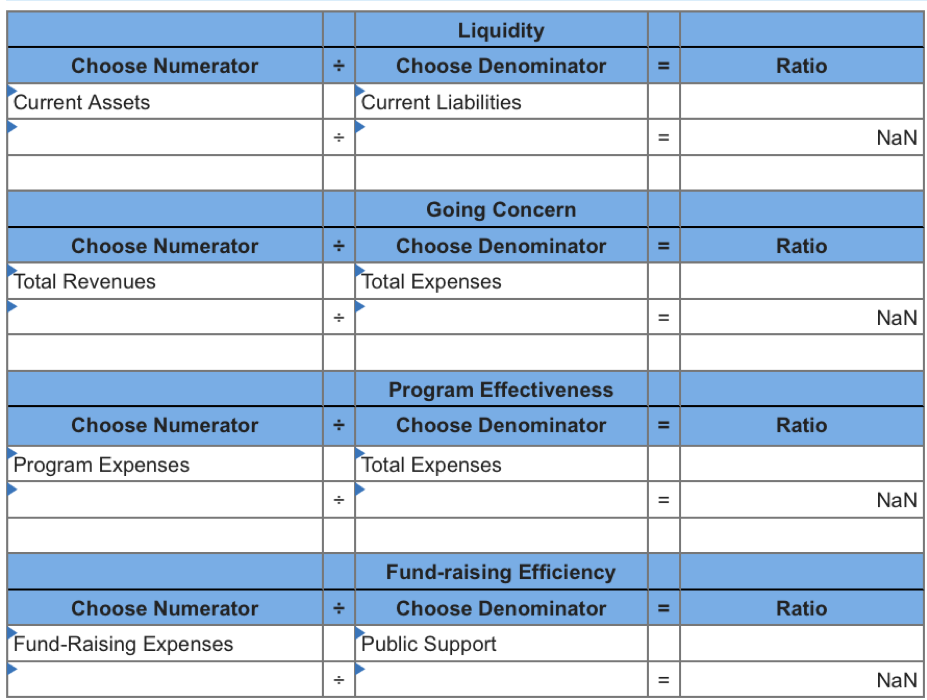

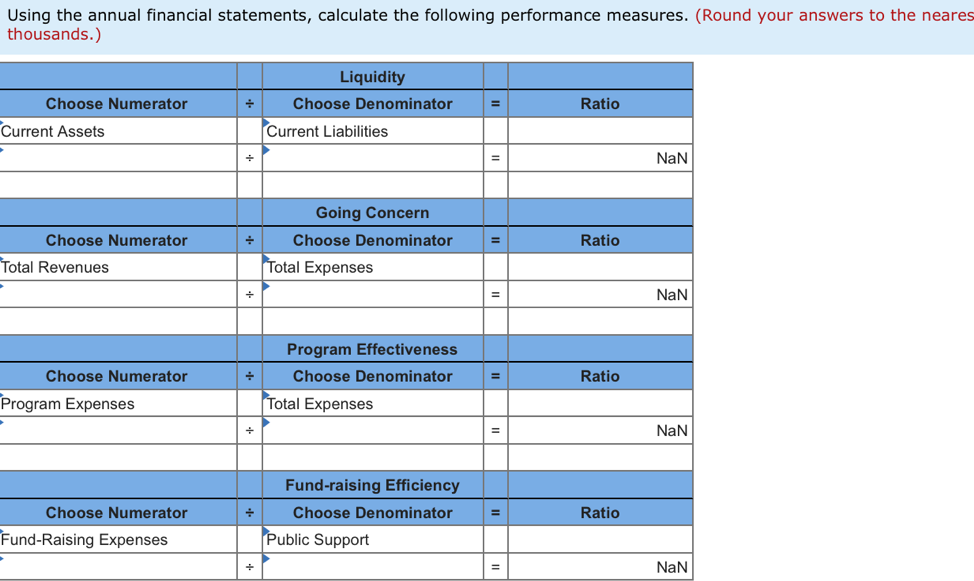

Question: Compute the following performance measures using the Form 990. (round to the nearest thousands) Part vill Statement OT Hevenue Check if Schedule O contains a

- Compute the following performance measures using the Form 990. (round to the nearest thousands)

-

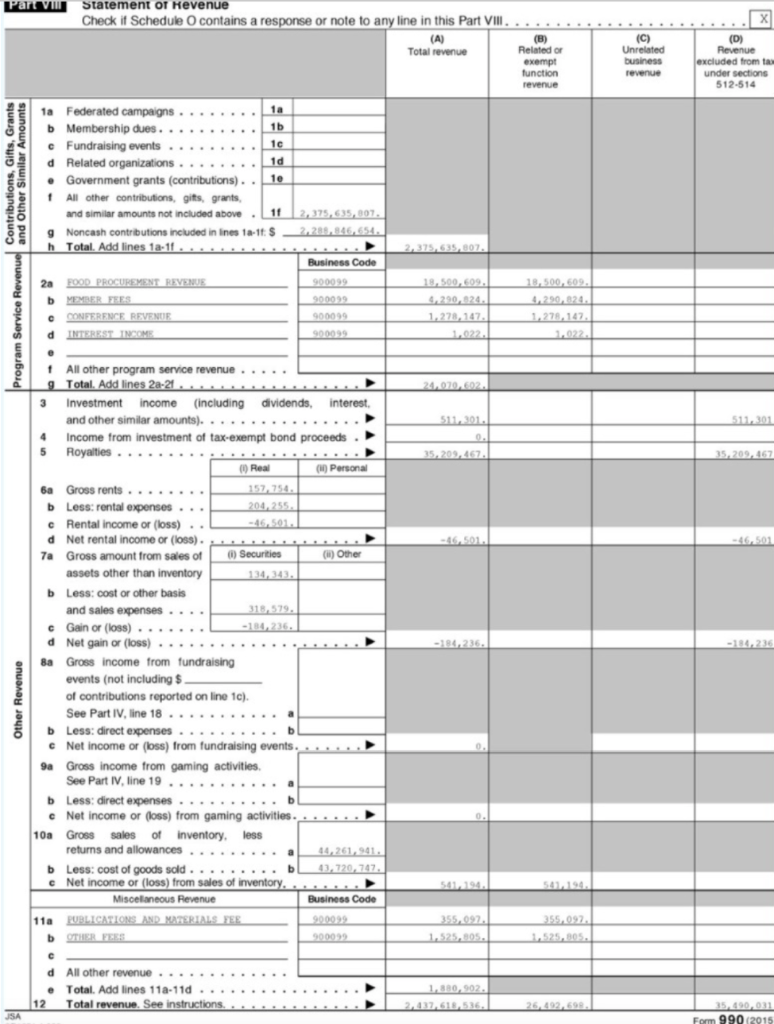

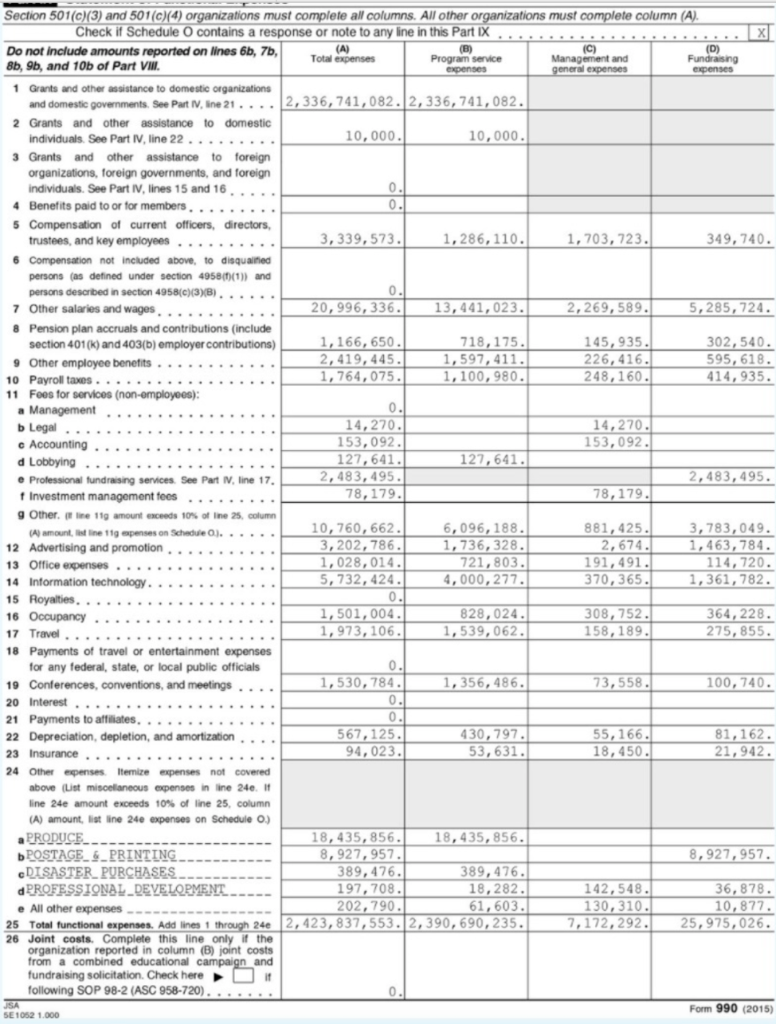

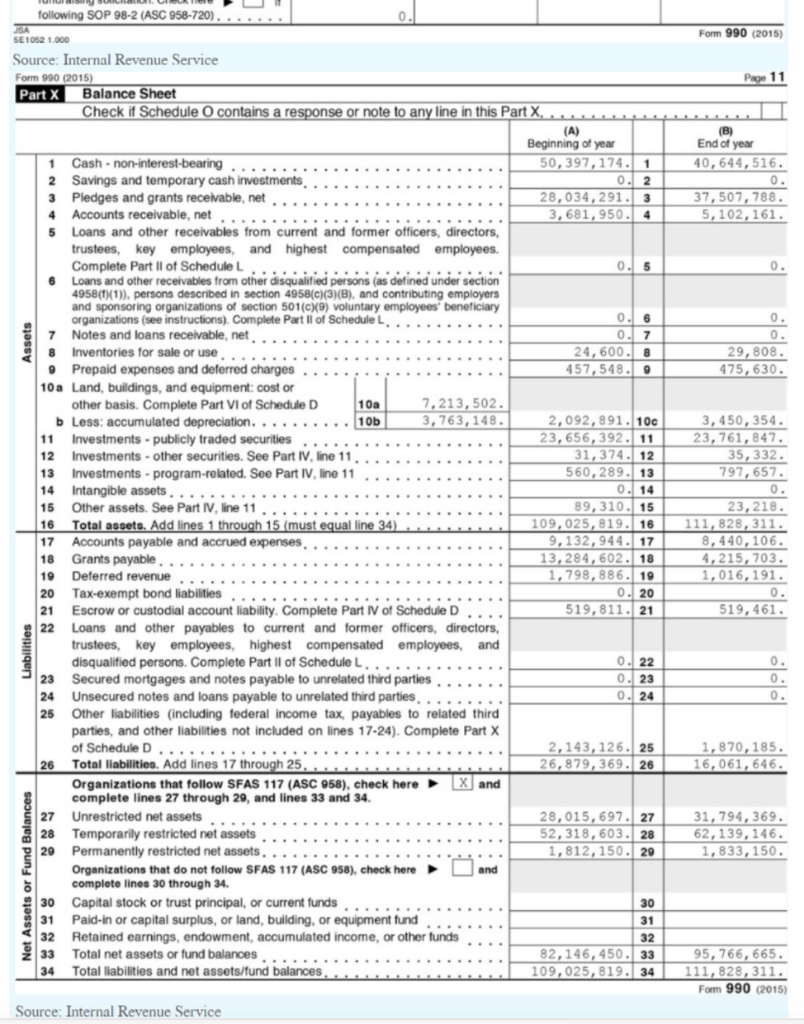

Part vill Statement OT Hevenue Check if Schedule O contains a response or note to any line in this Part VIlI (B) on exemp (C) A) (D) Total revenue bunicess excluded under sections 512-514 tas function revenue revenue 1a 1a Federated campaigns 1b b Membership dues. . c Fundraising events d Related organizations.. 1c 1d 1e Government grants (contributions). f All other contributions, gits, grants, and similar amounts not included above 1f 2,375,635,807, . g Noncash contributions included in ines 1a-1f: $ h Total. Add lines 1a-1f. .... ,. . 2,28,846,654. 2,375,635, 807. Business Code 18,500,609 18,500, 609 4,290,824 FOOD PROCUREMENT REVENUE MEMBER FEES 900099 2a 4,290,824 bi 900039 c CONFERENCE REVENUE 1,278-147 900099 900099 1,278,147. d INTEREST INCOM 1,022. 1,022. service revenue All other Total. Add ines 28-21 aaLaA 24,070, 602. income interest Investment (including dividends, and other similar amounts)..... ...... 511301 511.301 Income from investment of tax-exempt bond proceeds Royalties 35, 209,467. 35,209,467 ......... () Real Personal 6a Gross rents.. 157,754 204,255 b Less: rental expenses c Rental income or (loss) d Net rental income or (loss). -46,501. -46, 501 46,501. Securities ()Other Gross amount from sales of 7a assets other than inventory 134,343 b Less: cost or other basis and sales expenses. - c Gain or (loss). .. d Net gain or (loss) 318,579. -184,236. -184,236 -184,236 8a Gross income from fundraising events (not including $ of contributions reported on line 1c). See Part IV, line 18... . b Less: direct expenses c Net income or (loss) from fundraising events... . ... Gross income from gaming activities. See Part IV, line 19........ . 9a a Less: direct expenses.. . . b b Net income or (loss) from gaming activities. 10a Gross sales of inventory, less returns and allowances 44,261,941. Less: cost of goods scld.... b 43,720,747 b c Net income or (loss) from sales of inventory 541,194. 541,194. Miscellaneous Revenue Business Code 11a UBLICATIONS AND MATERIALS FEE 900099 355,097. 355,097.) 1,525, 805. OTHER FEES 525,805 b 900099 - All other revenue d Total. Add lines 11a-11d . 1,880,902. e 2,437,618,536,I 12 26, 492,698. Total revenue. See instructions. 35, 490, 031 Form 990(2015 Program Service Re Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A). Check if Schedule O contains a response or note to any line in this Part I ............. ....x Do not include amounts reported on lines 6b, 7b, 8b, 9b, and 10b of Part VII Total expenses Management and general expenses Program service expenses Fundraising expenses 1 Grants and other assistance to domestic organizations and domestic govemments. See Part V, ine 21....2,336,741,082. 2,336,741,082. 2 Grants and other assistance to domestic individuals See Part IV, line 22.. .... . 10,000 . 10,000. 3 Grants and other assistance to foreign organizations, foreign governments, and foreign 0 individuals. See Part IV, lines 15 and 16 0. Benefits paid to or for members 4 Compensation of current officers, directors, trustees, and key employees ..... 1,286,110 349,740. 3,339,573. 1,703, 23. 6 Compensation not included above, to disquaifed persons (as defined under section 4958(0)(1) persons described in section 4958(c)(3) (B ) Other salaries and wages and 20,996,336. 13,441,023. 2,269,589. 5,285,724. 7 8 Pension plan accruals and contributions (include section 401(k) and 403(b) employer contributions) 1,166, 650. 2,419,445 . 1,764, 075 . 302,540. 595, 618. 414,935. 718,175. 145,935 226,416 248,160 1,597,411. 9 Other employee benetits.. 10 Payroll taxes . 11 Fees for services (non-employees): 1,100, 980. 0 Management b Legal.. 14,270 153,092. 14,270 153,092 c Accounting 127,641. 2,483, 495. 78,179. 127,641 d Lobbying. 2,483,495. e Professional fundraising services. See Part IV, line 17, 78,179. f Investment management tees g Other t line 11g amount exceeds 10% of Ine 25, column 6,096, 188. 1,736, 328 . 721,803. 4,000, 277 . 10,760, 662. 3,202, 786 1,028, 014 . 5,732,424 0. 881,425 3,783,049 1,463,784. 114,720. 1,361,782. Schedule O). (A) amount, ist line 11g apenses 12 Advertising and promotion 13 Office expenses 2,674. 191,491. 370,365 14 Information technology 15 Royalties. . . . . . 1,501,004. 1,973,106. 308, 752 . 364,228 275, 855 828,024 1,539,062 16 Occupancy 158,189 17 Travel 18 Payments of travel or entertainment expenses for any federal, state, or local public officials 1,356, 486. 73,558 1,530, 784 100, 740. 19 Conferences, conventions, and meetings .. 20 Interest ........ . 21 Payments to affiliates... 567,125. 94,023. 55,166 18,450 81,162. 21,942 430,797. 53,631. 22 Depreciation, depletion, and amortization 23 Insurance... ...* 24 Other epenses Itemize expenses not covered above (List miscellaneous expenses in line 24e. I line 24e amount exceeds 10% of line 25, column (A) amount, list line 24e expenses on Schedule O) PRODUCE------. POSTAGE &_PRBINTING DISASTER. PUBCHASES dPROFESSIONAL_DEVELOPMENT. - e All other expenses 25 Total functional expenses. Add lines 1 through 24e 2, 423, 837,553. 2,390, 690, 235 . 18,435, 856. 8,927,957 389, 476. 197,708. 202,790. 18,435,856. 8,927,957 389, 476. 18,282 61,603 36,878. 10,877. 25,975,026 142, 548 . 130,310 7,172,292. 26 organization reported in column (B) joint costs from a combined educational campaign and fundraising solicitation. Check here following SOP 98-2 (ASC 958-720) if ..... . Form 990 (2015) SE1052 1.000 following SOP 98-2 (ASC 958-720). . ..... Form 990 (2015) SE1052 1.000 Source: Internal Revenue Service Page 11 Form 990 (2015) Balance Sheet Check if Schedule O contains a response or note to any line in this Part X, Part X (A) Beginning of year End of year Cash-non-interest-bearing... .. 50,397,174. 1 0. 2 28,034,291. 3 3, 681,950. 40,644, 516 0. 37, 507, 788. 5,102,161. 1 Savings and temporary cash investments 3 Pledges and grants receivable, net Accounts receivable. net. **** 2 4 4 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees. Complete Part I of Schedule L 6 0 5 0. Loans and other receivables from other disqualified persons (as defined under section 4958(1)(1)), persons described in section 4958(c)(3)(B), and contributing employers and sponsoring organizations Complet C employees' beneficiary 0. 0. Part II of Sc 6 0. 0. Notes and loans receivable, net Inventories for sale or use .. . . . . 9 Prepaid expenses and deferred charges 10a Land, buildings, and equipment: cost or other basis. Complete Part VI of Schedule D b Less: accumulated depreciation..... 11 7 7 8 29,808 475, 630. 24, 600 . 457,548 . 7,213, 502. 3, 763, 148 . 10a 10b 2,092,891.10c 23, 656, 392. 11 31,374.12 560,289. 13 0. 14 89,310.15 109, 025, 819 9,132,944.17 13,284,602. 18 1,798, 886. 19 0. 20 519, 811 . 21 3,450,354. 23,761,847. 35,332 797, 657 0. 23,218. 111,828,311. 8,440,106. 4,215, 703. 1,016, 191 . Investments-publicly traded securities 12 Investments-other securities. See Part IV, line 11 13 Investments- program-related. See Part IV, line 11 14 Intangible assets 15 Other assets. See Part IV, line 11 16 Total ascets. Add lines 1 through 15 (must equal line 34) Accounts payable and accrued expenses Grants payable. . 16 17 18 19 Deferred revenue.. 20 Tax-exempt bond liabilities 21 0. 519,461 Schedule D Escrow or custodial account liability. Complete Part IV 22 Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, disqualified persons. Complete Part II of Schedule L . . . ... Secured mortgages and notes payable to unrelated third parties Unsecured notes and loans paya ble to unrelated third parties 25 and 0. 22 0.23 0. 24 0. 0. 23 0. 24 Other liabilities (including federal income tax, payables to related third parties, and other liabilities not included on lines 17-24). Complete Part X 2,143, 126.25 26,879,369. 26 1,870,185 16,061, 646. of Schedule D .. Total liabilities. Add lines 17 through 25,......is..iiisss 26 Xand Organizations that follow SFAS 117 (ASC 958), check here complete lines 27 through 29, and lines 33 and 34. Unrestricted net assets.. .. 28,015, 697. 27 52,318,603. 28 1,812, 150. 29 27 31,794,369 62,139,146. 28 Temporarily restricted net assets Permanently restricted net assets. .. 1,833,150. 29 and Organizations that do not follow SFAS 117 (ASC 958), check here complete lines 30 through 34 30 Capital stock or trust principal, or current funds 30 31 Paid-in or capital surplus, or land, building, or equipment f 31 32 Retained earnings, endowment, accumulated income, or other funds 32 Total net assets or fund balances.... 33 82,146, 450.33 109, 025, 819.34 95,766, 665. 111, 828, 311. Form 990 (2015) Total liabilities and net assets/fund balances 34 Source: Internal Revenue Service Net Assets or Fund Balances Liabilities Assets Liquidity Choose Numerator Choose Denominator Ratio Current Assets Current Liabilities NaN Going Concern Choose Numerator Choose Denominator Ratio Total Revenues Total Expenses NaN Program Effectiveness Choose Numerator Choose Denominator Ratio Program Expenses Total Expenses NaN Fund-raising Efficiency Choose Numerator Choose Denominator Ratio Fund-Raising Expenses Public Support NaN + II II II II II II Using the annual financial statements, calculate the following performance measures. (Round your answers to the neares thousands.) Liquidity Choose Numerator Ratio Choose Denominator Current Assets Current Liabilities NaN = Going Concern Choose Numerator Choose Denominator Ratio Total Revenues Total Expenses NaN Program Effectiveness Choose Denominator Choose Numerator Ratio Program Expenses Total Expenses NaN Fund-raising Efficiency Choose Denominator Choose Numerator Ratio Public Support Fund-Raising Expenses NaN Part vill Statement OT Hevenue Check if Schedule O contains a response or note to any line in this Part VIlI (B) on exemp (C) A) (D) Total revenue bunicess excluded under sections 512-514 tas function revenue revenue 1a 1a Federated campaigns 1b b Membership dues. . c Fundraising events d Related organizations.. 1c 1d 1e Government grants (contributions). f All other contributions, gits, grants, and similar amounts not included above 1f 2,375,635,807, . g Noncash contributions included in ines 1a-1f: $ h Total. Add lines 1a-1f. .... ,. . 2,28,846,654. 2,375,635, 807. Business Code 18,500,609 18,500, 609 4,290,824 FOOD PROCUREMENT REVENUE MEMBER FEES 900099 2a 4,290,824 bi 900039 c CONFERENCE REVENUE 1,278-147 900099 900099 1,278,147. d INTEREST INCOM 1,022. 1,022. service revenue All other Total. Add ines 28-21 aaLaA 24,070, 602. income interest Investment (including dividends, and other similar amounts)..... ...... 511301 511.301 Income from investment of tax-exempt bond proceeds Royalties 35, 209,467. 35,209,467 ......... () Real Personal 6a Gross rents.. 157,754 204,255 b Less: rental expenses c Rental income or (loss) d Net rental income or (loss). -46,501. -46, 501 46,501. Securities ()Other Gross amount from sales of 7a assets other than inventory 134,343 b Less: cost or other basis and sales expenses. - c Gain or (loss). .. d Net gain or (loss) 318,579. -184,236. -184,236 -184,236 8a Gross income from fundraising events (not including $ of contributions reported on line 1c). See Part IV, line 18... . b Less: direct expenses c Net income or (loss) from fundraising events... . ... Gross income from gaming activities. See Part IV, line 19........ . 9a a Less: direct expenses.. . . b b Net income or (loss) from gaming activities. 10a Gross sales of inventory, less returns and allowances 44,261,941. Less: cost of goods scld.... b 43,720,747 b c Net income or (loss) from sales of inventory 541,194. 541,194. Miscellaneous Revenue Business Code 11a UBLICATIONS AND MATERIALS FEE 900099 355,097. 355,097.) 1,525, 805. OTHER FEES 525,805 b 900099 - All other revenue d Total. Add lines 11a-11d . 1,880,902. e 2,437,618,536,I 12 26, 492,698. Total revenue. See instructions. 35, 490, 031 Form 990(2015 Program Service Re Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A). Check if Schedule O contains a response or note to any line in this Part I ............. ....x Do not include amounts reported on lines 6b, 7b, 8b, 9b, and 10b of Part VII Total expenses Management and general expenses Program service expenses Fundraising expenses 1 Grants and other assistance to domestic organizations and domestic govemments. See Part V, ine 21....2,336,741,082. 2,336,741,082. 2 Grants and other assistance to domestic individuals See Part IV, line 22.. .... . 10,000 . 10,000. 3 Grants and other assistance to foreign organizations, foreign governments, and foreign 0 individuals. See Part IV, lines 15 and 16 0. Benefits paid to or for members 4 Compensation of current officers, directors, trustees, and key employees ..... 1,286,110 349,740. 3,339,573. 1,703, 23. 6 Compensation not included above, to disquaifed persons (as defined under section 4958(0)(1) persons described in section 4958(c)(3) (B ) Other salaries and wages and 20,996,336. 13,441,023. 2,269,589. 5,285,724. 7 8 Pension plan accruals and contributions (include section 401(k) and 403(b) employer contributions) 1,166, 650. 2,419,445 . 1,764, 075 . 302,540. 595, 618. 414,935. 718,175. 145,935 226,416 248,160 1,597,411. 9 Other employee benetits.. 10 Payroll taxes . 11 Fees for services (non-employees): 1,100, 980. 0 Management b Legal.. 14,270 153,092. 14,270 153,092 c Accounting 127,641. 2,483, 495. 78,179. 127,641 d Lobbying. 2,483,495. e Professional fundraising services. See Part IV, line 17, 78,179. f Investment management tees g Other t line 11g amount exceeds 10% of Ine 25, column 6,096, 188. 1,736, 328 . 721,803. 4,000, 277 . 10,760, 662. 3,202, 786 1,028, 014 . 5,732,424 0. 881,425 3,783,049 1,463,784. 114,720. 1,361,782. Schedule O). (A) amount, ist line 11g apenses 12 Advertising and promotion 13 Office expenses 2,674. 191,491. 370,365 14 Information technology 15 Royalties. . . . . . 1,501,004. 1,973,106. 308, 752 . 364,228 275, 855 828,024 1,539,062 16 Occupancy 158,189 17 Travel 18 Payments of travel or entertainment expenses for any federal, state, or local public officials 1,356, 486. 73,558 1,530, 784 100, 740. 19 Conferences, conventions, and meetings .. 20 Interest ........ . 21 Payments to affiliates... 567,125. 94,023. 55,166 18,450 81,162. 21,942 430,797. 53,631. 22 Depreciation, depletion, and amortization 23 Insurance... ...* 24 Other epenses Itemize expenses not covered above (List miscellaneous expenses in line 24e. I line 24e amount exceeds 10% of line 25, column (A) amount, list line 24e expenses on Schedule O) PRODUCE------. POSTAGE &_PRBINTING DISASTER. PUBCHASES dPROFESSIONAL_DEVELOPMENT. - e All other expenses 25 Total functional expenses. Add lines 1 through 24e 2, 423, 837,553. 2,390, 690, 235 . 18,435, 856. 8,927,957 389, 476. 197,708. 202,790. 18,435,856. 8,927,957 389, 476. 18,282 61,603 36,878. 10,877. 25,975,026 142, 548 . 130,310 7,172,292. 26 organization reported in column (B) joint costs from a combined educational campaign and fundraising solicitation. Check here following SOP 98-2 (ASC 958-720) if ..... . Form 990 (2015) SE1052 1.000 following SOP 98-2 (ASC 958-720). . ..... Form 990 (2015) SE1052 1.000 Source: Internal Revenue Service Page 11 Form 990 (2015) Balance Sheet Check if Schedule O contains a response or note to any line in this Part X, Part X (A) Beginning of year End of year Cash-non-interest-bearing... .. 50,397,174. 1 0. 2 28,034,291. 3 3, 681,950. 40,644, 516 0. 37, 507, 788. 5,102,161. 1 Savings and temporary cash investments 3 Pledges and grants receivable, net Accounts receivable. net. **** 2 4 4 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees. Complete Part I of Schedule L 6 0 5 0. Loans and other receivables from other disqualified persons (as defined under section 4958(1)(1)), persons described in section 4958(c)(3)(B), and contributing employers and sponsoring organizations Complet C employees' beneficiary 0. 0. Part II of Sc 6 0. 0. Notes and loans receivable, net Inventories for sale or use .. . . . . 9 Prepaid expenses and deferred charges 10a Land, buildings, and equipment: cost or other basis. Complete Part VI of Schedule D b Less: accumulated depreciation..... 11 7 7 8 29,808 475, 630. 24, 600 . 457,548 . 7,213, 502. 3, 763, 148 . 10a 10b 2,092,891.10c 23, 656, 392. 11 31,374.12 560,289. 13 0. 14 89,310.15 109, 025, 819 9,132,944.17 13,284,602. 18 1,798, 886. 19 0. 20 519, 811 . 21 3,450,354. 23,761,847. 35,332 797, 657 0. 23,218. 111,828,311. 8,440,106. 4,215, 703. 1,016, 191 . Investments-publicly traded securities 12 Investments-other securities. See Part IV, line 11 13 Investments- program-related. See Part IV, line 11 14 Intangible assets 15 Other assets. See Part IV, line 11 16 Total ascets. Add lines 1 through 15 (must equal line 34) Accounts payable and accrued expenses Grants payable. . 16 17 18 19 Deferred revenue.. 20 Tax-exempt bond liabilities 21 0. 519,461 Schedule D Escrow or custodial account liability. Complete Part IV 22 Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, disqualified persons. Complete Part II of Schedule L . . . ... Secured mortgages and notes payable to unrelated third parties Unsecured notes and loans paya ble to unrelated third parties 25 and 0. 22 0.23 0. 24 0. 0. 23 0. 24 Other liabilities (including federal income tax, payables to related third parties, and other liabilities not included on lines 17-24). Complete Part X 2,143, 126.25 26,879,369. 26 1,870,185 16,061, 646. of Schedule D .. Total liabilities. Add lines 17 through 25,......is..iiisss 26 Xand Organizations that follow SFAS 117 (ASC 958), check here complete lines 27 through 29, and lines 33 and 34. Unrestricted net assets.. .. 28,015, 697. 27 52,318,603. 28 1,812, 150. 29 27 31,794,369 62,139,146. 28 Temporarily restricted net assets Permanently restricted net assets. .. 1,833,150. 29 and Organizations that do not follow SFAS 117 (ASC 958), check here complete lines 30 through 34 30 Capital stock or trust principal, or current funds 30 31 Paid-in or capital surplus, or land, building, or equipment f 31 32 Retained earnings, endowment, accumulated income, or other funds 32 Total net assets or fund balances.... 33 82,146, 450.33 109, 025, 819.34 95,766, 665. 111, 828, 311. Form 990 (2015) Total liabilities and net assets/fund balances 34 Source: Internal Revenue Service Net Assets or Fund Balances Liabilities Assets Liquidity Choose Numerator Choose Denominator Ratio Current Assets Current Liabilities NaN Going Concern Choose Numerator Choose Denominator Ratio Total Revenues Total Expenses NaN Program Effectiveness Choose Numerator Choose Denominator Ratio Program Expenses Total Expenses NaN Fund-raising Efficiency Choose Numerator Choose Denominator Ratio Fund-Raising Expenses Public Support NaN + II II II II II II Using the annual financial statements, calculate the following performance measures. (Round your answers to the neares thousands.) Liquidity Choose Numerator Ratio Choose Denominator Current Assets Current Liabilities NaN = Going Concern Choose Numerator Choose Denominator Ratio Total Revenues Total Expenses NaN Program Effectiveness Choose Denominator Choose Numerator Ratio Program Expenses Total Expenses NaN Fund-raising Efficiency Choose Denominator Choose Numerator Ratio Public Support Fund-Raising Expenses NaN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts