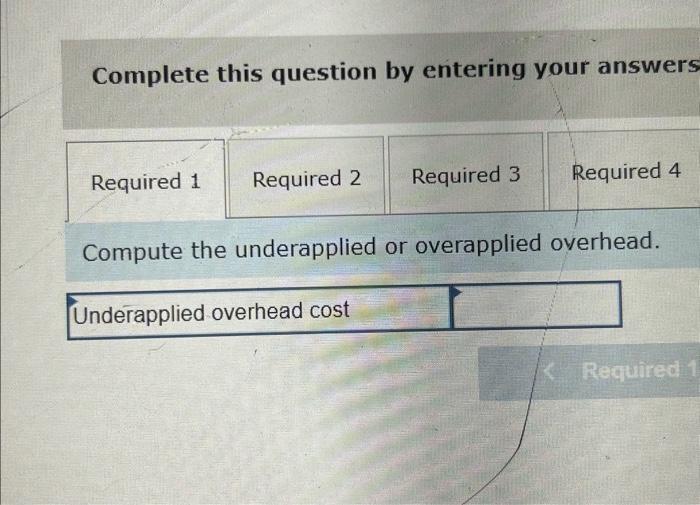

Question: Complete this question by entering your answers Compute the underapplied or overapplied overhead. Complete this question by entering your answers in the tabs below. How

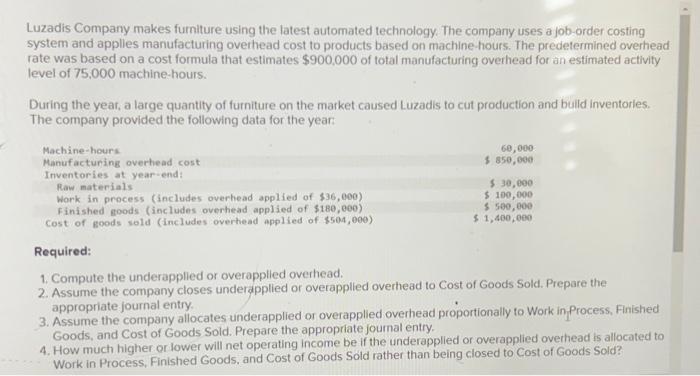

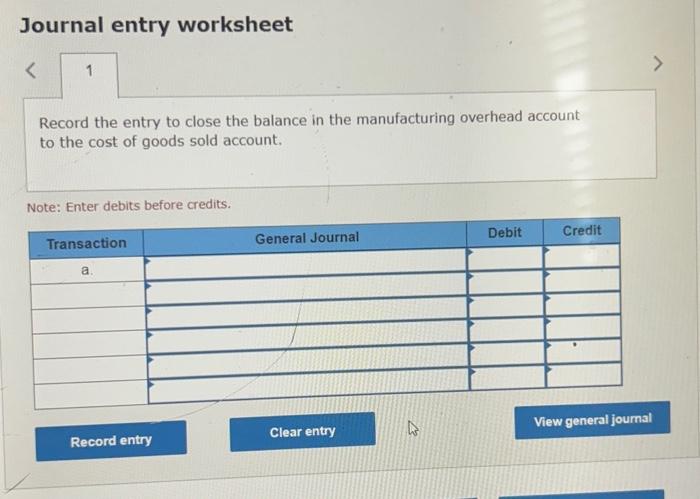

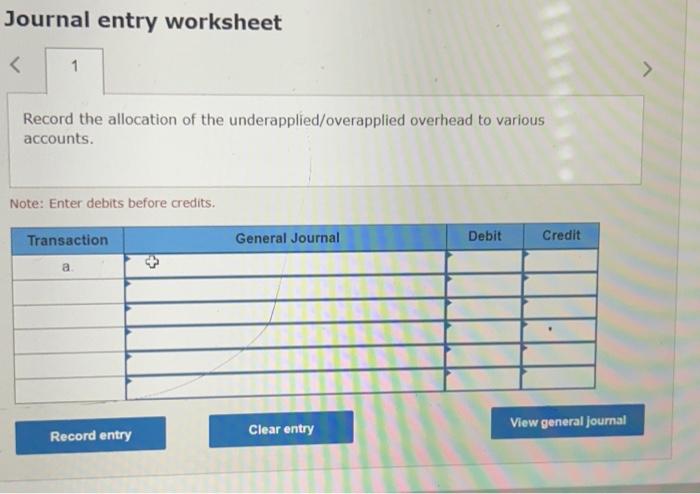

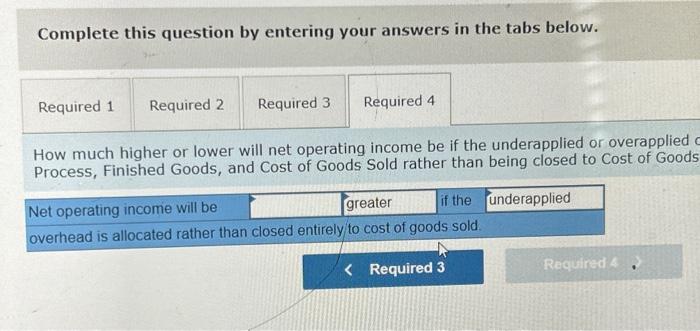

Complete this question by entering your answers Compute the underapplied or overapplied overhead. Complete this question by entering your answers in the tabs below. How much higher or lower will net operating income be if the underapplied or overapplied Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Good Journal entry worksheet Record the entry to close the balance in the manufacturing overhead account to the cost of goods sold account. Note: Enter debits before credits. Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applles manufacturing overhead cost to products based on machine-hours. The predetermined overhead rate was based on a cost formula that estimates $900,000 of total manufacturing overhead for an estimated activity level of 75,000 machine-hours. During the year, a large quantity of furniture on the market caused Luzadis to cut production and build inventorles. The company provided the following data for the year: Required: 1. Compute the underapplied or overapplied overhead. 2. Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. 3. Assume the company allocates underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. 4. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Journal entry worksheet Record the allocation of the underapplied/overapplied overhead to various accounts. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts