Question: (Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichol savings as a way of applying what she

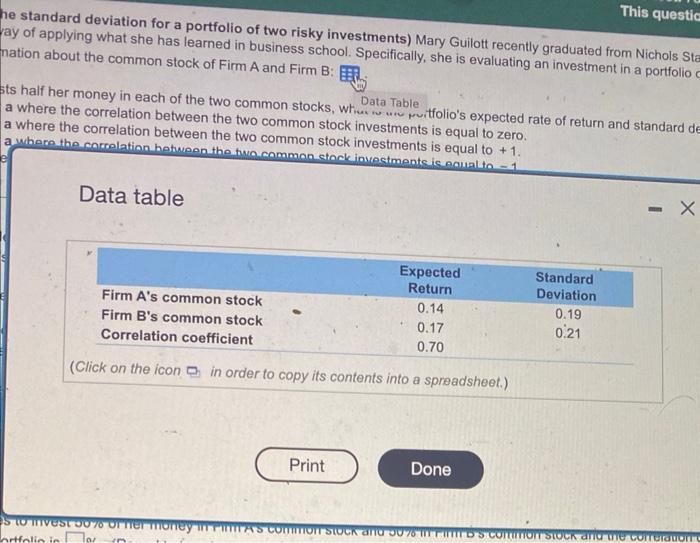

(Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichol savings as a way of applying what she has learned in business school. Specifically, she is evaluating an investment in a portf following information about the common stock of Firm A and Firm B: a. If Mary invests half her money in each of the two common stocks, what is the portfolio's expected rate of return and standa b. Answer part a where the correlation between the two common stock investments is equal to zero. c. Answer part a where the correlation between the two common stock investments is equal to +1. d. Answer part a where the correlation between the two common stock investments is equal to -1 . e. Using your responses to questions a-d, describe the relationship between the correlation and the risk and retum of the a. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm B's common stock and the correl in the portfolio is \%. (Round to two decimal places.) The standard deviation in the portfolio is \%. (Round to twodecimal places.) b. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm B's common stock and the corre in the portfolio is \%. (Round to two decimal places.) The standard deviation in the portfolio is \%. (Round to two decimal places.) c. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm B's common stock and the corr of return in the portfolio is \%. (Round to two decimal places.) The standard deviation in the portfolio is \%. (Round to two decimal places.) d. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm B's common stock and the co of retum in the portfolio is \%: (Round to two decimal places.) The standard deviation in the portfolio is \%. (Round to two decimal places.) e. Using your responses to questions a-d, which of the following statements best describes the relationship between choice below.) This questic ray of applying what she has learned in business school. Specifically, she is evaluating an investment in a portfolio nation about the common stock of Firm A and Firm B: . sts half her money in each of the two common stocks, wtic Data Table witfolio's expected rate of return and standard d a where the correlation between the two common stock investments is equal to zero. a where the correlation between the two common stock investments is equal to +1 . Data table (Click on the icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts