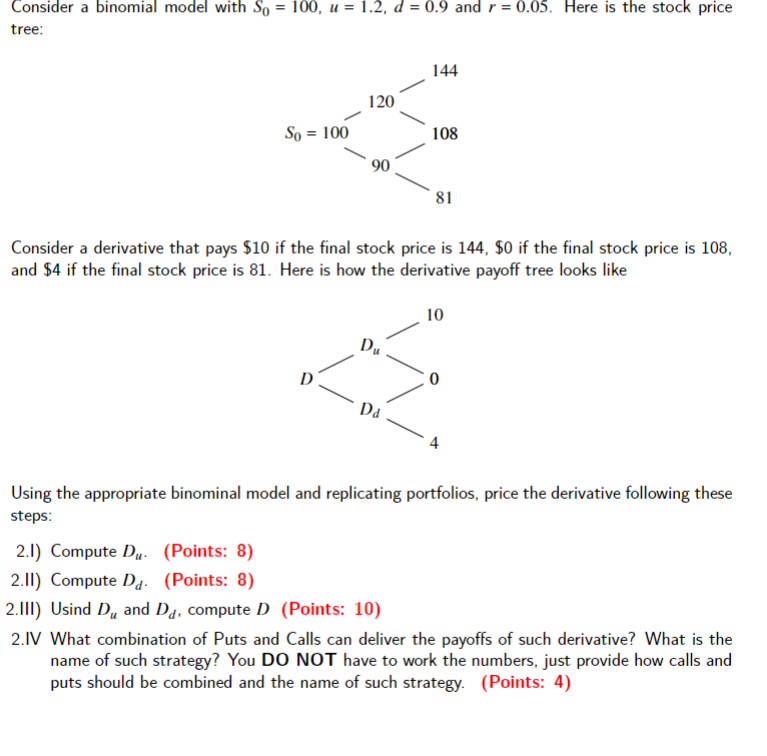

Question: Consider a binomial model with S0=100,u=1.2,d=0.9 and r=0.05. Here is the stock price tree: Consider a derivative that pays $10 if the final stock price

Consider a binomial model with S0=100,u=1.2,d=0.9 and r=0.05. Here is the stock price tree: Consider a derivative that pays $10 if the final stock price is 144,$0 if the final stock price is 108 , and $4 if the final stock price is 81 . Here is how the derivative payoff tree looks like Using the appropriate binominal model and replicating portfolios, price the derivative following these steps: 2.I) Compute Du. (Points: 8) 2.II) Compute Dd. (Points: 8) 2.III) Usind Du and Dd, compute D (Points: 10) 2.IV What combination of Puts and Calls can deliver the payoffs of such derivative? What is the name of such strategy? You DO NOT have to work the numbers, just provide how calls and puts should be combined and the name of such strategy. (Points: 4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts