Question: Company A has established a defined benefit plan for the employee. Annual payments under the plan are equal to highest lifetime salary multiplied by 2%

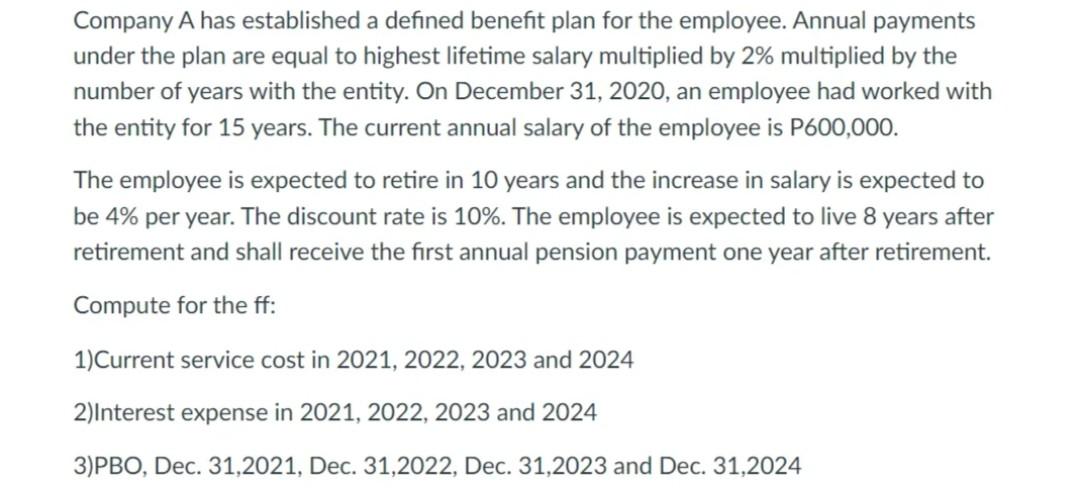

Company A has established a defined benefit plan for the employee. Annual payments under the plan are equal to highest lifetime salary multiplied by 2% multiplied by the number of years with the entity. On December 31, 2020, an employee had worked with the entity for 15 years. The current annual salary of the employee is P600,000. The employee is expected to retire in 10 years and the increase in salary is expected to be 4% per year. The discount rate is 10%. The employee is expected to live 8 years after retirement and shall receive the first annual pension payment one year after retirement. Compute for the ff: 1)Current service cost in 2021, 2022, 2023 and 2024 2)Interest expense in 2021, 2022, 2023 and 2024 3)PBO, Dec. 31,2021, Dec. 31,2022, Dec. 31,2023 and Dec. 31,2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts