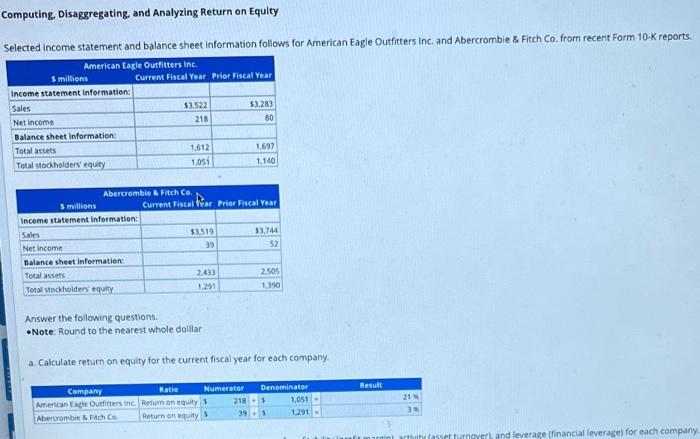

Question: Computing, Disaggregating, and Analyzing Return on Equity Selected income statement and balance sheet information follows for American Eagle Outfitters Inc. and Abercrombie & Fitch

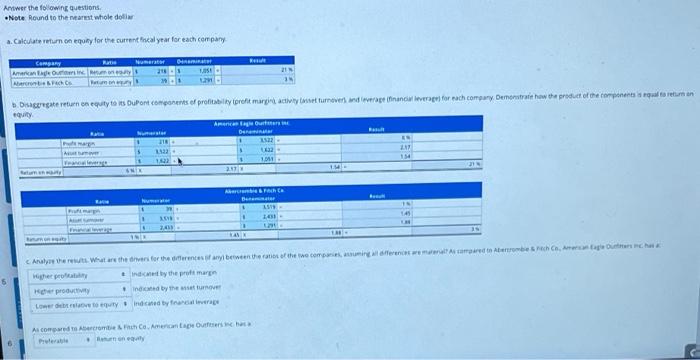

Computing, Disaggregating, and Analyzing Return on Equity Selected income statement and balance sheet information follows for American Eagle Outfitters Inc. and Abercrombie & Fitch Co. from recent Form 10-K reports. American Eagle Outfitters Inc. 5 millions Income statement information: Sales Net income Balance sheet information: Current Fiscal Year Prior Fiscal Year $3.522 $3,283 218 80 Total assets 1,612 1,697 Total stockholders' equity 1,051 1,140 Abercrombie & Fitch Co. 5 millions Current Fiscal Year Prior Fiscal Year Income statement Information: Sales $3,519 $3,744 Net income 39 52 Balance sheet information: Total assets 2,433 2.505 Total stockholders equity 1,291 1,390 Answer the following questions. Note: Round to the nearest whole dolllari a. Calculate return on equity for the current fiscal year for each company. Company Ratio Numerator Denominator Result American Eagle Outfitters Inc. Abercrombie & Fitch Co. Return on equity $ 218 $ 1,051 21% Return on equity $ 393 1,291 argin) arthrity (asset turnoverk, and leverage (financial leverage) for each company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts