Question: PART II THE BINOMIAL OPTION PRICING MODEL Answer questions #10- #15 based on the following information. We have a two-state, two-period world (i.e. there are

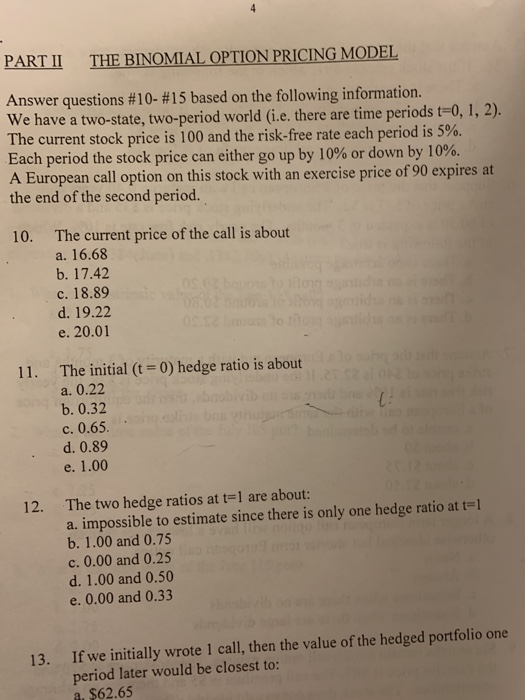

PART II THE BINOMIAL OPTION PRICING MODEL Answer questions #10- #15 based on the following information. We have a two-state, two-period world (i.e. there are time periods t=0, 1, 2). The current stock price is 100 and the risk-free rate each period is 5%. Each period the stock price can either go up by 10% or down by 10%. A European call option on this stock with an exercise price of 90 expires at the end of the second period. The current price of the call is about 10. a. 16.68 b. 17.42 c. 18.89 d. 19.22 e. 20.01 The initial (t = 0) hedge ratio is about 11. a. 0.22 b. 0.32 c. 0.65. d. 0.89 e. 1.00 The two hedge ratios at t=1 are about: a. impossible to estimate since there is only one hedge ratio at t=1 b. 1.00 and 0.75 12. c. 0.00 and 0.25 d. 1.00 and 0.50 e. 0.00 and 0.33 If we initially wrote 1 call, then the value of the hedged portfolio one 13. period later would be closest to: a. $62.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts