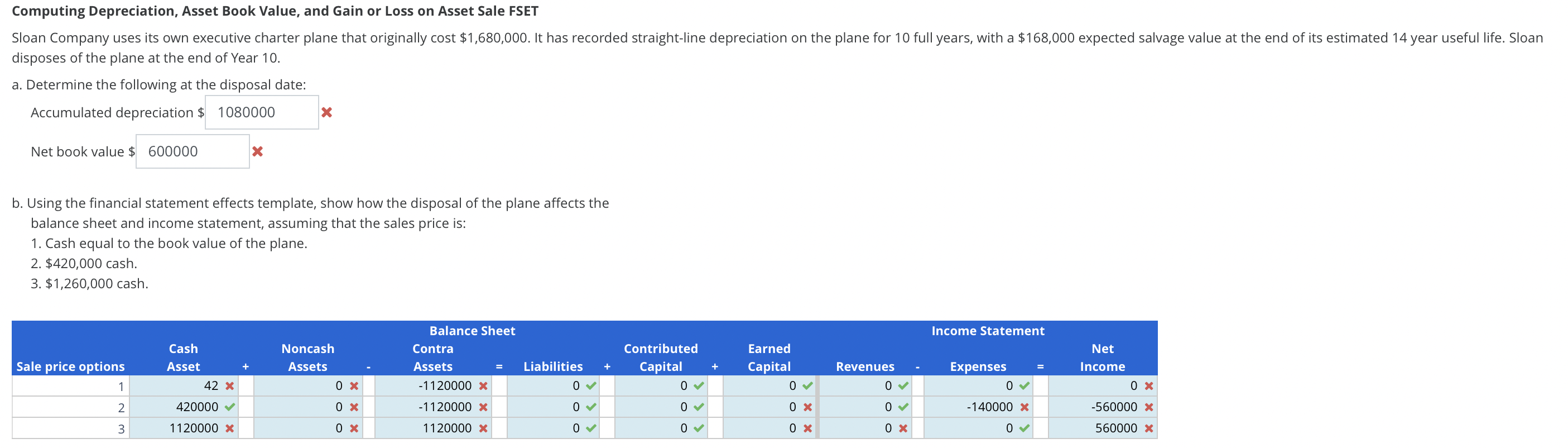

Question: Computing Depreciation, Asset Book Value, and Gain or Loss on Asset Sale FSET disposes of the plane at the end of Year 1 0 .

Computing Depreciation, Asset Book Value, and Gain or Loss on Asset Sale FSET

disposes of the plane at the end of Year

a Determine the following at the disposal date:

Accumulated depreciation &

Net book value $

b Using the financial statement effects template, show how the disposal of the plane affects the

balance sheet and income statement, assuming that the sales price is:

Cash equal to the book value of the plane.

$ cash.

$ cash.Sloan Company uses its own executive charter plane that originally cost $ It has recorded straightline depreciation on the plane for full years, with a $ expected salvage value at the end of its estimated year useful life. Sloan disposes of the plane at the end of Year

a Determine the following at the disposal date:

Accumulated depreciation $Answer

Net book value $Answer

b Using the financial statement effects template, show how the disposal of the plane affects the

balance sheet and income statement, assuming that the sales price is:

Cash equal to the book value of the plane.

$ cash.

$ cash.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock