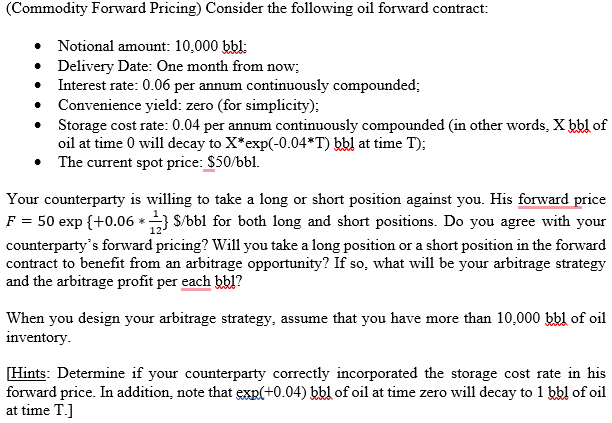

(Commodity Forward Pricing) Consider the following oil forward contract: - Notional amount: 10,000bbl; - Delivery Date: One month from now; - Interest rate: 0.06 per annum continuously compounded; - Convenience yield: zero (for simplicity); - Storage cost rate: 0.04 per annum continuously compounded (in other words, X bbl of oil at time 0 will decay to Xexp(0.04T) bbl at time T); - The current spot price: $50/bbl. Your counterparty is willing to take a long or short position against you. His forward price F=50exp{+0.06121}$/ bbl for both long and short positions. Do you agree with your counterparty's forward pricing? Will you take a long position or a short position in the forward contract to benefit from an arbitrage opportunity? If so, what will be your arbitrage strategy and the arbitrage profit per each bbl? When you design your arbitrage strategy, assume that you have more than 10,000bbl of oil inventory. [Hints: Determine if your counterparty correctly incorporated the storage cost rate in his forward price. In addition, note that exp(+0.04)bbl of oil at time zero will decay to 1bbl of oil at time T.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts