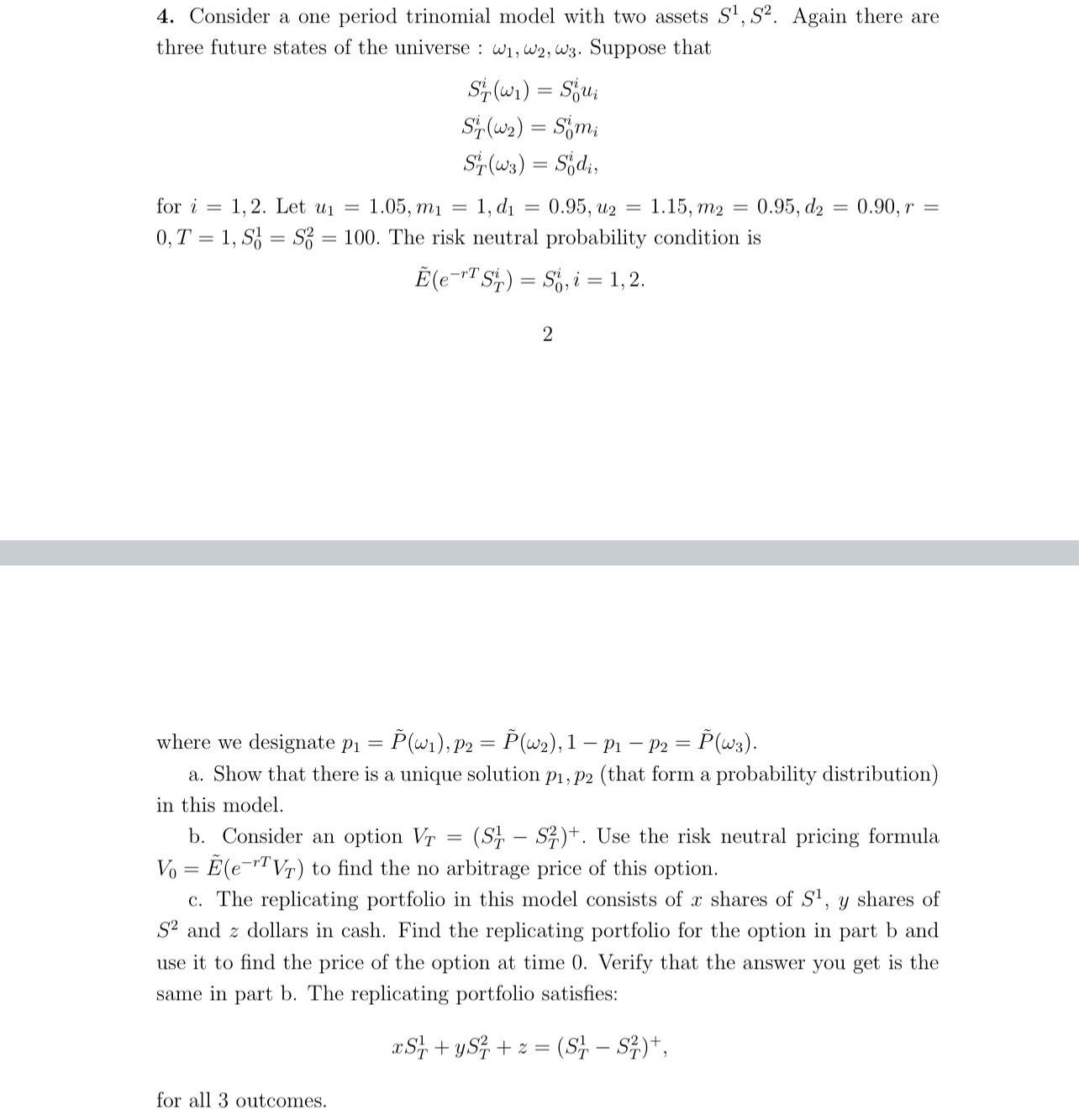

Question: Consider a one period trinomial model with two assets S 1 , S 2 . Again there are three future states of the universe :

Consider a one period trinomial model with two assets Again there are

three future states of the universe : Suppose that

for Let

The risk neutral probability condition is

tilde

where we designate tildetildetilde

a Show that there is a unique solution that form a probability distribution

in this model.

b Consider an option Use the risk neutral pricing formula

tilde to find the no arbitrage price of this option.

c The replicating portfolio in this model consists of shares of shares of

and dollars in cash. Find the replicating portfolio for the option in part b and

use it to find the price of the option at time Verify that the answer you get is the

same in part b The replicating portfolio satisfies:

for all outcomes.Consider a one period trinomial model with two assets Again there are

three future states of the universe : Suppose that

for Let

The risk neutral probability condition is

tilde

where we designate tildetildetilde

a Show that there is a unique solution that form a probability distribution

in this model.

b Consider an option Use the risk neutral pricing formula

tilde to find the no arbitrage price of this option.

c The replicating portfolio in this model consists of shares of shares of

and dollars in cash. Find the replicating portfolio for the option in part b and

use it to find the price of the option at time Verify that the answer you get is the

same in part b The replicating portfolio satisfies:

for all outcomes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock