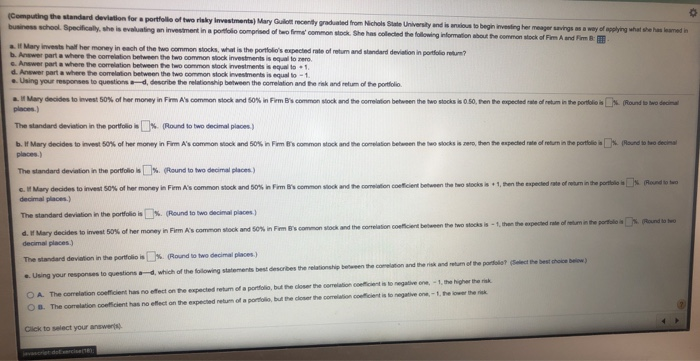

Question: Computing the standard deviation for a portfolio of two risky Investments, Mary G ot recently graduated from Nichols State University and is us to begin

Computing the standard deviation for a portfolio of two risky Investments, Mary G ot recently graduated from Nichols State University and is us to begin investing her meager savings business school Specifically, she is evaluating an investment in a portfolio comprised of two firma common stock. She has collected the following information thout the common stock of Fim A and a way of lying what she has been If Mary invests hall her money in each of the common stocks, what is the portfolio's expected rate of return and standard deviation in portfolio retur? b. Answer part a where the correlation between the two on vock investments is equal to zero Arwer part where the correlation between the two common stock investment is equal to 1. d. Answer part a where the correlation between the two common stock investments is equal to - 1 .. Using your responses to questions , describe the relationship between the correlation and the risk and return of the portfolio Mary decides to invest 50% of her money in Firm A's common stock and Sox in Fum's common stock and the correlation between the two stocks is 0.50, then the expected places) of retum in the port Round two deca 's common stock and the correlation between the two size, then the expected rule of return the port Round to two deca The standard deviation in the portfolio (Round to two decimal places) b. If Mary decides to invest 50% of her money in Form A's common Mock and 50% in Firm places.) The standard deviation in the portfolios % (Round to two decimal places) Hound to two o nd to ho c. Mary decides to invest 50% of her money in Fim A's common stock and 50% in Firm's com and the common coeficient between the two ocis 1, then the expected to return in the portfolio decimal places.) The standard deviation in the portfolio is (Round to two decimal places) d. Mary decides to invest 50% of her money in Firm A's common stock and 50 in Form B's common wock and the correlation coeficient between the two stockis - , then the expected role of alumin the porolo decimal places.) The landard deviation in the portfolioiss. Round to two decimal places.) ect the best choice bew) .. Using your responses to questions , which of the following statements et describes the relationship between the common and there and return of the prot O A The correlation coefficient has no effect on the expected return of a portfolio, but the closer the correlation coefficient is to negative one-1, the higher the risk B. The correlation coefficient has no effect on the expected return of a portfolio, but the close the correlation coefficient is to negative on the lower the risk O Click to select your answers Computing the standard deviation for a portfolio of two risky Investments, Mary G ot recently graduated from Nichols State University and is us to begin investing her meager savings business school Specifically, she is evaluating an investment in a portfolio comprised of two firma common stock. She has collected the following information thout the common stock of Fim A and a way of lying what she has been If Mary invests hall her money in each of the common stocks, what is the portfolio's expected rate of return and standard deviation in portfolio retur? b. Answer part a where the correlation between the two on vock investments is equal to zero Arwer part where the correlation between the two common stock investment is equal to 1. d. Answer part a where the correlation between the two common stock investments is equal to - 1 .. Using your responses to questions , describe the relationship between the correlation and the risk and return of the portfolio Mary decides to invest 50% of her money in Firm A's common stock and Sox in Fum's common stock and the correlation between the two stocks is 0.50, then the expected places) of retum in the port Round two deca 's common stock and the correlation between the two size, then the expected rule of return the port Round to two deca The standard deviation in the portfolio (Round to two decimal places) b. If Mary decides to invest 50% of her money in Form A's common Mock and 50% in Firm places.) The standard deviation in the portfolios % (Round to two decimal places) Hound to two o nd to ho c. Mary decides to invest 50% of her money in Fim A's common stock and 50% in Firm's com and the common coeficient between the two ocis 1, then the expected to return in the portfolio decimal places.) The standard deviation in the portfolio is (Round to two decimal places) d. Mary decides to invest 50% of her money in Firm A's common stock and 50 in Form B's common wock and the correlation coeficient between the two stockis - , then the expected role of alumin the porolo decimal places.) The landard deviation in the portfolioiss. Round to two decimal places.) ect the best choice bew) .. Using your responses to questions , which of the following statements et describes the relationship between the common and there and return of the prot O A The correlation coefficient has no effect on the expected return of a portfolio, but the closer the correlation coefficient is to negative one-1, the higher the risk B. The correlation coefficient has no effect on the expected return of a portfolio, but the close the correlation coefficient is to negative on the lower the risk O Click to select your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts