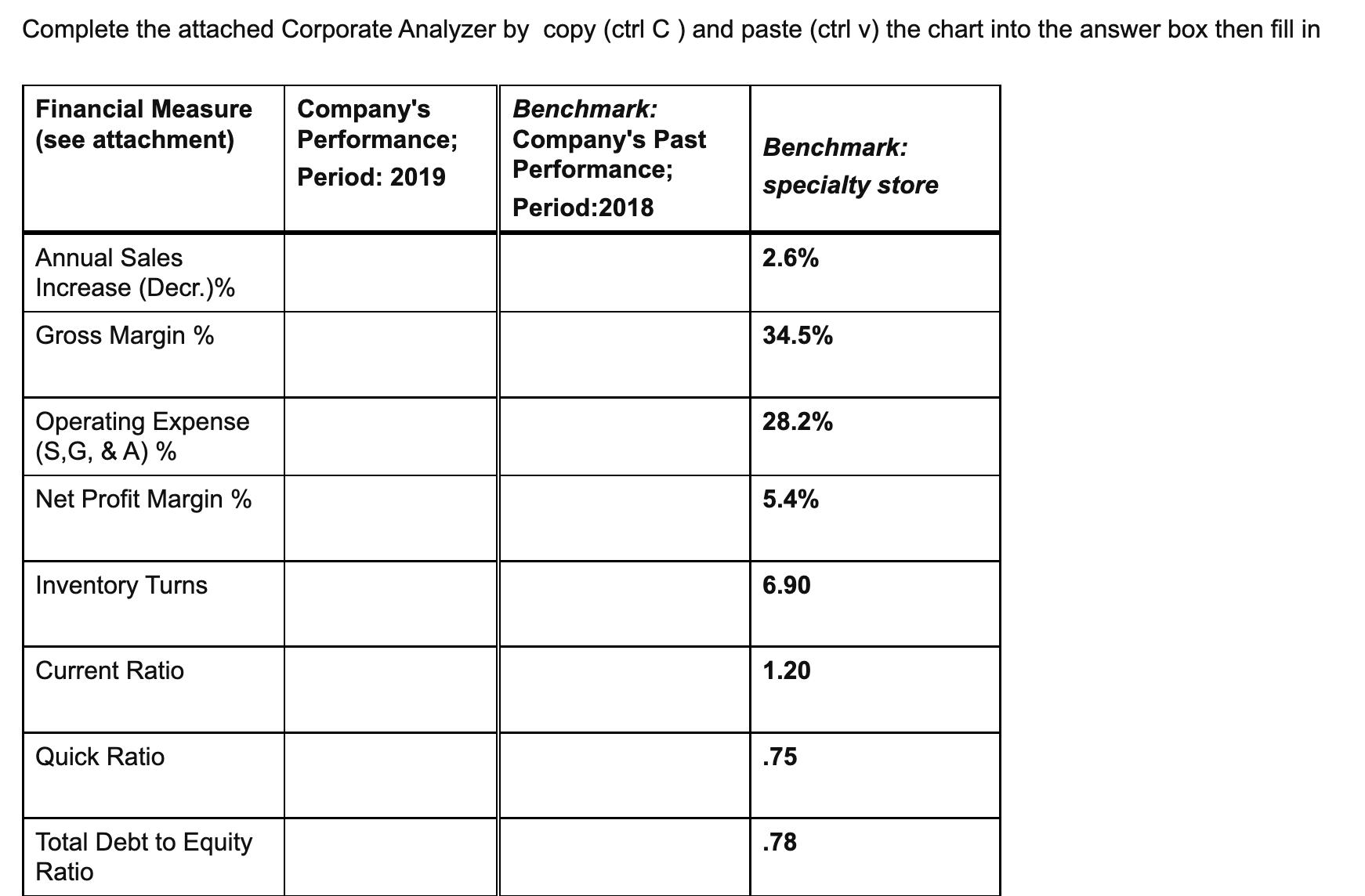

Question: **Complete the attached Corporate Analyzer by copy (ctrl C ) and paste (ctrl v) the chart into the answer box then fill in Financial Measure

**Complete the attached Corporate Analyzer by copy (ctrl C ) and paste (ctrl v) the chart into the answer box then fill in

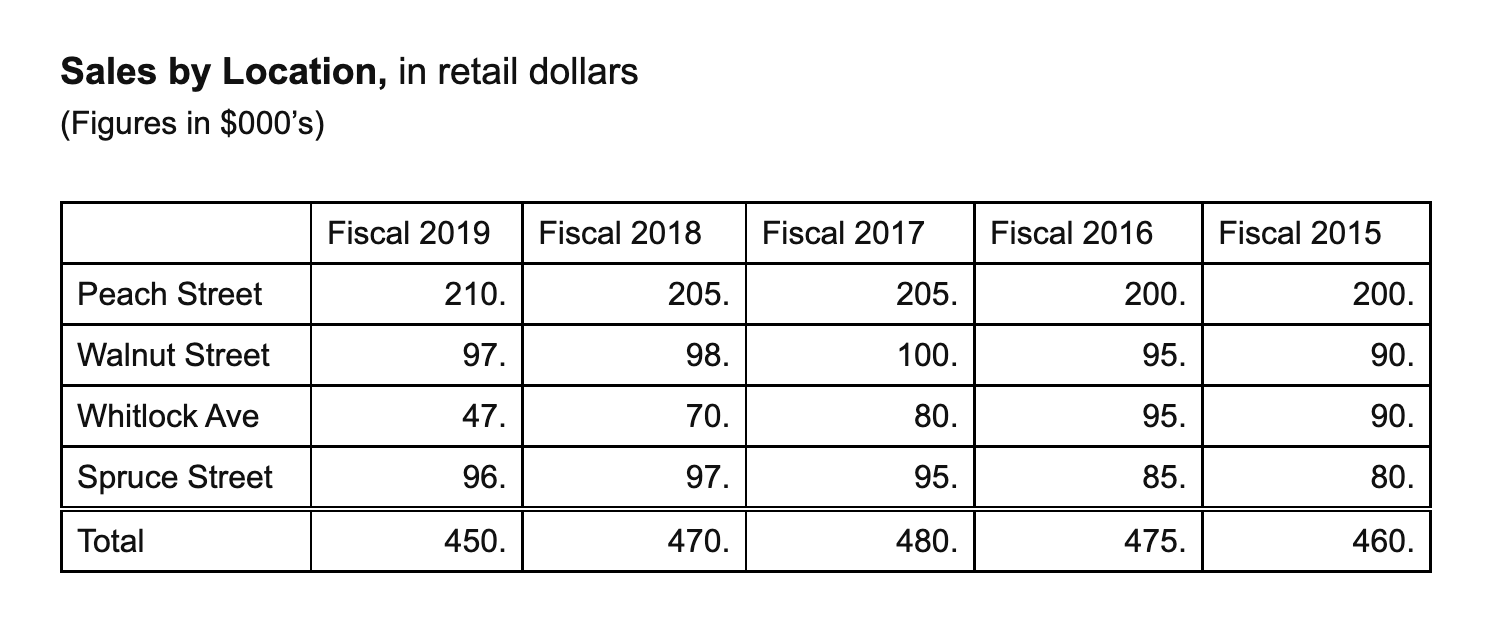

| Financial Measure (see attachment) | Company's Performance; Period: 2019 | Benchmark:Company's Past Performance; Period:2018 | Benchmark: specialty store |

| Annual Sales Increase (Decr.)% | 2.6% | ||

Gross Margin % | 34.5% | ||

| Operating Expense (S,G, & A) % | 28.2% | ||

Net Profit Margin % | 5.4% | ||

| Inventory Turns | 6.90 | ||

| Current Ratio | 1.20 | ||

| Quick Ratio | .75 | ||

| Total Debt to Equity Ratio | .78 |

Use only the information provided in the case study to answer the following questions

Case Study:

The Boutique

Kathy Brennon met Monday morning with James her lead sales person, "sales have been slowing and I'm concerned we have too much stock in some categories and won't have enough open to buy money to bring in new spring merchandise" said Kathy. "We will have to be careful to invest in the categories that sell. We need to analyze the business and make smart decisions with limited funds," said James.

Kathy Brennon has been running The Boutique in Atlanta for 20 years. Stock ownership has always been shared among members of the Brennon family. When the store opened, Peach Tree Heights was the high-end suburb of Atlanta: old established families, black tie parties, debutante balls, charity luncheons. Kathy built a profitable business selling very fine apparel to the wives and daughters of Atlanta's most successful families. She featured extra-fine quality (french seams, silk linings), fittings, and in-store fashion shows. As her success grew, Kathy ultimately expanded to four stores.

One of those stores is on Peach Street. Down the block is her main competition in town, Lilac & Rose. This large store draws customers from all parts of Peach Tree Heights with its wide assortment of good-to-better women's apparel. Most of Lilac & Rose's business is somewhat lower in price than The Boutique, though they work also carry prices and styles that compete directly.

But Peach Tree Heights has been changing. The old, conservative society families are being replaced by a younger generation of professionals and middle-class wage earners, mostly with one or two children. Husbands and wives both work as lawyers, doctors, and business people.

Kathy pointed to today's Atlanta Press. Did you see that Lilac & Rose is closing! What a shame after 30 years." James said, "Kathy, you know Lilac & Rose was never as nice as our store. They had so few salespeople they could never provide proper service. I noticed that there was less and less merchandise in the store every season. I heard that their business was actually quite good, but they were running out of cash. Rose the owner was undisciplined and spent every cent that the business brought in on herself with travel, spa treatments and expensive cars, she never reinvested in her business."

At this point Nicole a high school student who just started working there part-time spoke up. "Kathy, I think you've just got to change what you're selling! These styles aren't right. My friends in high school think this store isn't what high school girls want. Instead of working on the selling floor I could be your buyer and select the styles my friends and I would wear.

James interrupted "I'm really most worried about all the new stores that have opened in town. Just in the past couple of years, Kohl's and Target. Over on the other side of Atlanta, the new Fur Volt is 2 miles away! It's just too much!

Kathy looked stressed and exclaimed "Wal-Mart and Sam's Club and TJX are now in the new strip mall on the south side, I hear that parking lot is always crowded"

"That's just what I mean!" explained Nicole. "Why don't you open a store in that new strip mall? All my friends are going there. Meanwhile, in your stores Kathy, you've got so many salespeople that we have become like used-car salesmen, pouncing on each customer that comes in. I don't think the customers even like us to help them!"

"But that's what we're all about, fine and attentive service," countered James.

"I've got an idea," replied Nicole. "Over at your Whitlock Ave store, why don't you let me pick out the assortment? I know your business has been especially bad at that store. My friends can't believe the 'old lady' clothes! What they want is more like Rue 21, Aeropostleor American Eagle."

James gasped "Do you even know our customer? I suppose you want loud teen music blaring too. That doesn't really seem to be what we are known for."

Whitlock Ave has been difficult for a while; the lease is due next month. I really have to think about what to do there, Kathy Exclaimed.

Kathy had just spent the day finalizing her annual figures. It was discouraging. Sales were down. Kathy was perplexed because she had sold about as many units as last year... it must be the big markdowns. ("I never used to take markdowns at all...only clearance!") She noticed that the biggest markdowns came from two classifications. Her profits have also been on the decline.

Kathy was thinking about and article she had just read in the Wall Street Journal stating that online sales represent 15% of total retail sales and will growing at 9% year over year. Brick and mortar specialty stores are experiencing a 2% growth year over year. Was she making the most of her family's business?

Nicole spoke up. "Finest quality, finest service, are you sure your customers really want all this?"

"But this is what makes us special," explained James. "No one else in town provides this kind of service and quality. It's our heritage. I say we should make more of it. Get the word out to get the new families in. We could do something exciting like trunk shows. I understand Bergdorf Goodman does this. How about live music on Saturdays? Make this place really stand out from those awful strip mall stores."

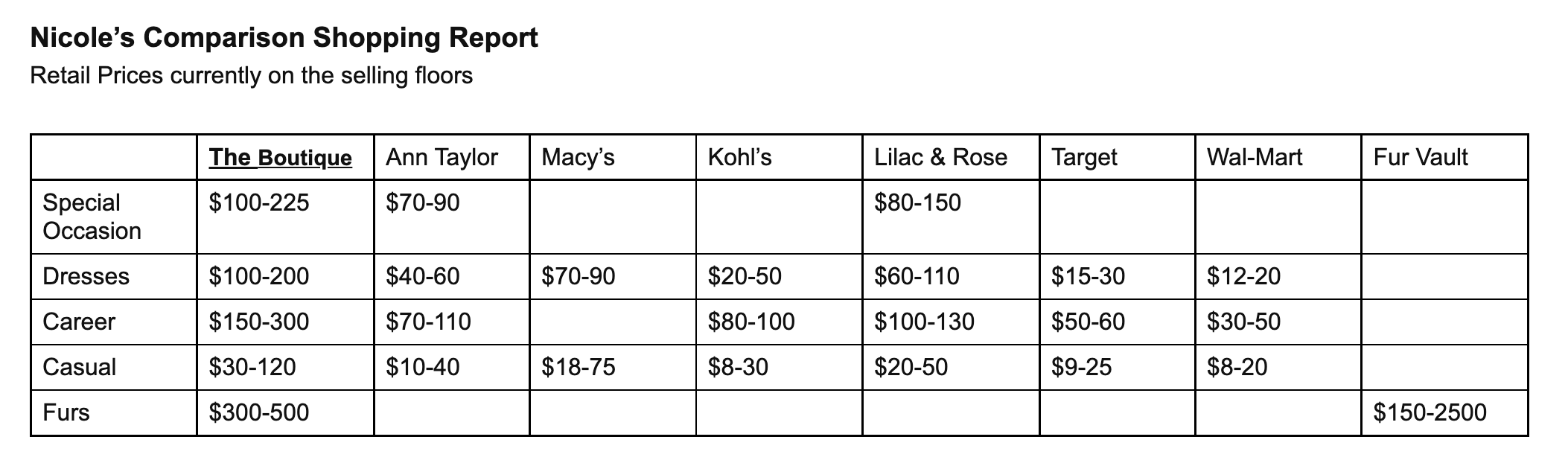

"In my high school marketing class we learned that you've got to know your competition. Why don't I go to these other stores and see what they've got? See what their prices are like?" Nicole added.

Kathy thought about it, "Well, it couldn't hurt to find out this information. Not that I think any of those stores is really our competition... Still, our revenues and income are dropping. Nicole, you go out and bring back that information. I will bring in all the financial statements and James you run our selling reports. I would like to review this with the FIT college seniors and see if they can come up with substantiated merchandising ideas. I really want our business to get back on track!"

Note: based on the4-5-4 calendar Feb 1, 2020 is the year end 2019

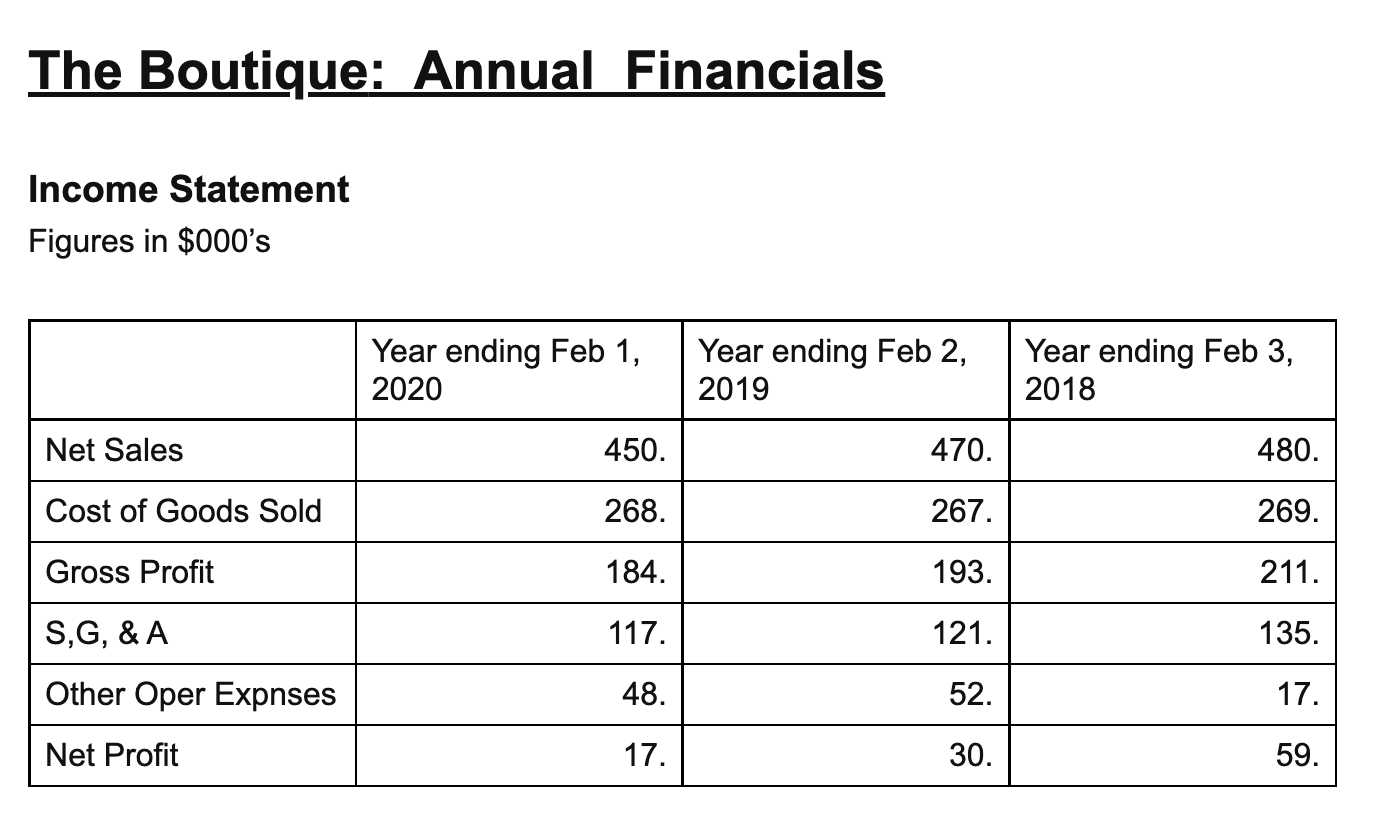

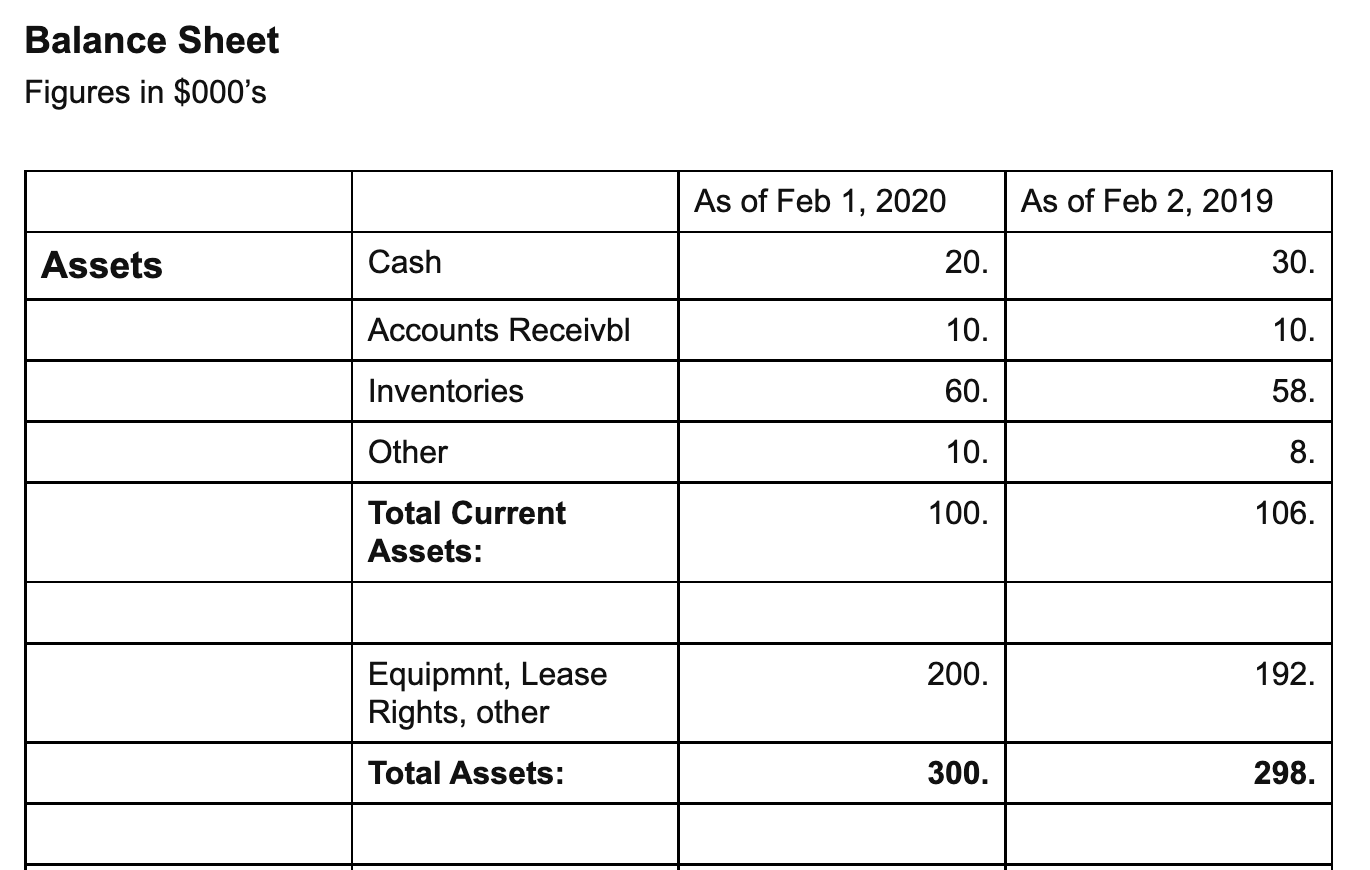

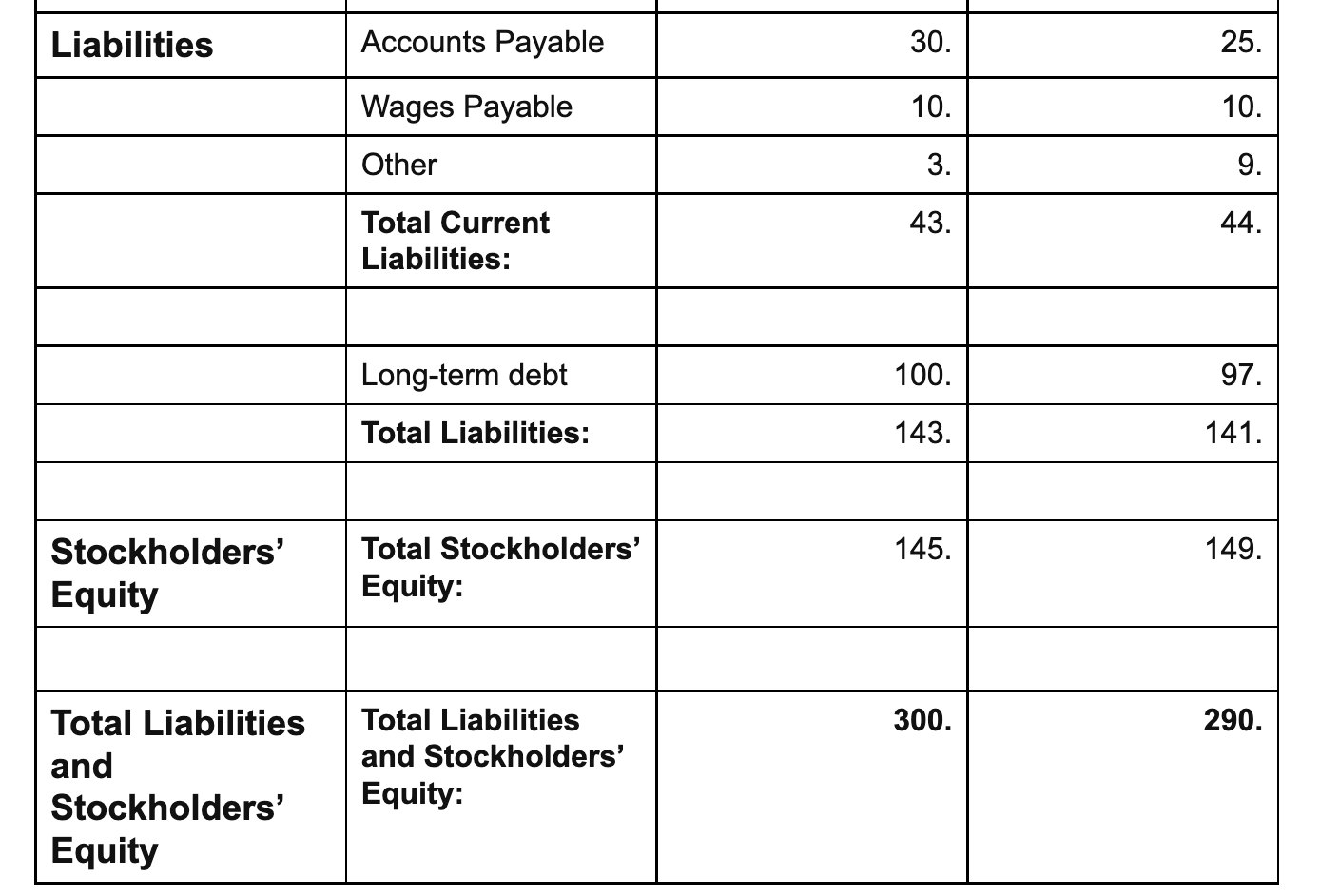

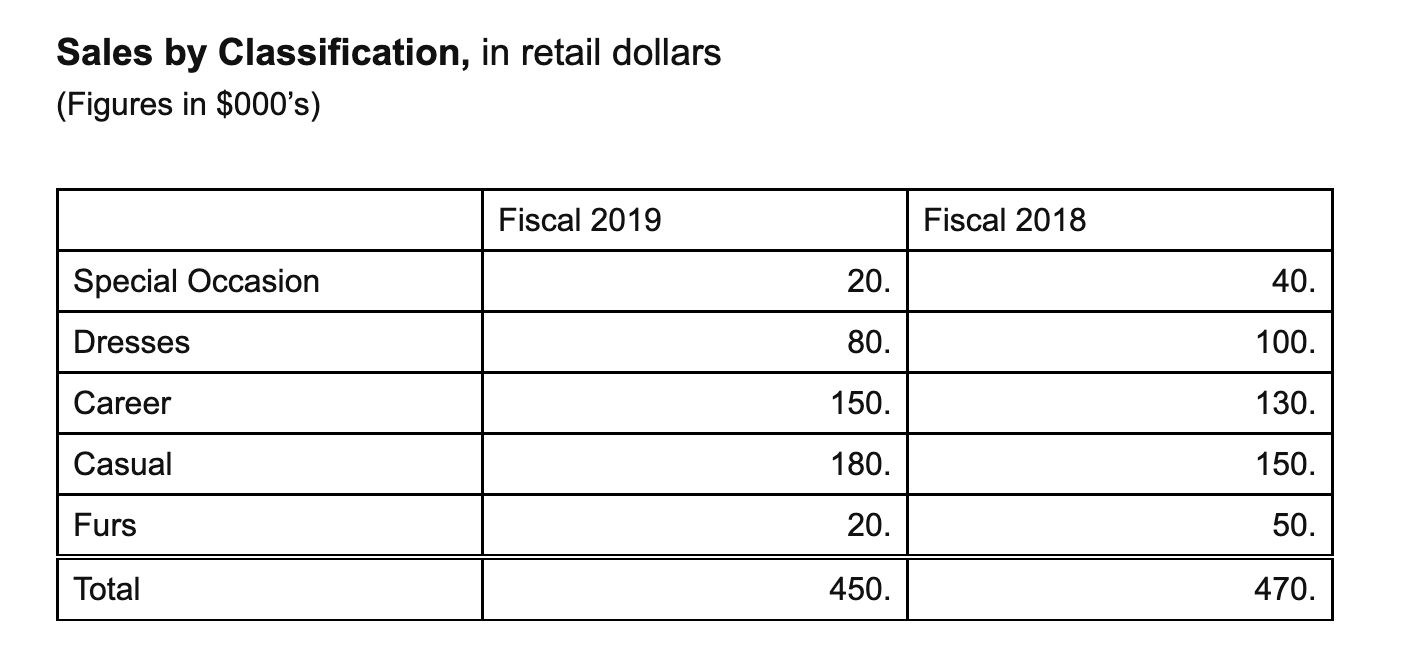

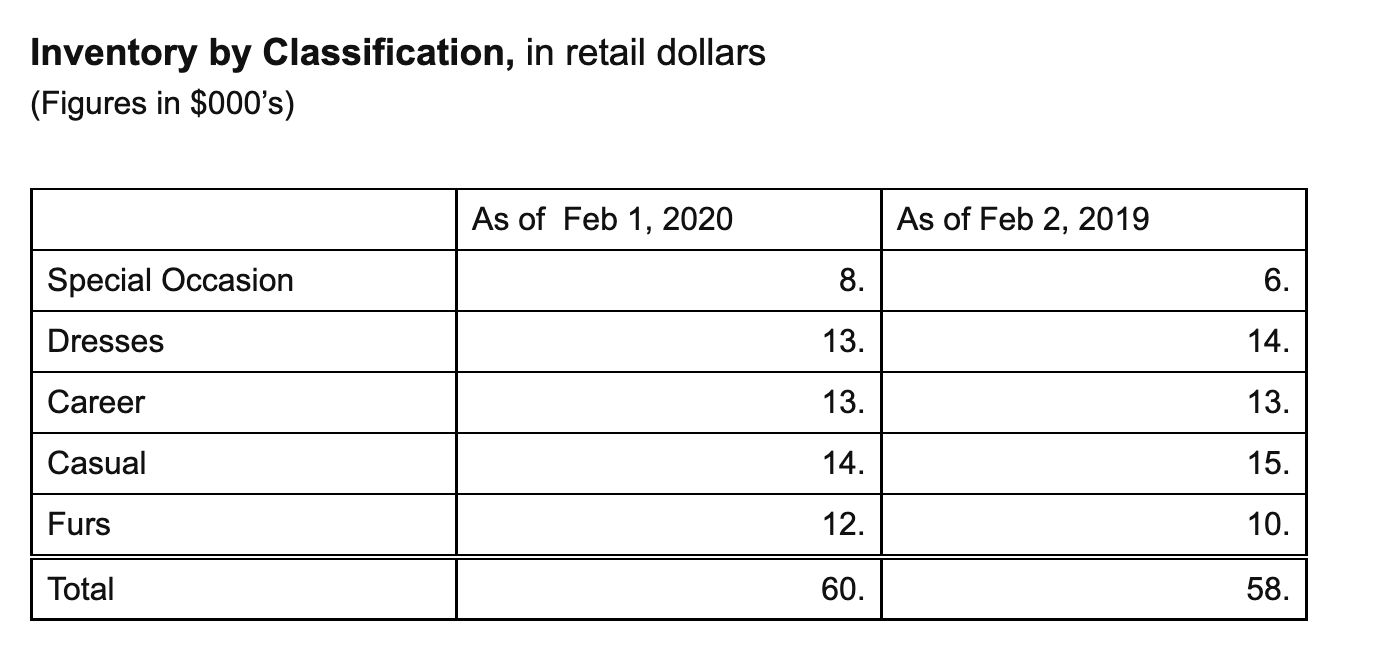

The Boutique: Annual Financials Income Statement Figures in $000's Year ending Feb 1, Year ending Feb 2, Year ending Feb 3, 2020 2019 2018 Net Sales 450. 470. 480. Cost of Goods Sold 268. 267. 269. Gross Profit 184. 193. 211. S,G, & A 117. 121. 135. Other Oper Exposes 48. 52. 17. Net Profit 17. 30. 59.\f ---- Liabilities: Long-term debt 100. 97. Total Liabilities: 143. 141. Stockholders' Total Stockholders' 145. ' Equity: Total Liabilities Total Liabilities and and Stockholders' Stockholders' EqUity: Equity Sales by Location, in retail dollars (Figures in $000's) _ Fiscal 2019 Fiscal 2018 Fiscal 2016 Fiscal 2015 m Sales by Classification, in retail dollars (Figures in $000's) Fiscal 2019 Fiscal 2018 Special Occasion 20. 40. Dresses 80. 100. Career 150. 130. Casual 180. 150. Furs 20. 50. Total 450. 470.Inventory by Classification, in retail dollars (Figures in $000's) As of Feb 1, 2020 As of Feb 2, 2019 Special Occasion 8. 6. Dresses 13. 14. Career 13. 13. Casual 14. 15. Furs 12. 10. Total 60. 58.Nicole's Comparison Shopping Report Retail Prices currently on the selling floors The Boutique Ann Taylor Macy's Kohl's Lilac & Rose Target Wal-Mart Fur Vault Special $100-225 $70-90 $80-150 Occasion Dresses $100-200 $40-60 $70-90 $20-50 $60-110 $15-30 $12-20 Career $150-300 $70-110 $80-100 $100-130 $50-60 $30-50 Casual $30-120 $10-40 $18-75 $8-30 $20-50 $9-25 $8-20 Furs $300-500 $150-2500Complete the attached Corporate Analyzer by copy (ctri C ) and paste (ctri v) the chart into the answer box then fill in Financial Measure Company's Benchmark: (see attachment) Performance; Company's Past Benchmark: Period: 2019 Performance; specialty store Period:2018 Annual Sales 2.6% Increase (Decr.)% Gross Margin % 34.5% Operating Expense 28.2% (S,G, & A) % Net Profit Margin % 5.4% Inventory Turns 6.90 Current Ratio 1.20 Quick Ratio .75 Total Debt to Equity 78 Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts