Question: Consider a financial world in which there are only two risky assets, A and B, and a risk-free asset F. The value of the asset

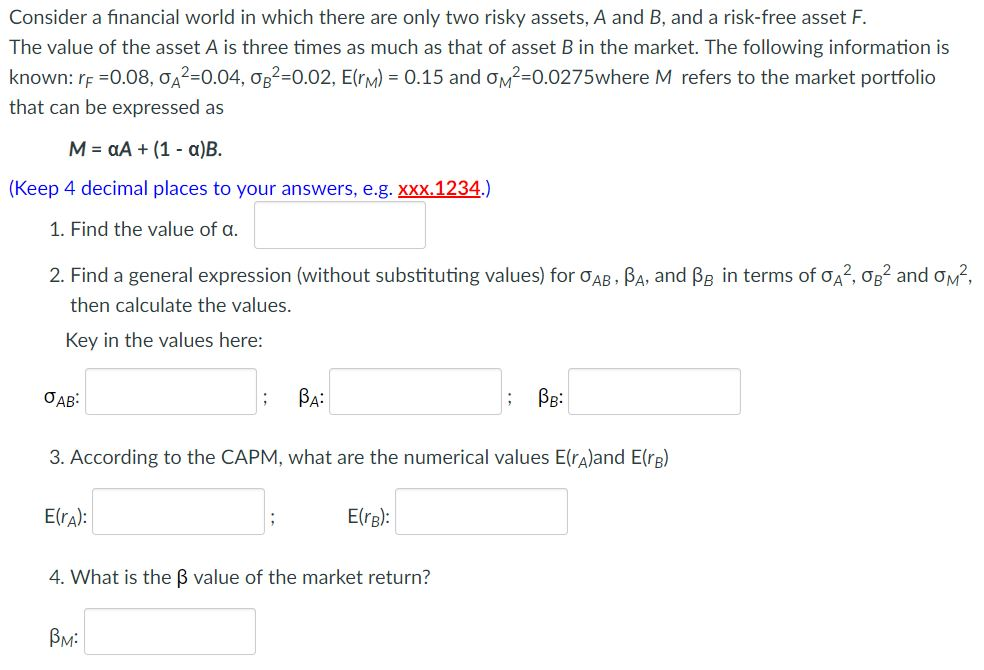

Consider a financial world in which there are only two risky assets, A and B, and a risk-free asset F. The value of the asset A is three times as much as that of asset B in the market. The following information is known: rF-0.08, A2-004, 2-0.02. E(rm)-0.15 and M2-0.0275where M refers to the market portfolio that can be expressed as (Keep 4 decimal places to your answers, e.g. xxx.1234. 1. Find the value of . 2. Find a general expression (without substituting values) for , , and 1n terms of A2,0B2 and M2, then calculate the values. Key in the values here: OAB: | 3. According to the CAPM, what are the numerical values E(rA)and E(rB) E(rA): 4. What is the B value of the market return? BM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts