Question: Compute the Present Value index for each Alternative. Tax rate is 20% Year 1 through 20 10 years Group 4 Alternative 1 Alternative 2 Alternative

Compute the Present Value index for each Alternative. Tax rate is 20%

Year 1 through 20

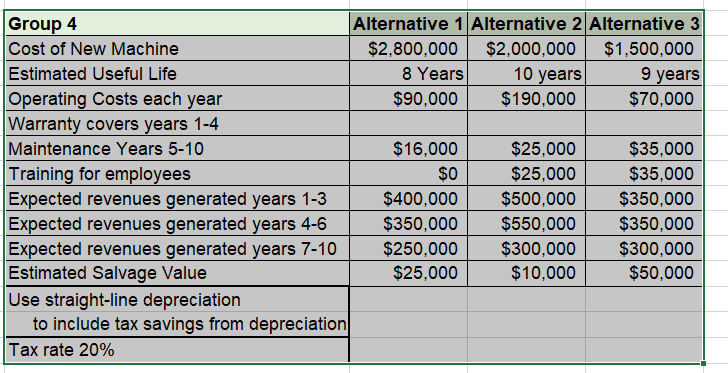

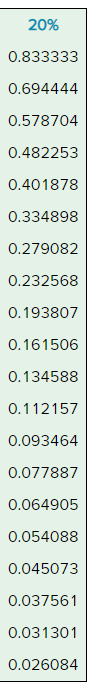

10 years Group 4 Alternative 1 Alternative 2 Alternative 3 Cost of New Machine $2,800,000 $2,000,000 $1,500,000 Estimated Useful Life 8 Years 9 years Operating Costs each year $90,000 $190,000 $70,000 Warranty covers years 1-4 Maintenance Years 5-10 $16,000 $25,000 $35,000 Training for employees $0 $25,000 $35,000 Expected revenues generated years 1-3 $400,000 $500,000 $350,000 Expected revenues generated years 4-6 $350,000 $550,000 $350,000 Expected revenues generated years 7-10 $250,000 $300,000 $300,000 Estimated Salvage Value $25,000 $10,000 $50,000 Use straight-line depreciation to include tax savings from depreciation Tax rate 20% 20% 0.833333 0.694444 0.578704 0.482253 0.401878 0.334898 0.279082 0.232568 0.193807 0.161506 0.134588 0.112157 0.093464 0.077887 0.064905 0.054088 0.045073 0.037561 0.031301 0.026084

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts