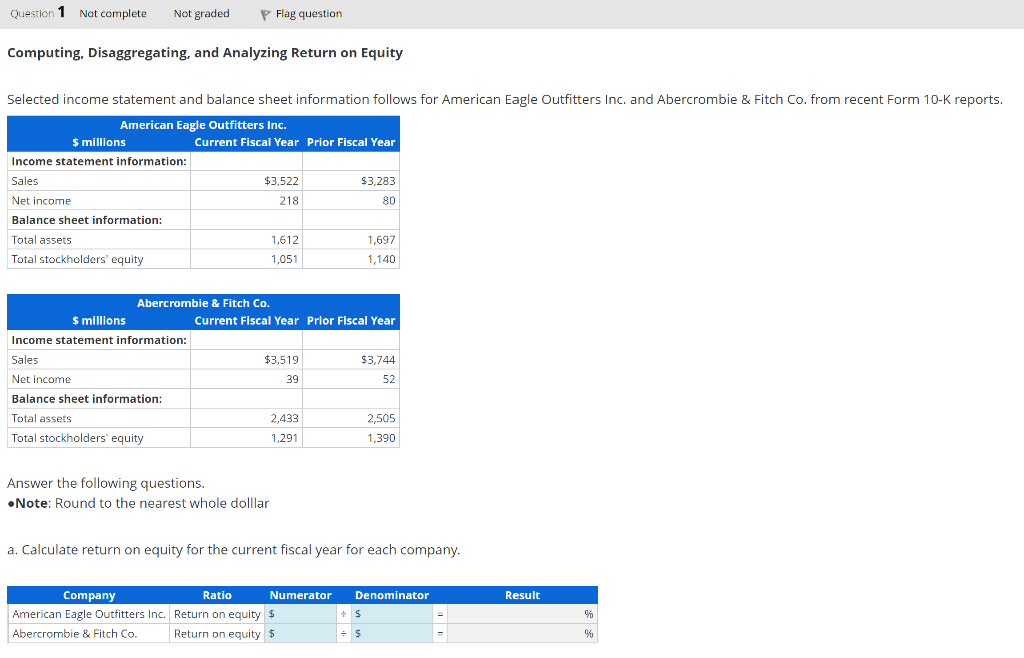

Question: Computing, Disaggregating, and Analyzing Return on Equity Selected income statement and balance sheet information follows for American Eagle Outfitters Inc. and Abercrombie & Fitch Co.

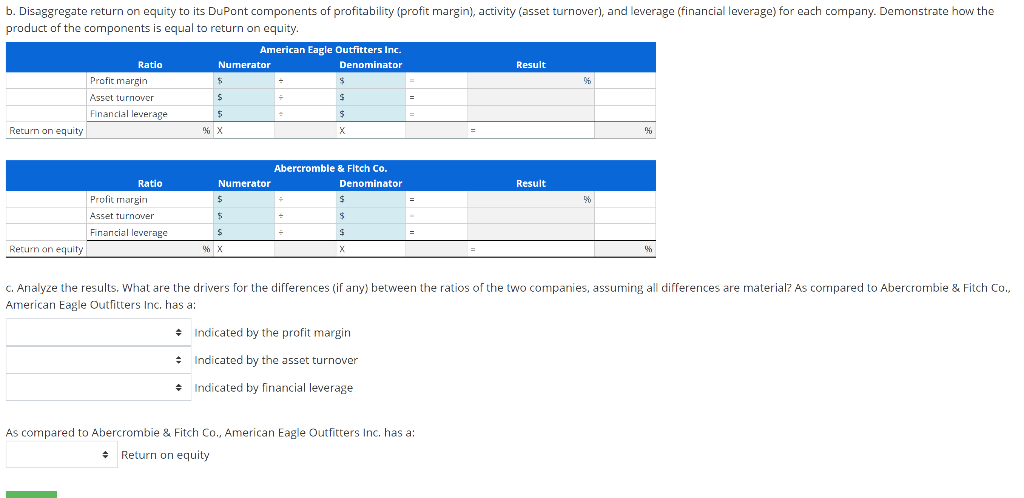

Computing, Disaggregating, and Analyzing Return on Equity Selected income statement and balance sheet information follows for American Eagle Outfitters Inc. and Abercrombie \& Fitch Co. from recent Form 10-K reports. Answer the following questions. Note: Round to the nearest whole dolllar a. Calculate return on equity for the current fiscal year for each company. c. Analyze the results. What are the drivers for the differences (if any) between the ratios of the two companies, assuming all differences are material? As compared to Abercrombie \& Fitch Co., American Eagle Outfitters Inc, has a: Indicated by the profit margin Indicated by the asset turnover Indicated by financial leverage As compared to Abercrombie \& Fitch Co., American Eagle Outfitters Inc, has a: Return on equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts