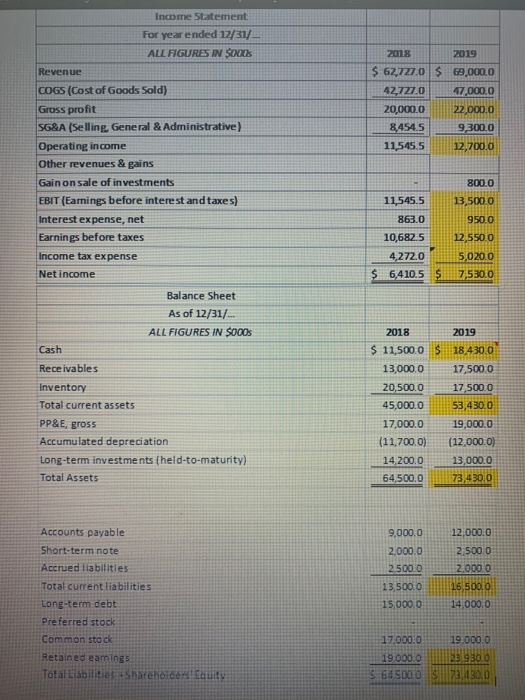

Question: complete cashflow statement using balance & income statement Income Statement For year ended 12/31/ ALL FIGURES IN SOUL 2019 69,000.0 Revenue $ 47.000.0 2018 $

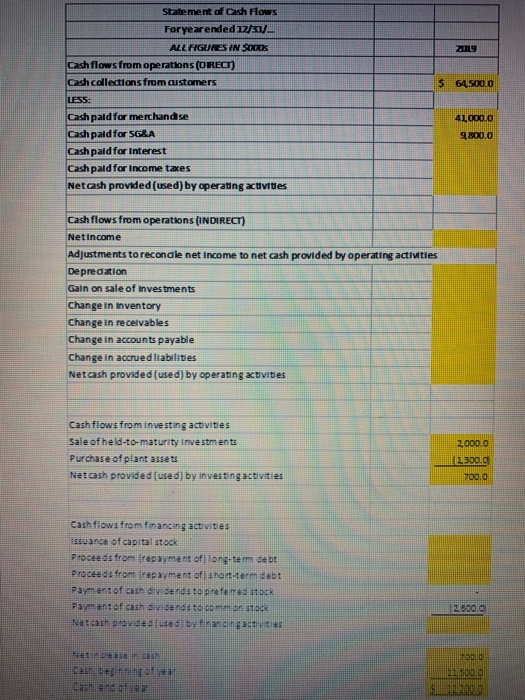

Income Statement For year ended 12/31/ ALL FIGURES IN SOUL 2019 69,000.0 Revenue $ 47.000.0 2018 $ 62,777.0 42,727.0 20,000,0 8.454.5 11.545.5 22.000.0 93000 12,700.0 COGS (Cost of Goods Sold) Gross profit SG&A (Selling, General & Administrative) Operating income Other revenues & gains Gain on sale of investments EBIT (Earnings before interest and taxes) Interest expense, net Earnings before taxes Income tax expense 11,545.5 863.0 800.0 13,500.0 950.0 12 550.0 5,020.0 7,530.0 10,682.5 4,272.0 6,410.5 Net income $ $ Balance Sheet As of 12/31/ ALL FIGURES IN $000s Cash Receivables Inventory Total current assets PP&E, gross Accumulated depreciation Long-term investments (held-to-maturity) Total Assets 2018 $ 11,500.0 13,000.0 20,500.0 45,000.0 17,000.0 (11,700.0) 14,200.0 64,500.0 2019 S 18,430,0 17,5000 17,500.0 53,430.0 19,000.0 (12,000.0) 13,000.0 173.430.0 12,000.0 Accounts payable Short-term note Accrued liabilities Total current liabilities Long-term debt Preferred stock Common stock Retained earnings Total Liabilities Shareholders Equity 9,000.0 2.000.0 2.500.0 13.500.0 15,000.0 14.000.0 19.000.0 17.000.0 19.000.0 $ 64500.0 Statement of Cash Flows Foryear ended 12/31 ALL FIGURES IN SODES Cash flows from operations (ORECT) Cash collections from customers $ 64,500.0 Cashpaldfor merchandise Cashpaldfor SG&A Cashpald for interest Cash paid for income taxes Netcash provided (used) by operating activities TE 41.000.0 9.800.0 1 / / ET / / Cashflows from operations (INDIRECT) Netincome Adjustments to reconcile net income to net cash provided by operating activities w De predation Gain on sale of investments Change in Inventory Change in receivables Change in accounts payable Change in accrued liabilities Net cash provided (used) by operating activities Cash flows from investing activities Sale of held-to-maturity investments Purchase of plant assets Netcash provided used) by investing activities Cash flows from financing activities issuance of capital stock Proceeds from repayment of long-tem debt Proceeds from repayment of shortterm debt Payment of cash didends to preferred stock Payment of cash dividends to common stock Nutcash provide d by financing activities 2 500.0 in Mette Cash Casheed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts