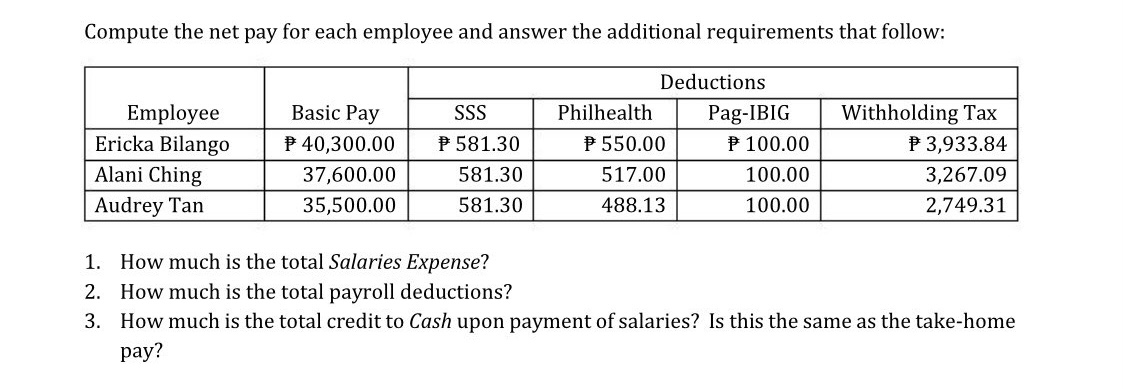

Question: Compute the net pay for each employee and answer the additional requirements that follow: Deductions Employee Basic Pay SSS Philhealth Pag-IBIG Withholding Tax Ericka Bilango

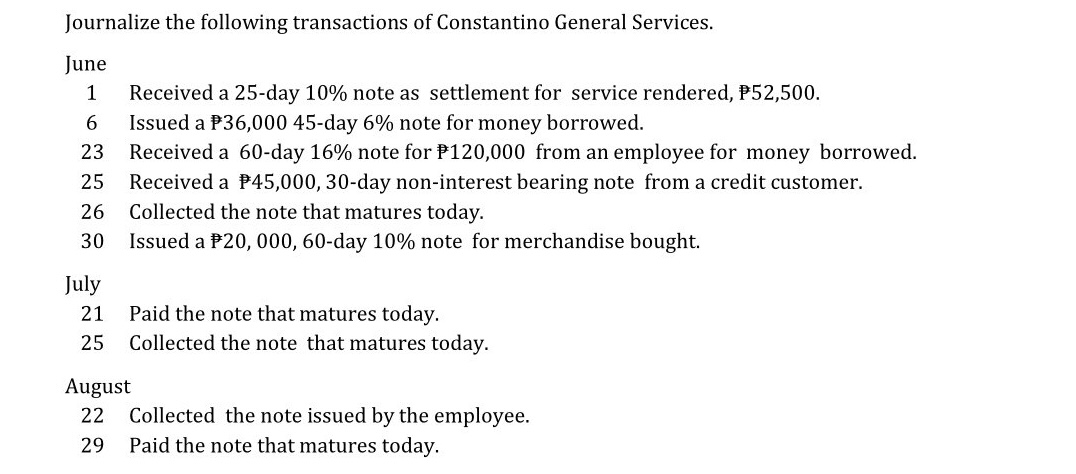

Compute the net pay for each employee and answer the additional requirements that follow: Deductions Employee Basic Pay SSS Philhealth Pag-IBIG Withholding Tax Ericka Bilango P 40,300.00 P 581.30 P 550.00 P 100.00 P 3,933.84 Alani Ching 37,600.00 581.30 517.00 100.00 3,267.09 Audrey Tan 35,500.00 581.30 488.13 100.00 2,749.31 1. How much is the total Salaries Expense? 2. How much is the total payroll deductions? 3. How much is the total credit to Cash upon payment of salaries? Is this the same as the take-home pay?Journalize the following transactions of Constantino General Services. June Received a 25-day 10% note as settlement for service rendered, P52,500. 6 Issued a P36,000 45-day 6% note for money borrowed. 23 Received a 60-day 16% note for P120,000 from an employee for money borrowed. 25 Received a P45,000, 30-day non-interest bearing note from a credit customer. 26 Collected the note that matures today. 30 Issued a P20, 000, 60-day 10% note for merchandise bought. July 21 Paid the note that matures today. 25 Collected the note that matures today. August 22 Collected the note issued by the employee. 29 Paid the note that matures today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts