Question: (Computing the standard deviation for a portfolio of two riaky investments) Mary Gulot recently graduated trom Nohols Stute Universty and is anxious to begin invesing

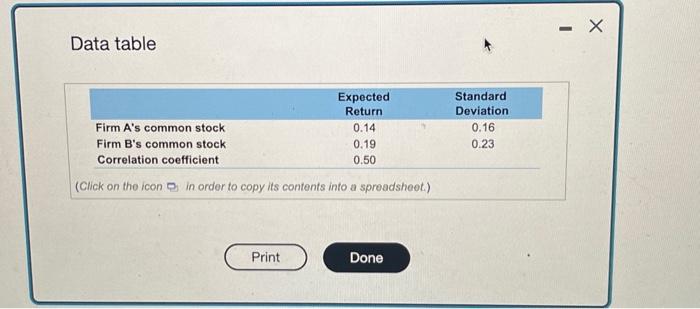

(Computing the standard deviation for a portfolio of two riaky investments) Mary Gulot recently graduated trom Nohols Stute Universty and is anxious to begin invesing her mepger savings as a way of opplying what she has ieamed in bueness school. Specfically, she is evaluating an imestment in a portblo comprised of two firms' commen stock. She has collecled the following iformason about the common stock of Firm A and Firm B. a. Iy Mary invests haif her money in each of the fwo common stocks; what is the portfolio's expected rate of return and atandard devation in portfolio retum? b. Answer part a where the correlstion between the two cormenon atock investments is oqual to zero. c. Answer part a where the correlation between the two common stock investrents is equal to + 1 d. Answer part a where the correlation between the two common stock imvestments is equal 101 e. Using your responses to questions a-d, deschbo the retalonshe between the correlation and the risk and refurn of the portblo, a. It Mary decldes to imest so\% of her money in Firm A's common atock and 50% in Firm Es commich stock and the correlation between the two stocks is 0.50 , then the expected rate of return in the partolo is (Round to tao decimal places) Data table (Click on the icon D in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts