Question: Computers purchases integrated chips at $350 per chip. The holding cost is $37 per unit per year, the ordering cost is $123 per order, and

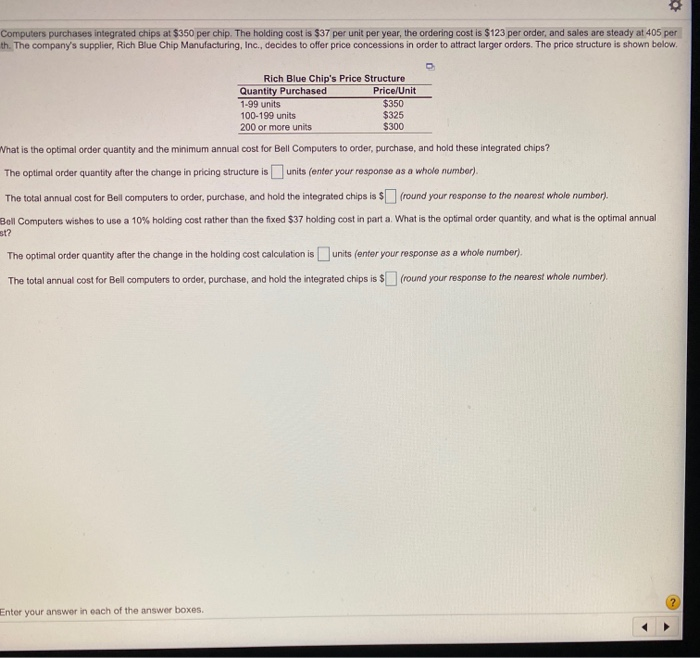

Computers purchases integrated chips at $350 per chip. The holding cost is $37 per unit per year, the ordering cost is $123 per order, and sales are steady at 405 per th. The company's supplier, Rich Blue Chip Manufacturing, Inc., decides to offer price concessions in order to attract larger orders. The price structure is shown below. Rich Blue Chip's Price Structure Quantity Purchased Price/Unit 1-99 units $350 100-199 units $325 200 or more units $300 What is the optimal order quantity and the minimum annual cost for Bell Computers to order, purchase, and hold these integrated chips? The optimal order quantity after the change in pricing structure is units (enter your response as a whole number) The total annual cost for Boll computers to order, purchase, and hold the integrated chips is $ (round your response to the nearest whole number). Ball Computers wishes to use a 10% holding cost rather than the fixed $37 holding cost in part a What is the optimal order quantity, and what is the optimal annual st? The optimal order quantity after the change in the holding cost calculation is units (enter your response as a whole number). The total annual cost for Bell computers to order, purchase, and hold the integrated chips is $| (round your response to the nearest whole number). ? Enter your answer in each of the answer boxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts