Question: Consider a binomial model with 2 time periods. At time t = 0, the stock price is 80 dollars. After one time period, the stock

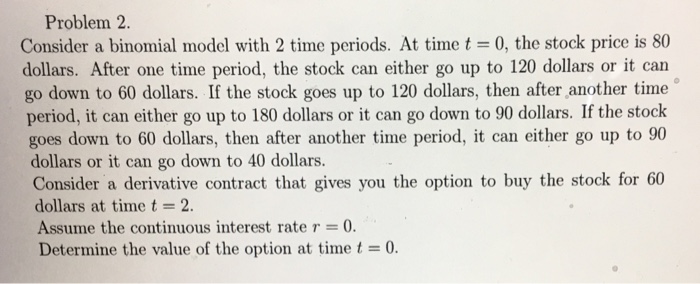

Consider a binomial model with 2 time periods. At time t = 0, the stock price is 80 dollars. After one time period, the stock can either go up to 120 dollars or it can go down to 60 dollars. If the stock goes up to 120 dollars, then after another time period, it can either go up to 180 dollars or it can go down to 90 dollars. If the stock goes down to 60 dollars, then after another time period, it can either go up to 90 dollars or it can go down to 40 dollars. Consider a derivative contract that gives you the option to buy the stock for 60 dollars at time t = 2. Assume the continuous interest rate r = 0. Determine the value of the option at time t = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts