Question: Compute what is required in the following problems. Show your complete solution in a separate excel sheet. 1. A resident taxpayer has the following

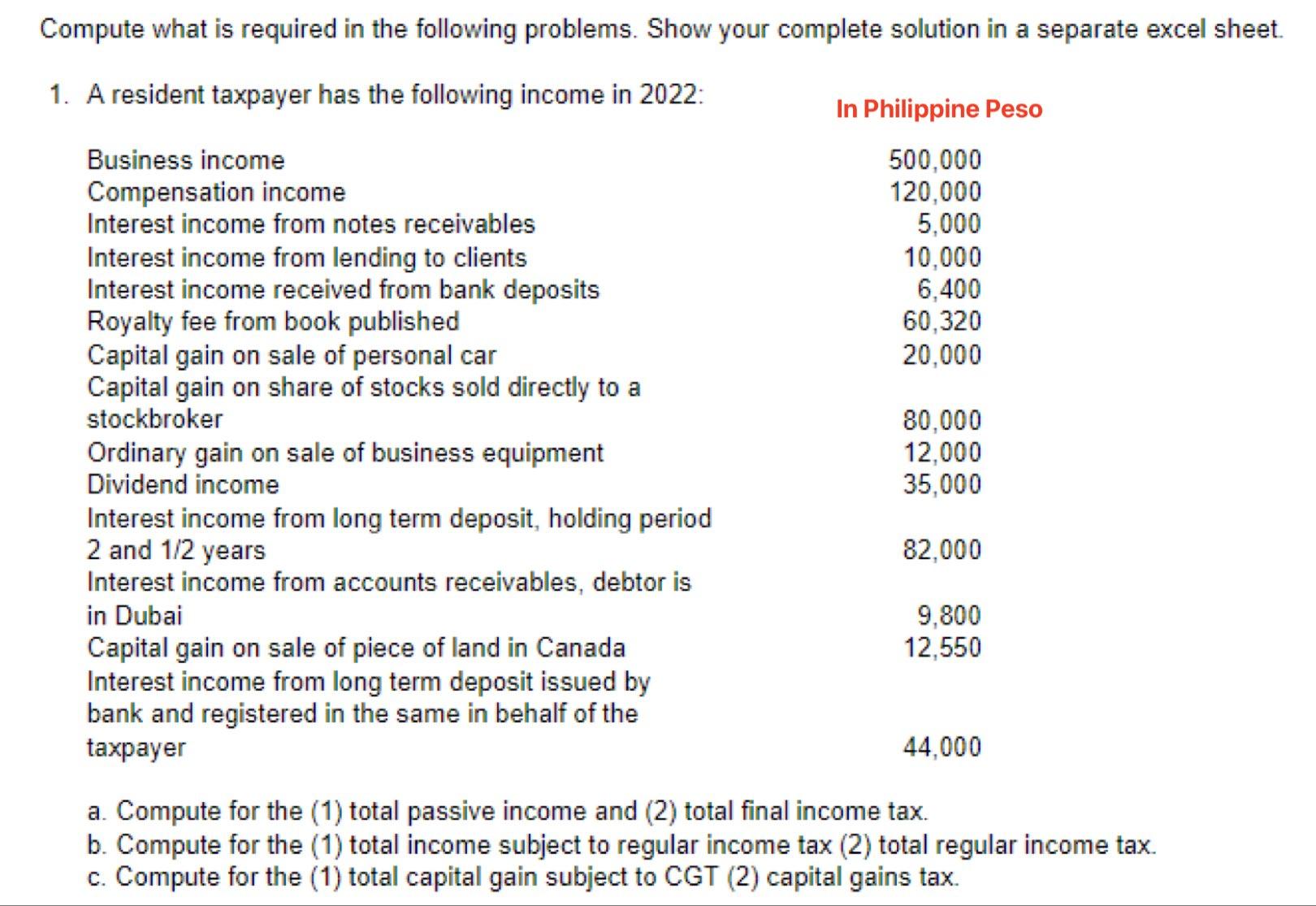

Compute what is required in the following problems. Show your complete solution in a separate excel sheet. 1. A resident taxpayer has the following income in 2022: Business income Compensation income Interest income from notes receivables Interest income from lending to clients Interest income received from bank deposits Royalty fee from book published Capital gain on sale of personal car Capital gain on share of stocks sold directly to a stockbroker Ordinary gain on sale of business equipment Dividend income Interest income from long term deposit, holding period 2 and 1/2 years Interest income from accounts receivables, debtor is in Dubai Capital gain on sale of piece of land in Canada Interest income from long term deposit issued by bank and registered in the same in behalf of the taxpayer In Philippine Peso 500,000 120,000 5,000 10,000 6,400 60,320 20,000 80,000 12,000 35,000 82,000 9,800 12,550 44,000 a. Compute for the (1) total passive income and (2) total final income tax. b. Compute for the (1) total income subject to regular income tax (2) total regular income tax. c. Compute for the (1) total capital gain subject to CGT (2) capital gains tax.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Here are stepbystep calculations for each part of the problem a Total Passive Income and Total Final Income Tax Passive income includes interest incom... View full answer

Get step-by-step solutions from verified subject matter experts