Question: completion Status QUESTION 1 15 points Saved A contractor has purchased a grader for $150,000 and expects to use it about 1,000 hours per year

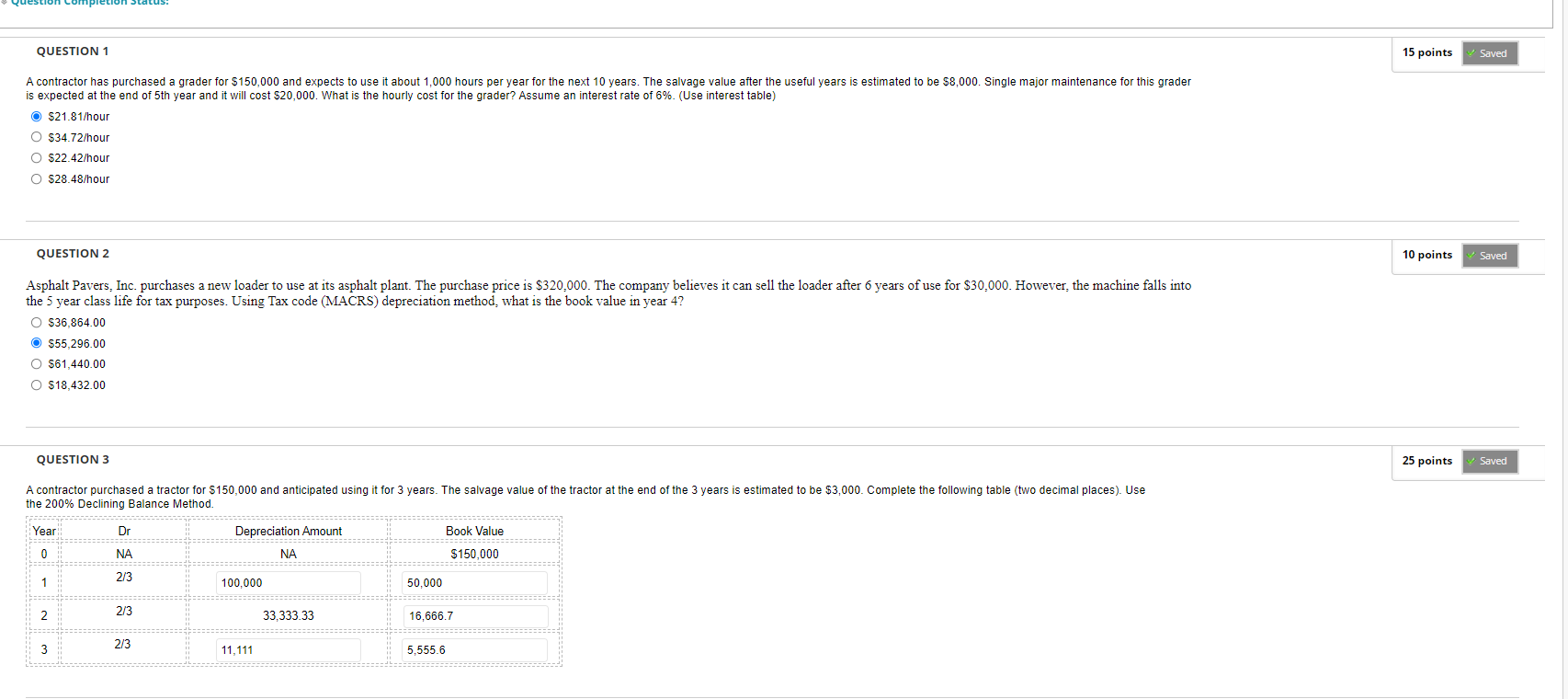

completion Status QUESTION 1 15 points Saved A contractor has purchased a grader for $150,000 and expects to use it about 1,000 hours per year for the next 10 years. The salvage value after the useful years is estimated to be $8,000. Single major maintenance for this grader is expected at the end of 5th year and it will cost $20,000. What is the hourly cost for the grader? Assume an interest rate of 6%. (Use interest table) O $21.81/hour O $34.72/hour O $22.42/hour O $28.48/hour QUESTION 2 10 points Saved Asphalt Pavers, Inc. purchases a new loader to use at its asphalt plant. The purchase price is $320,000. The company believes it can sell the loader after 6 years of use for $30,000. However, the machine falls into the 5 year class life for tax purposes. Using Tax code (MACRS) depreciation method, what is the book value in year 4? O $36,864.00 O $55.296.00 O $61,440.00 O S18,432.00 QUESTION 3 25 points Saved A contractor purchased a tractor for $150,000 and anticipated using it for 3 years. The salvage value of the tractor at the end of the 3 years is estimated to be $3,000. Complete the following table (two decimal places). Use the 200% Declining Balance Method. Year Dr Book Value Depreciation Amount NA 0 NA $150,000 1 2/3 100,000 50,000 2 2/3 33,333.33 16,666.7 3 2/3 11,111 5,555.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts