Question: Please help with answering this problem BTN 1-2 Key comparative figures (S thousands) for both Polaris and Arctic Cat follow. COMPARATIVE ANALYSIS A1 A2 A3

Please help with answering this problem

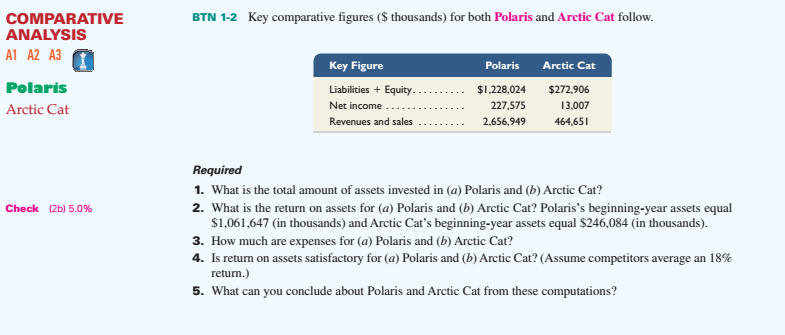

BTN 1-2 Key comparative figures (S thousands) for both Polaris and Arctic Cat follow. COMPARATIVE ANALYSIS A1 A2 A3 Key Figure Polaris Arctic Cat Polaris Arctic Cat Liabilities + Equity. Net income Revenues and sales $1.228,024 $272.906 227,57513,007 2,656,949 464,65 Required 1. What is the total amount of assets invested in (a) Polaris and (b) Arctic Cat? 2. What is the return on assets for (a) Polaris and (b) Arctic Cat? Polaris's beginning-year assets equal Check (2b) 5.0% $1,061,647 (in thousands) and Arctic Cat's beginning-year assets equal $246,084 (in thousands). 3. How much are expenses for (a) Polaris and (b) Arctic Cat? 4. Is return on assets satisfactory for (a) Polaris and (b) Arctic Cat? (Assume competitors average an 18% return.) 5. What can you conclude about Polaris and Arctic Cat from these computations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts