Question: Consider a Bear Put Spread under which you short for $1 (P1) a European put with a strike price of $40 (K1) and long for

- Consider a Bear Put Spread under which you short for $1 (P1) a European put with a strike price of $40 (K1) and long for $3 (P2) a European put with a strike price of $45 (K2). Fill in the blanks with $ amount per share (not in terms of notations) in the following payoff table.

| Stock Price Range | Cost of Spread Strategy | Payoff from exercising K1 put you short | Payoff from exercising K2 put you long |

Net profit |

| ST = $35 |

|

|

|

|

| ST = $42 |

|

|

|

|

| ST = $48 |

|

|

|

|

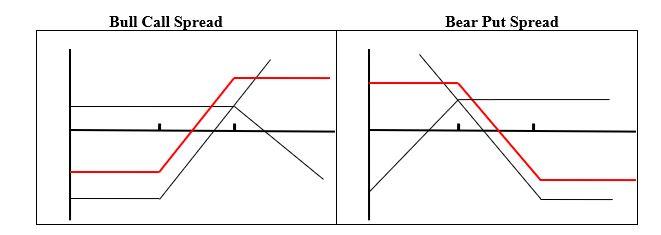

Bull Call Spread Bear Put Spread

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock