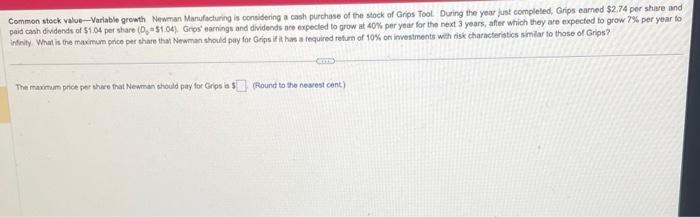

Question: Common steck value-Variable growth Newenan Manufacturing is considering a cash purchase of the sack of Grips Tool. During the year just compleled, Grips earned $2.74

Common steck value-Variable growth Newenan Manufacturing is considering a cash purchase of the sack of Grips Tool. During the year just compleled, Grips earned \$2.74 per shise and paid cash dividends of 51.04 per share (0e =$1. 04) Gros' earnings and dividends are expected to grow at 40% per year for the next 3 years, afler which they are expected to grow 7% per year to intrity. What is the maximum peice per thare that Newman shoild pay for Grips ir it has a fequired refuan of 10% on imwestments with risk characteristics similar to those of Grips? The maximum price per chere that Newman should pay for Grips is (Round to the nevest cent)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock