Question: compute the and by instead using the analytical formula given in the Example in the textbook. Finally, compare the beta you computed from the two

- compute the and by instead using the analytical formula given in the Example in the textbook.

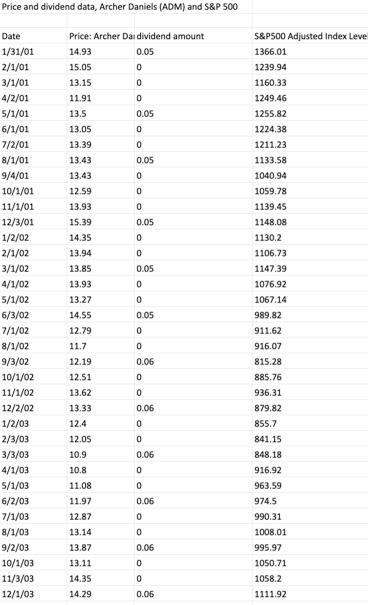

- Finally, compare the beta you computed from the two methods to the beta for Archer Daniels listed in the upper left-hand corner of Value Lines Stock Report. Do your results match the Value Line beta? What might explain the differences?

Price and dividend data, Archer Daniels (ADM) and S&P 500 Price: Archer Dai dividend amount 14.93 0.05 15.05 0 13.15 0 11.91 0 13.5 0.05 13.05 0 13.39 0 13.43 0.05 13.43 OOO 0.05 12.59 13.93 15.39 14.35 13.94 13.85 0 S&P500 Adjusted Index Leve 1366.01 1239.94 1160.33 1249.46 1255.82 1224.38 1211.23 1133.58 1040.94 1059.78 1139.45 1148.08 1130.2 1106.73 1147.39 1076.92 1067.14 989.82 911.62 916.07 815.28 885.76 936.31 879.82 855.7 841.15 0 0.05 13.93 0 Date 1/31/01 2/1/01 3/1/01 4/2/01 5/1/01 6/1/01 7/2/01 8/1/01 9/4/01 10/1/01 11/1/01 12/3/01 1/2/02 2/1/02 3/1/02 4/1/02 5/1/02 6/3/02 7/1/02 8/1/02 9/3/02 10/1/02 11/1/02 12/2/02 1/2/03 2/3/03 3/3/03 4/1/03 5/1/03 6/2/03 7/1/03 8/1/03 9/2/03 10/1/03 11/3/03 12/1/03 0 0.05 0 0 0.06 0 13.27 14.55 12.79 11.7 12.19 12.51 13.62 13.33 12.4 12.05 10.9 10.8 0 0.06 0 0 0.06 0 0 0.06 0 11.08 11.97 12.87 13.14 13.87 13.11 14.35 14.29 . 848.18 916.92 963.59 974.5 990.31 1008.01 995.97 1050.71 1058.2 0 0.06 0 0 0.06 1111.92 Price and dividend data, Archer Daniels (ADM) and S&P 500 Price: Archer Dai dividend amount 14.93 0.05 15.05 0 13.15 0 11.91 0 13.5 0.05 13.05 0 13.39 0 13.43 0.05 13.43 OOO 0.05 12.59 13.93 15.39 14.35 13.94 13.85 0 S&P500 Adjusted Index Leve 1366.01 1239.94 1160.33 1249.46 1255.82 1224.38 1211.23 1133.58 1040.94 1059.78 1139.45 1148.08 1130.2 1106.73 1147.39 1076.92 1067.14 989.82 911.62 916.07 815.28 885.76 936.31 879.82 855.7 841.15 0 0.05 13.93 0 Date 1/31/01 2/1/01 3/1/01 4/2/01 5/1/01 6/1/01 7/2/01 8/1/01 9/4/01 10/1/01 11/1/01 12/3/01 1/2/02 2/1/02 3/1/02 4/1/02 5/1/02 6/3/02 7/1/02 8/1/02 9/3/02 10/1/02 11/1/02 12/2/02 1/2/03 2/3/03 3/3/03 4/1/03 5/1/03 6/2/03 7/1/03 8/1/03 9/2/03 10/1/03 11/3/03 12/1/03 0 0.05 0 0 0.06 0 13.27 14.55 12.79 11.7 12.19 12.51 13.62 13.33 12.4 12.05 10.9 10.8 0 0.06 0 0 0.06 0 0 0.06 0 11.08 11.97 12.87 13.14 13.87 13.11 14.35 14.29 . 848.18 916.92 963.59 974.5 990.31 1008.01 995.97 1050.71 1058.2 0 0.06 0 0 0.06 1111.92

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts