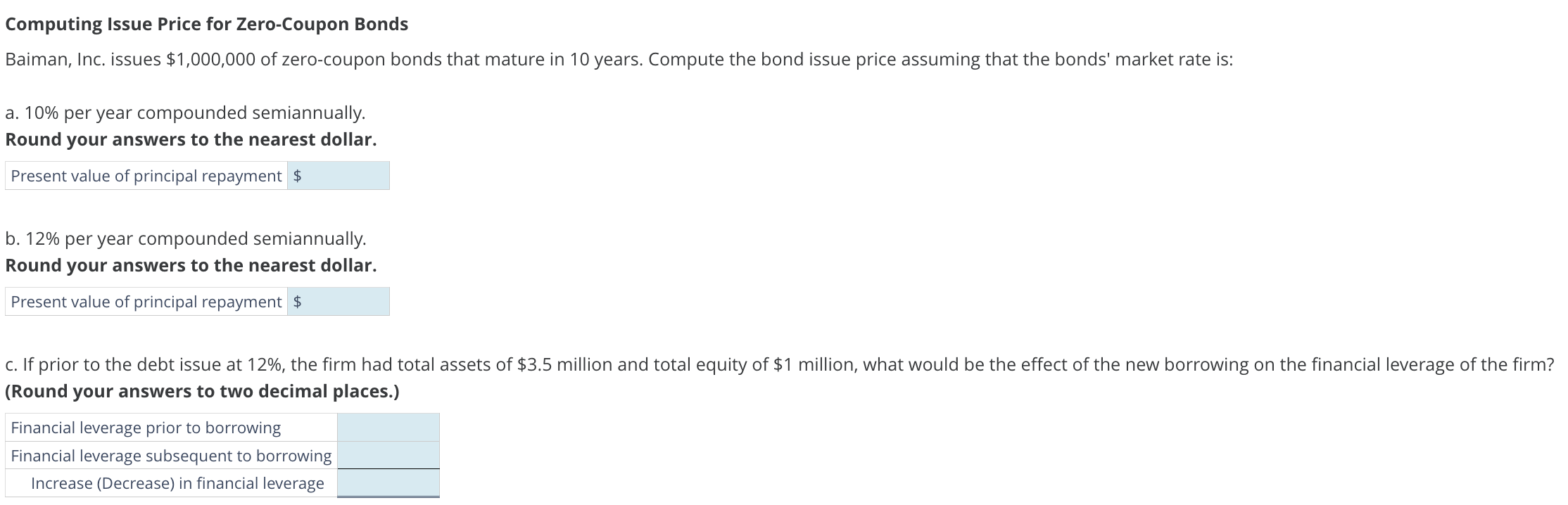

Question: Computing Issue Price for Zero-Coupon Bonds Baiman, Inc. issues $1,000,000 of zero-coupon bonds that mature in 10 years. Compute the bond issue price assuming that

Computing Issue Price for Zero-Coupon Bonds Baiman, Inc. issues $1,000,000 of zero-coupon bonds that mature in 10 years. Compute the bond issue price assuming that the bonds' market rate is: a. 10% per year compounded semiannually. Round your answers to the nearest dollar. Present value of principal repayment b. 12% per year compounded semiannually. Round your answers to the nearest dollar. Present value of principal repayment (Round your answers to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts