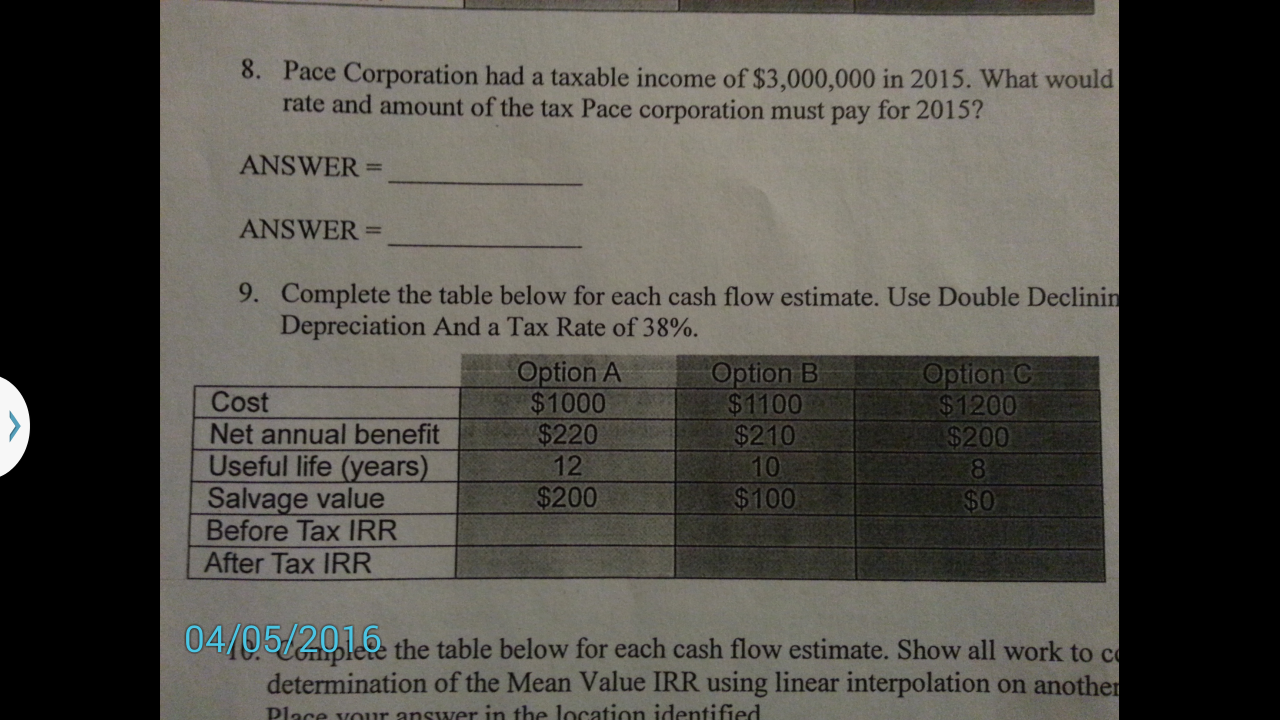

Question: Complete the table below for each cash flow estimate. Use Double Declining Balance Depreciation And a Tax Rate of 38%. please show work 8. Pace

Complete the table below for each cash flow estimate. Use Double Declining Balance Depreciation And a Tax Rate of 38%. please show work

8. Pace Corporation had a taxable inco Pace Corporation had a taxable income of $3,000,000 in 2015. What would be the rate and amount of the tax Pace corporation must pay for 2 015? ANSWER ANSWER = 9. Complete the table below for each cash flow estimate. Use Double Declining Ba Depreciation And a Tax Rate of 38% Option A $1000 $220 12 $200 tion B $1200 $200 Cost Net annual benefit Useful life (years Salvage value Before Tax IRR $1100 $210 10 $100 After Tax IRR determination of the Mean Value IRR using linear interpolation on anothe Place your answer in the location identified. 10. Complete the table below for each cash flow estimate. Show all work to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts