Question: + Consider a five-year project with the following information: initial fixed asset investment = $490,000; straight-line depreciation to zero over the five-year life; zero

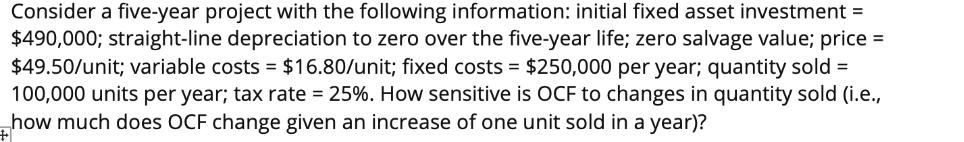

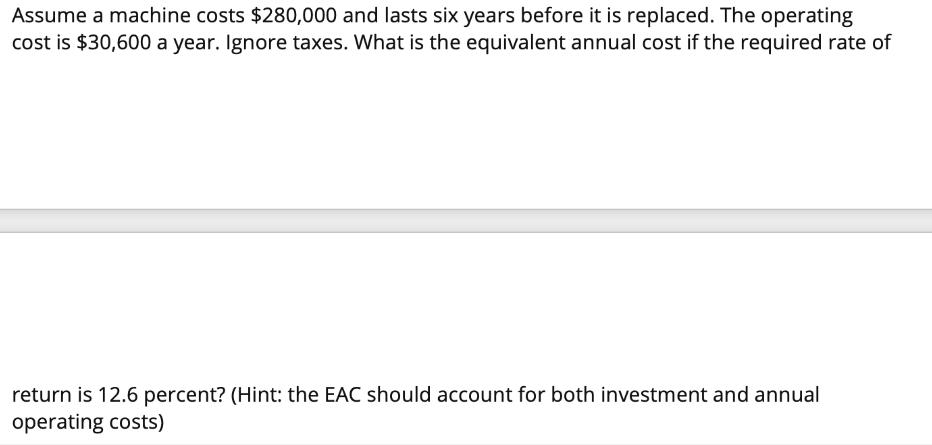

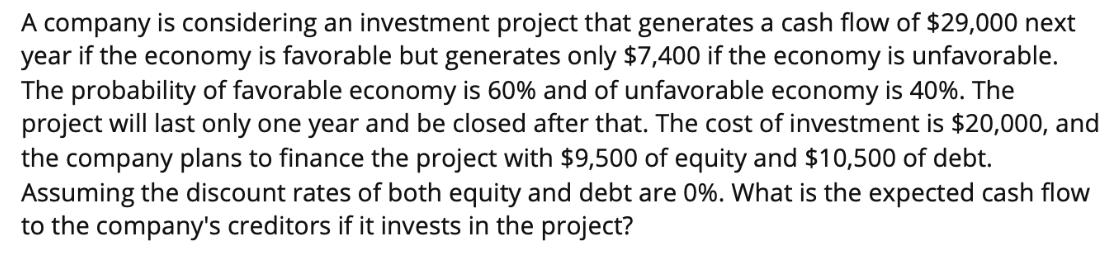

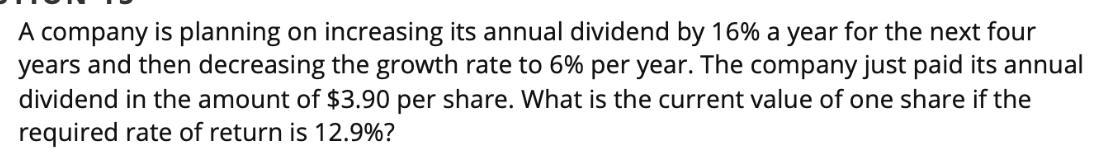

+ Consider a five-year project with the following information: initial fixed asset investment = $490,000; straight-line depreciation to zero over the five-year life; zero salvage value; price = $49.50/unit; variable costs = $16.80/unit; fixed costs = $250,000 per year; quantity sold = 100,000 units per year; tax rate = 25%. How sensitive is OCF to changes in quantity sold (i.e., how much does OCF change given an increase of one unit sold in a year)? A company had a current share price of $65.50, and the firm had 1,400,000 shares of stock outstanding. The company is considering an investment project that requires an immediate $7,200,000 investment but will produce cash flows of $2,000,000, $2,600,000, $3,000,000, and $4,000,000 in years 1 to 4, respectively. If the company invests in the project, what would the new share price be? The company's cost of capital is 9.2%. (Hint: consider how the project NPV affects the stock price) Assume a machine costs $280,000 and lasts six years before it is replaced. The operating cost is $30,600 a year. Ignore taxes. What is the equivalent annual cost if the required rate of return is 12.6 percent? (Hint: the EAC should account for both investment and annual operating costs) A company is considering an investment project that generates a cash flow of $29,000 next year if the economy is favorable but generates only $7,400 if the economy is unfavorable. The probability of favorable economy is 60% and of unfavorable economy is 40%. The project will last only one year and be closed after that. The cost of investment is $20,000, and the company plans to finance the project with $9,500 of equity and $10,500 of debt. Assuming the discount rates of both equity and debt are 0%. What is the expected cash flow to the company's creditors if it invests in the project? A company is planning on increasing its annual dividend by 16% a year for the next four years and then decreasing the growth rate to 6% per year. The company just paid its annual dividend in the amount of $3.90 per share. What is the current value of one share if the required rate of return is 12.9%? A firm has 700,000 shares of common stock outstanding at a market price of $60 a share. Last month, the firm paid an annual dividend in the amount of $3 per share. The dividend growth rate is 6%. The company also has 32,000 bonds outstanding with a face value of $1,000 per bond. The bonds carry a 6% coupon, pay interest annually, and mature in 10 years. The bonds are selling at 102% of face value. The company's tax rate is 25%. What is the company's weighted average cost of capital (WACC)? A firm is considering an investment project that will produce an operating cash flow of $158,000 at the end of each year for three years. The initial cash outlay for equipment will be $318,000. The equipment can be sold for $34,000 (before tax) at the end of the project. The project requires $32,000 of net working capital that will be fully recovered. The tax rate is 25%. What is the net present value of the project if the required rate of return is 10.6 percent? 1. A firm is analyzing two machines to determine which one it should purchase. Whichever machine is purchased will be replaced at the end of its useful life. The company requires a 12 percent rate of return and uses straight-line depreciation to a zero book value over the life of the machine. Machine A has a cost of $600,000, annual operating costs of $52,000, and a 8-year life. Machine B costs $350,000, has annual operating costs of $87,000, and a 5-year life. The firm currently pays no taxes. Which machine should be purchased and why (Hint: calculate and compare the EAC of the two machines)? You need to show your work in order to earn full credit for this question. 1. A company purchased some fixed assets four years ago at a cost of $520,000. It no longer needs these assets, so it is going to sell them today at a price of $145,000. The assets are classified as 5-year property for MACRS. The MACRS table values.2000,.3200,. 1920, 1152,.1152, and.0576 for Years 1 to 6, respectively. What is the current book value of these assets?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts