Question: Compute this in Excel using Yahoo Finance 1. Non-parametric VaR Download adjusted closing prices for MELI (Mer- cadoLibre) from Feb 1 2016 to Feb 1

Compute this in Excel using Yahoo Finance

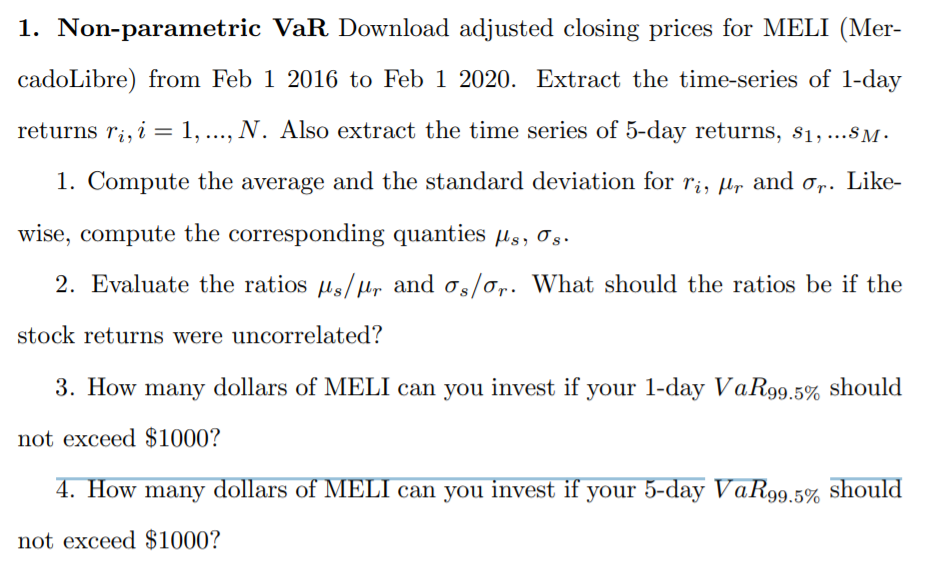

1. Non-parametric VaR Download adjusted closing prices for MELI (Mer- cadoLibre) from Feb 1 2016 to Feb 1 2020. Extract the time-series of 1-day returns ri,i = 1, ..., N. Also extract the time series of 5-day returns, S1, ...SM. 1. Compute the average and the standard deviation for ri, Mr and Or. Like- wise, compute the corresponding quanties jis, 0g. 2. Evaluate the ratios is/per and os/or. What should the ratios be if the stock returns were uncorrelated? 3. How many dollars of MELI can you invest if your 1-day VaR99.5% should not exceed $1000? 4. How many dollars of MELI can you invest if your 5-day VaR99.5% should not exceed $1000? 1. Non-parametric VaR Download adjusted closing prices for MELI (Mer- cadoLibre) from Feb 1 2016 to Feb 1 2020. Extract the time-series of 1-day returns ri,i = 1, ..., N. Also extract the time series of 5-day returns, S1, ...SM. 1. Compute the average and the standard deviation for ri, Mr and Or. Like- wise, compute the corresponding quanties jis, 0g. 2. Evaluate the ratios is/per and os/or. What should the ratios be if the stock returns were uncorrelated? 3. How many dollars of MELI can you invest if your 1-day VaR99.5% should not exceed $1000? 4. How many dollars of MELI can you invest if your 5-day VaR99.5% should not exceed $1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts