Question: Company ABC is doing a pipeline construction project. For simplicity sake, let's assume that five risks were identified for this project which will have impact

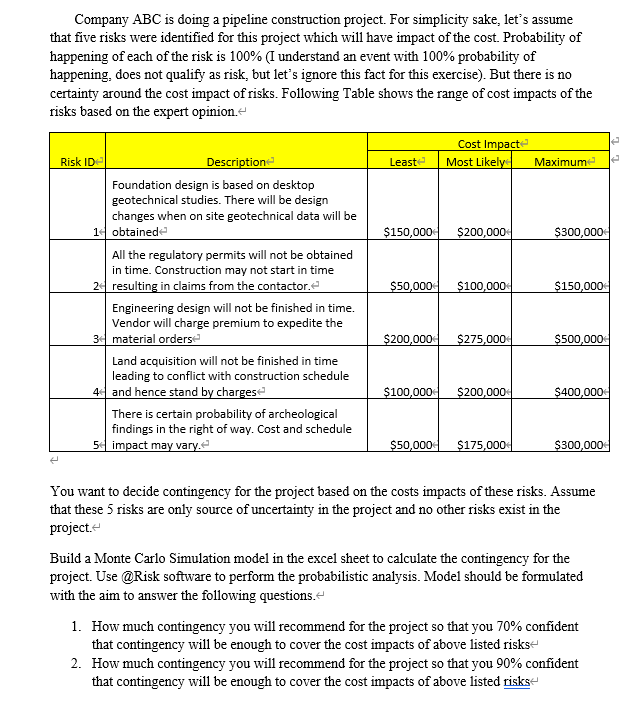

Company ABC is doing a pipeline construction project. For simplicity sake, let's assume

that five risks were identified for this project which will have impact of the cost. Probability of

happening of each of the risk is I understand an event with probability of

happening, does not qualify as risk, but let's ignore this fact for this exercise But there is no

certainty around the cost impact of risks. Following Table shows the range of cost impacts of the

risks based on the expert opinion.

You want to decide contingency for the project based on the costs impacts of these risks. Assume

that these risks are only source of uncertainty in the project and no other risks exist in the

project.

Build a Monte Carlo Simulation model in the excel sheet to calculate the contingency for the

project. Use @Risk software to perform the probabilistic analysis. Model should be formulated

with the aim to answer the following questions.

How much contingency you will recommend for the project so that you confident

that contingency will be enough to cover the cost impacts of above listed risks

How much contingency you will recommend for the project so that you confident

that contingency will be enough to cover the cost impacts of above listed risks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock