Question: Company S is evaluating two mutually exclusive projects, Project A and Project B. Each has a useful life of four years and the study period

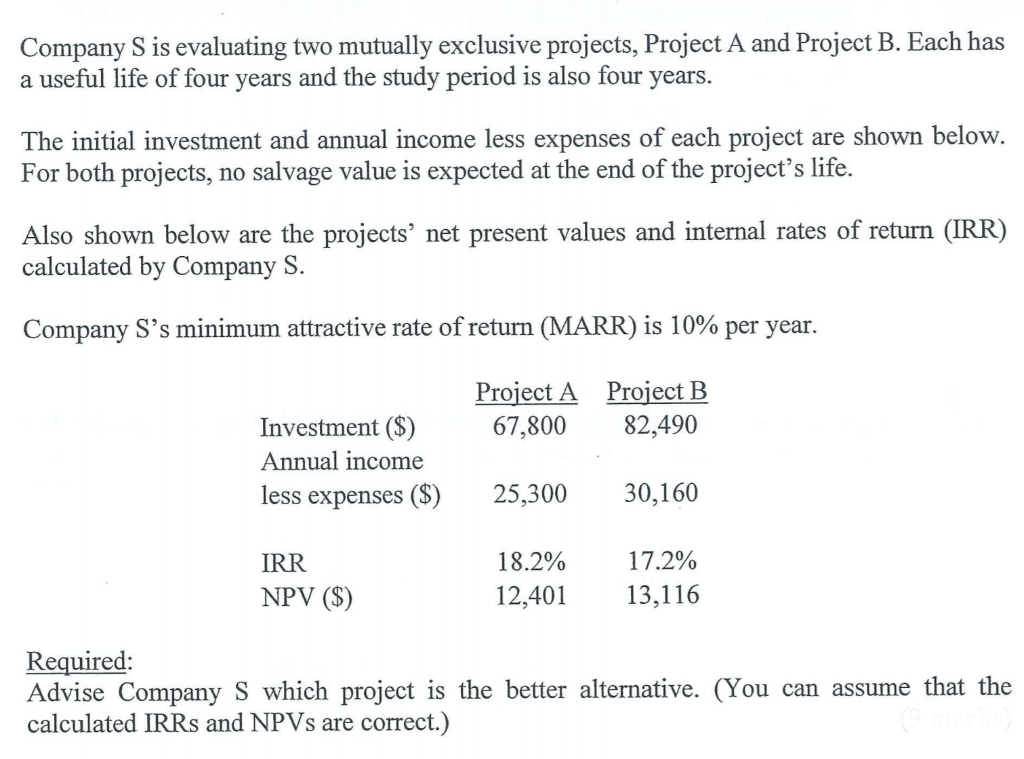

Company S is evaluating two mutually exclusive projects, Project A and Project B. Each has a useful life of four years and the study period is also four years The initial investment and annual income less expenses of each project are shown below. For both projects, no salvage value is expected at the end of the project's life. Also shown below are the projects' net present values and internal rates of return (IRR) calculated by Company S. Company S's minimum attractive rate of return (MARR) is 10% per year Proiect A Project B 67,800 82,490 Investment ($) Annual income less expenses () 25,300 30,160 17.2% 13,116 18.2% 12,401 IRR NPV (S) Required Advise Company S which project is the better alternative. (You can assume that the calculated IRRs and NPVs are correct.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts