Question: (Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichols State Uriversity and is anxious to begin itwesting

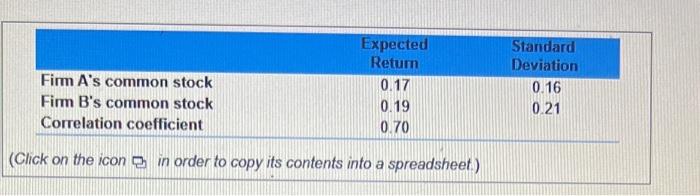

(Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichols State Uriversity and is anxious to begin itwesting her meager savings as a way of applying what nhe has heamed in business school Specifically, she is evaluating an investenent in a portiolio coenprised of two firms' common stock. Shet has collected the following information about the comman slock of Firm A and Firm B. a. If Mary irwests hall her money in each of the two common stocks, what is the poctiolio's expectod rate of retum and standard deviation in portlo45 return? b. Mrwwer part a where the cocrelation between the two coeninon stock imesiments b equal to zero c. Answer part a where the correlation between the two comenon stock irventments k equal to if d. Arswor part a where the correlation betwoen the two cornmon stock irventments is equal is 1. e. Using your responses to questions a-d. descithe the relationship between the contetation and the risk and retum of the portiolio a. If Mary dedides to invest 50% of her money in Firm A 's common stock and 50% in Fim B's common siock and the contelation between the two stocks 60.79, then the eippecied rate of return in the partiolio is %. (Round to two decimal places.) (Click on the icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts