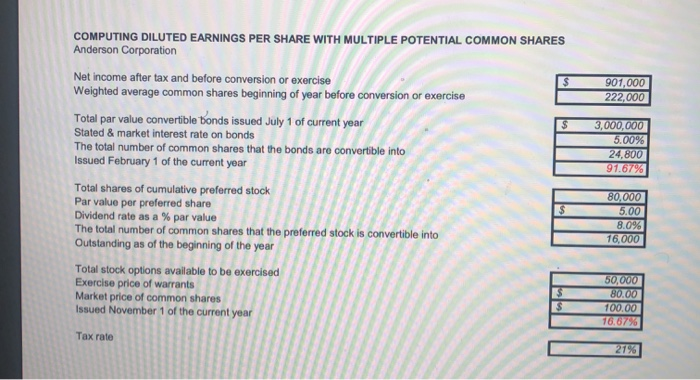

Question: COMPUTING DILUTED EARNINGS PER SHARE WITH MULTIPLE POTENTIAL COMMON SHARES Anderson Corporation $ Net income after tax and before conversion or exercise Weighted average common

COMPUTING DILUTED EARNINGS PER SHARE WITH MULTIPLE POTENTIAL COMMON SHARES Anderson Corporation $ Net income after tax and before conversion or exercise Weighted average common shares beginning of year before conversion or exercise 901.000 222,000 $ Total par value convertible bonds issued July 1 of current year Stated & market interest rate on bonds The total number of common shares that the bonds are convertible into Issued February 1 of the current year 3,000,000 5.00% 24,800 91.67% Total shares of cumulative preferred stock Par value per preferred share Dividend rate as a % par value The total number of common shares that the preferred stock is convertible into Outstanding as of the beginning of the year 80,000 5.00 8.0% 16,000 Total stock options available to be exercised Exercise price of warrants Market price of common shares Issued November 1 of the current year 50,000 80.00 100.00 16.67 Tax rate 27% P VVVVVVVVUDIO PUIULUU JUUR. 7.) Compute the incremental increase in the number of shares outstanding for the stock options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts