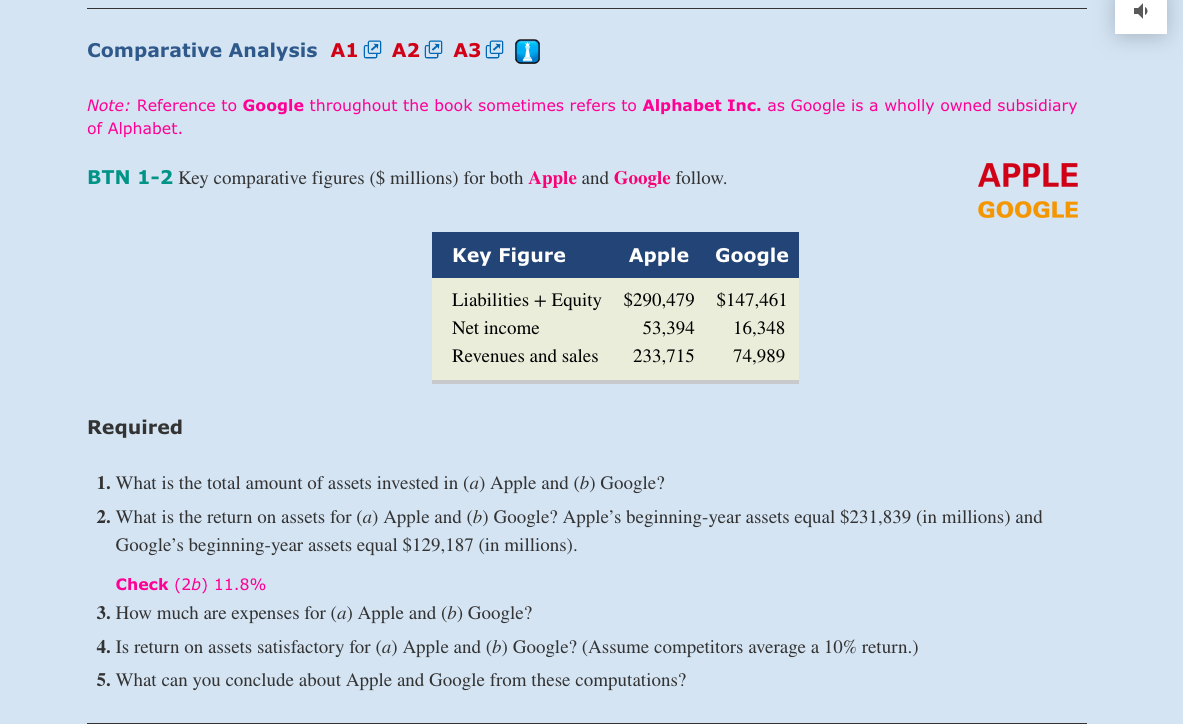

Question: Comparative Analysis A1 A2 A3 T Note: Reference to Google throughout the book sometimes refers to Alphabet Inc. as Google is a wholly owned subsidiary

Comparative Analysis A1 A2 A3 T Note: Reference to Google throughout the book sometimes refers to Alphabet Inc. as Google is a wholly owned subsidiary of Alphabet. APPLE BTN 1-2 Key comparative figures ($ millions) for both Apple and Google follow. GOOGLE Google Key Figure Apple Liabilities Equity $290,479 $147,461 Net income 53,394 16,348 Revenues and sales 233,715 74.989 Required 1. What is the total amount of assets invested in (a) Apple and (b) Google? 2. What is the return on assets for (a) Apple and (b) Google? Apple's beginning-year assets equal $231,839 (in millions) and Google's beginning-year assets equal $129,187 (in millions). Check (2b) 11.8% 3. How much are expenses for (a) Apple and (b) Google? 4. Is return on assets satisfactory for (a) Apple and (b) Google? (Assume competitors average a 10% return.) 5. What can you conclude about Apple and Google from these computations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts