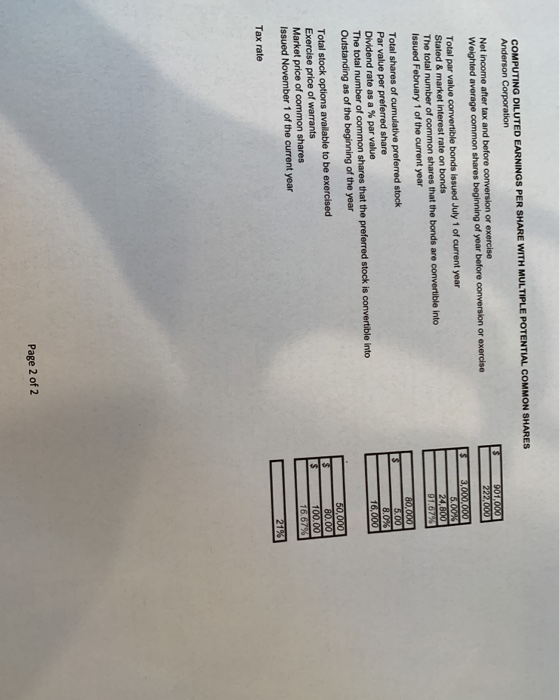

Question: COMPUTING DILUTED EARNINGS PER SHARE WITH MULTIPLE POTENTIAL COMMON SHARES Anderson Corporation 901,000 22,000 Net Income after tax and before conversion or exercise Weighted average

COMPUTING DILUTED EARNINGS PER SHARE WITH MULTIPLE POTENTIAL COMMON SHARES Anderson Corporation 901,000 22,000 Net Income after tax and before conversion or exercise Weighted average common shares beginning of year before conversion or exercise 3,000,000 Total par value convertible bonds issued July 1 of current year Stated & market interest rate on bonds The total number of common shares that the bonds are convertible into Issued February 1 of the current year 24,800 91.67% Total shares of cumulative preferred stock Par value per preferred share Dividend rate as a % par value The total number of common shares that the preferred stock is convertible into Outstanding as of the beginning of the year 80,000 5.00 8.0% 16,000 50,000 80.00 100.00 16.67% Total stock options available to be exercised Exercise price of warrants Market price of common shares Issued November 1 of the current year $ 27% Tax rate Page 2 of 2 Intermediate Accounting Chapter 19 HW for Credit USE THE FACT PATTERN BELOW TO ANSWER ALL OF THE FOLLOWING QUESTIONS: 1.) Compute net income available to common stockholders. 2.) Compute basic earnings per share. Round to two decimal places. 3.) Compute the foregone interest expense AFTER TAX on the convertible bonds. 4.) Compute the per share effect of the convertible bonds. Round to two decimal places. COMPUTING DILUTED EARNINGS PER SHARE WITH MULTIPLE POTENTIAL COMMON SHARES Anderson Corporation 901,000 22,000 Net Income after tax and before conversion or exercise Weighted average common shares beginning of year before conversion or exercise 3,000,000 Total par value convertible bonds issued July 1 of current year Stated & market interest rate on bonds The total number of common shares that the bonds are convertible into Issued February 1 of the current year 24,800 91.67% Total shares of cumulative preferred stock Par value per preferred share Dividend rate as a % par value The total number of common shares that the preferred stock is convertible into Outstanding as of the beginning of the year 80,000 5.00 8.0% 16,000 50,000 80.00 100.00 16.67% Total stock options available to be exercised Exercise price of warrants Market price of common shares Issued November 1 of the current year $ 27% Tax rate Page 2 of 2 Intermediate Accounting Chapter 19 HW for Credit USE THE FACT PATTERN BELOW TO ANSWER ALL OF THE FOLLOWING QUESTIONS: 1.) Compute net income available to common stockholders. 2.) Compute basic earnings per share. Round to two decimal places. 3.) Compute the foregone interest expense AFTER TAX on the convertible bonds. 4.) Compute the per share effect of the convertible bonds. Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts